With improved investment sentiment and apparent green shoots of economic recovery, more fund managers are optimistic towards equities and have boosted aggressively their equity positions for the 3rd quarter of 2009, according to a fund managers’ survey conducted by HSBC.

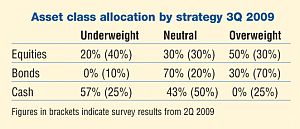

The survey results indicated that 50% of fund managers were overweight equity positions in the 3rd quarter 2009 compared to only 30% in the 2nd quarter 2009.

Fund managers’ views on bonds have shifted to neutral (70%) in the 3rd quarter 2009, compared to 20% in the 2nd quarter 2009. Only 30% of fund managers are still bullish on bonds down from 70% in the last quarter, according to this survey, which is conducted quarterly.

|

Cash has lost favour among the fund managers with 57% taking underweight positions in cash in the 3rd quarter 2009 versus 25% in the previous quarter. Those with neutral cash positions have dropped to 43% in the 3rd quarter 2009 from 50% previously, while, managers with overweight cash position dropped to zero percent in the 3rd quarter 2009 from 25% in the 2nd quarter 2009.

A total of 75% of fund managers remain bullish about Greater China equities this quarter (vs 75% in 2Q09), while nearly three-quarters (73%) of fund managers hold a positive view towards emerging markets equities, up from 27% in the 2nd quarter 2009.

Nine out of 10 fund managers polled in the survey are holding a positive view on Asia-Pacific ex-Japan equities in the 3rd quarter of 2009, up from 45% in the previous quarter.

The views are the least positive on cash, with a significant shift of fund managers (57% vs 25% in 2Q09) to an underweight view. No fund manager held an overweight view (vs 25% in 2Q09).

“We see that improving market performance, combined with some signs of economic recovery especially in Asia-Pacific and emerging markets, are buoying investor sentiment for equities,” says Bruno Lee, HSBC’s regional head of wealth management for Asia-Pacific, who presented the survey results.

The survey analyzed 13 of the world’s leading fund management houses by their assets under management (AUM), their asset allocation views and their global money flows. The net money flow estimates are derived from movements in AUM versus index movements in the equivalent class.

At the end of the 2nd quarter of 2009, the fund houses covered in the survey reported aggregated AUM of US$3.1 trillion, representing about 15.2% of the estimated total global AUM.

The survey shows that at the end of the 2nd quarter of 2009, AUM increased by US$315 billion, up 11.4% from the 1st quarter 2009. Equity funds, which decreased by US$85 billion in the previous quarter, posted an increase of US$206 billion in the 2nd quarter 2009, contributing the most to the overall AUM growth in during the quarter. All other funds, except for money market funds, saw an increase as well.

Survey participants include: Alliance Bernstein, Allianz Global Investors, Baring Asset Management, BlackRock, Fidelity Investment Management, Franklin Templeton, HSBC Global Asset Management, Invesco, Investec, J.P. Morgan, Prudential, Schroders and Societe Generale.