|

|

Indonesia is very likely to see a record sukuk issuance in 2012, including the offering of the country’s first US dollar corporate sukuk.

Herwin Bustaman, head of HSBC Amanah in Indonesia, notes that the Indonesian government has already sold USD1.5 billion of local sukuk in March this year and that another USD1 billion to USD1.5 billion of global government sukuk is likely to be sold in the second half of the year.

Bustaman notes that it was previously difficult to launch a corporate sukuk in Indonesia because of issues such as tax and the transfer of beneficiary ownership. However, with the new tax and sukuk laws, corporates in Indonesia can now issue US dollar sukuk and start reaching out to the Middle East investors.

“The investors from the Gulf Cooperation Council countries are definitely keen to invest in Indonesia especially with the recent investment rating upgrade,” he told an HSBC Amanah sukuk briefing on April 3. “They would also like to diversify their investment to countries such as Indonesia.”

What also makes the outlook for sukuk in Indonesia promising are the supportive regulatory initiatives. Bustaman notes that there are plans to reduce the listing fees for corporate sukuk issuance by the end of this year and it has also been confirmed that the tax treatment for sukuk is the same with the conventional bond. A company only needs one prospectus when issuing both local bonds and local sukuk.

“We are optimistic that these steps will encourage corporates to issue sukuk, besides conventional bonds, because through sukuk, the issuers can diversify their investor base,” Bustaman points out. “In the meantime, the sukuk arrangers should help explain these positive changes to potential issuers and maybe even arrange non-deal roadshows to raise the understanding and familiarity on sukuk by corporates in Indonesia.”

|

|

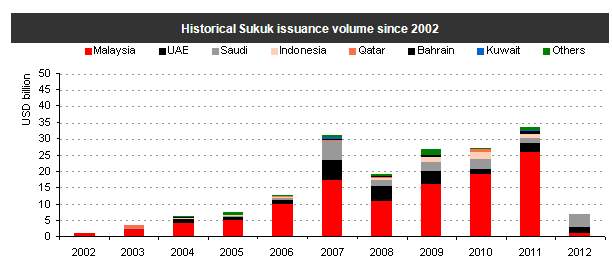

Overall, sukuk issuance in Asia is expected to be the highest this year, led by Malaysia, driven largely by the infrastructure projects across the region. “As it is, the sukuk market is already off to a strong start in 2012 and we are confident that there will be more in the pipeline given the Asian issuers and investors’ increasing appetite for sukuk offering in both foreign and local currencies,” says HSBC Amanah Malaysia CEO Rafe Haneef.

HSBC Amanah estimates that the total global sukuk issuance in 2012 will reach USD44 billion, up from USD26.5 billion in the previous year, with Malaysia accounting for 60 percent of the amount. Middle East and North African countries will contribute 32 percent, while the remaining eight percent will come from the other jurisdictions. Government and government-related entities will account for 50% of the total issuance, with the financial sector and corporates contributing 25 percent each.

Wynce Low, director and head of debt capital markets, global capital financing, at HSBC Bank Malaysia, says the projects being rolled out under the government’s Economic Transformation Programme would underpin the sukuk issuance in Malaysia. Projek Lebuhraya Usahasama (PLUS) has issued the world’s largest corporate sukuk amounting to 30.6 billion ringgit (USD10.03 billion) in January this year, while the Tanjung Bin Energy has arranged 3.29 billion ringgit sukuk to help fund a new 1,000 MW coal-fired power station project in Johore.