|

|

On the first trading day, emission permits totalling 21,112 tonnes CO2 exchanged parties – state-owned PetroChina Guangdong and private solar-panel maker Hanergy buying licences for 10,000 tonnes each at 28 yuan and 30 yuan per tonne, respectively, from utility company Shenzhen Energy (深圳能源集团). The remaining licences for 1,112 tonnes were exchanged in six additional transactions between other utilities companies, giving buyers the right to emit more carbon dioxide than what they are allocated when joining the scheme. The ETS covers 635 companies from 26 sectors, accounting for about 40% of Shenzhen’s 2010 emissions. The scheme encompasses only those corporations that emit 20,000 tonnes CO2 or more per annum.

Initial deals were planned and prices pre-determined to demonstrate the functionality of the system, but they failed to create momentum. “I am not aware that there has been fairly active trading since the launch on June 18,” comments Chan Wai-Shin, director of climate change strategy Asia at HSBC. “But that makes sense because companies on the exchange trade their 2013 annual allowances. Now it is July so these companies have difficulty gauging their emissions for the whole year. On the European carbon exchange, there is typically a flurry of trading at the end of the year – whether we will see this in Shenzhen is difficult to say at this moment.”

Beneficial strategy

Chan adds it is important to note that Shenzhen is merely a pilot scheme, a testing phase to see how and if carbon trading could work in China. Many of the trading mechanics have yet to be defined.

Christian Ellermann, chief representative for China at industry consultant Ecofys points out: “For market mechanisms to kick in, you need a certain trading volume. Shenzhen is quite far in setting up the infrastructure, but is still in the process of releasing more detailed guidelines. Since they are the first, they face many uncertainties. Environmental market mechanisms are something new for many of the companies that participate in the scheme. Some can transfer knowledge from experience with trading commodities, for others it is completely new territory.”

He adds, however: “We do advice companies that even though compliance is only required at the end of this year, a strategy for trading throughout the year that takes into account the company’s profile and market conditions can be very beneficial. For companies, the emission trading desk can be a profit centre not just an administrative burden.” In China, Ecofys advises the local government in Tianjin regarding the city’s own emissions exchange as well as participating corporates.

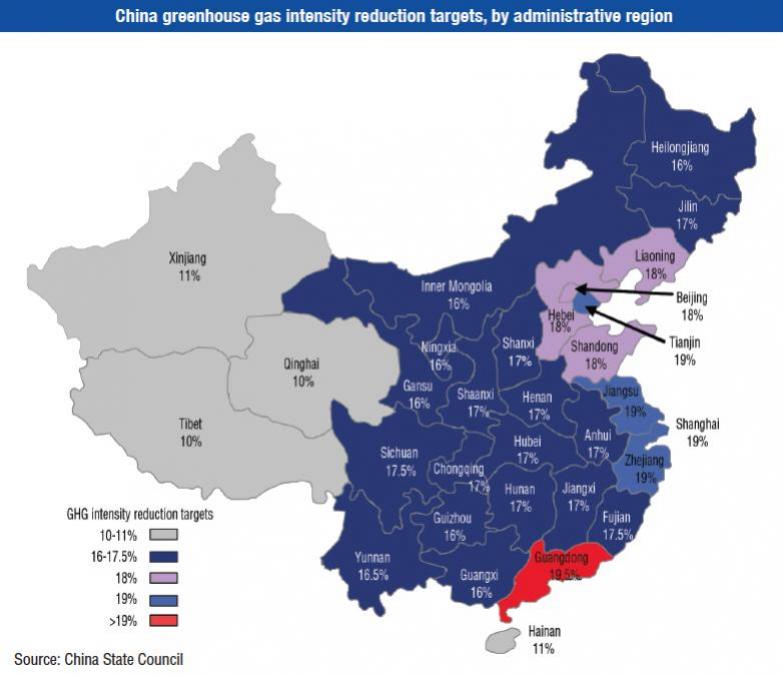

Apart from Shenzhen and Tianjin, three other directly administered cities and two provinces – Beijing, Shanghai, Chongqing, Guangdong and Hubei – were designated in 2011 by the National Development and Reform Commission (NDRC) as pilot areas for regional mandatory ETSs. Carbon trading markets form a pillar in the current 12th Five-Year Plan (period 2011 to 2015) in which China outlines ambitious targets relating to carbon emission reduction, climate change and the environment. Energy intensity, a measure of energy consumption over GDP, and carbon intensity, linking greenhouse gas emissions and GDP, are to be reduced by 16% and 17%, respectively, until 2015. (See map on previous page.)

Unclear launch dates

The NDRC had previously announced aspirations to construct a national ETS in China by 2015, but this timetable is not viable, experts say.

“A national trading scheme was first proposed for the year 2015, then it became 2016 and from what I could gather from meetings last month, the target now seems to be 2017,” shares Chan.

“The year is unimportant; the trend is that there are some delays because of the mechanics involved. China’s greatest problem in that respect has been the accuracy of data. Carbon emission data are difficult to measure and the officials acknowledge that there is an undercapacity of professionals with the expertise to audit carbon emissions.”

The launch dates of other pilot projects are thus unclear. The Shanghai exchange, for instance, was supposed to begin operations in June and a launch for Hubei province was originally planned for July 1, yet there have been no announcements made. Adds Ellermann of Ecofys: “As far as we are aware, the Tianjin ETS will launch later this year. In April, all companies that will be part of it were gathered and basic mechanics outlined. We are now awaiting more detailed guidelines.”

Some commentators have indicated that delays could be due to industry resistance, particularly coming from those engaged in resource-intensive cement manufacturing. “While there has been some pushback from some companies,” observes Chan, “that has been true in Europe and Australia as well. No business wants to be burdened additionally.”

Prices per tonne in Shenzhen on the first day of trading were about 25% lower than for what permits traded in Europe that day, but comparatively higher than the record low of x2.44 in April. Shenzhen and Shanghai have both indicated that overall emission allowances extended to companies are subject to upward (downward) adjustment in case prices increase (decrease) beyond a politically acceptable

.jpg)

.jpg)