|

|

| Consing: I don’t know where this market is going to go |

Of the many levers which the treasury and finance function controls in a firm’s value creation, perhaps establishing timely access to capital and maintaining an appropriate capital structure are the most critical, believes Rafael J Consing Jr, vice-president for finance and treasurer at International Container Terminal Services Inc (ICTSI), a Manila-based port management company involved in the operation and development of marine terminals and seaports globally.

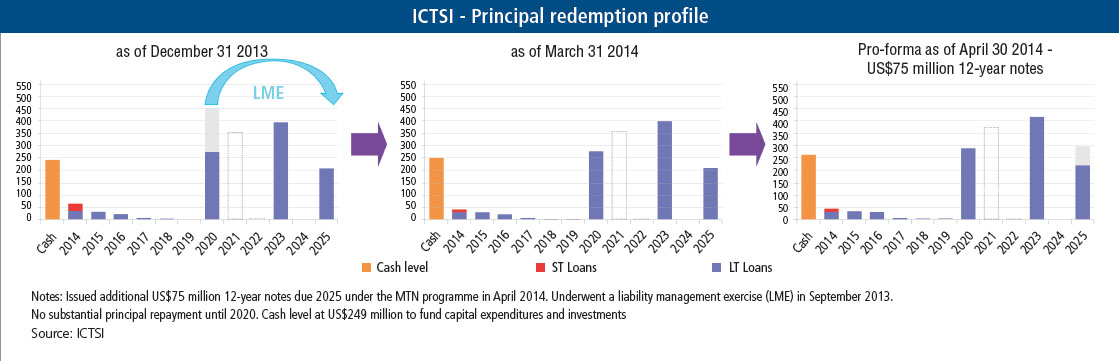

That was the journey the past five years Consing undertook for ICTSI extending duration by tapping the bond market and creating enough runway to allow the company to re-invest excess cash back into projects rather than to re-finance debt maturities. Now, he has taken another leap with the latest US$350 million syndicated financing this time from the loan market.

On the surface, it does not appear be out of the ordinary. ICTSI upsized the loan from US$250 million and attracted the participation of 24 domestic and international banks – including 11 banks from Taiwan – in another successful undertaking. But this deal stood out beyond the 3.34x oversubscription.

First, Consing had to convince both Australia and New Zealand Banking group (ANZ) and Standard Chartered, which acted as the arrangers, to agree to lead the US$1 billion loan programme, an issuance structure that is more akin to a medium-term note programme (MTN) practiced in the bond market. “Based on experience, every time you go to a bank, it is always a new round of negotiations,” he points out. “We looked at the MTN platform, which we have registered, and applied the same philosophy to the loan market.”

Consing believes that this may be the first time an Asian company structured a loan in such a format. “There is a similar precedent in Australia,” he shares. “We have taken it a step further by drafting the mechanics – say if there is an amendment, how do you go about it? How do you go about issuing loans? Essentially, it is MTN mechanics in loan format.”

The programme format in effect streamlines the process of bond or loan origination. In addition, Consing says that a homogenous set of debt covenants that covers both public and private debt reduces the cost of loan maintenance and frees up time for the finance team to focus on value creation.

Next, he upped the challenge by moving loan documentation standards away from maintenance of certain financial covenants throughout the life of the loan to one based on incurrence. He explains: “When you borrow from a bank, you have to maintain these financial covenants such that when you cross them, you are in default.”

ICTSI’s argument

In an incurrence-based regime, which is the case for ICTSI’s bonds, the company needed to meet the financial covenants only on the date of issuance. “If something happens in between and you breach a covenant, you are not declared in default,” he explains. “You simply lose the ability to borrow more.”

|

|

| ICTSI - Principal redemption profile |

Consing’s argument to the banks to adopt this approach is simple. “If the bond market was willing to buy our paper on a long-dated basis under an incurrence-based covenant regime, why would we go to a bank, take a shorter term funding, but have to be subject to maintenance covenants?” He admits that until this deal, banks he intimated this idea in the past three years were unwilling to accept his way of thinking and were especially worried to set a precedent. “That has always been the way they have done transactions” is what they would tell him.

Perhaps an equally nagging question for a treasurer such as Consing in pursuing his approach is concern on the impact of another round of synchronized market decline. “I don’t know where this market is going to go,” he shares with The Asset. “[But] corporates [such as ICTSI] should not be punished as a result of an entire industry weakening. Having an overall incurrence-based regime was the answer to this. You are always one step detached from getting into a default.”

Consing says that the combination of doing its latest financing in programme format under an incurrence-based regime was the exciting part. “It was unique in the Asian setting,” he says.

The icing on the cake for ICTSI’s latest financing was structuring the loan as a revolving facility. By taking advantage of the benefits of a revolver, the company is then able to manage the negative carry. “Had we funded through the bond market and received the principal today but the fund deployment would be later, it would have cost us money – a negative interest carry,” he adds.

As ICTSI generates excess cash every year, he says it made sense to come up with a structure that bridges the inflows against the construction outflows. “A revolving structure would best meet that,” he notes. “It was a challenge for the market because doing a revolving structure for five years was unheard of.”

For the revolving facility, ICTSI is paying Libor + 195bp for five years. “If we had done a bond, we would have a 4% to 4.5% negative carry,” he illustrates. “In this case, the negative carry is the commitment fee while the facility is undrawn, which is 78bp. Therefore this represents a savings of about 3.5%.”

In executing this latest deal, Consing says the company was filling a piece of the puzzle within the corporate financing structure, which is bank funding. At the same time, ICTSI had considerable room in the three- to five-year maturity given no debt outstanding in that bucket. “When I was looking at the manner in which banks were executing transactions, I felt that there was an opportunity to make it more efficient,” he explains.

Now, he says, the company should be able to arrange bank borrowings through this programme; including bilateral financing facilities. “When we talk to the banks, it is purely commercial. We no longer have to touch the covenants anymore.”

After ICTSI secured the backing of ANZ and Standard Chartered, Consing recalls that they also had to work closely with the legal counsel, Milbank, Tweed, Hadley & McCloy to also get them on board. The next step was to convince the participating banks. “We went on a series of roadshows like I would with a bond issue; we went to Taiwan and Singapore. We walked through the credit, the structure, the rationale to educate the banks,” he says. Working in ICTSI’s favour is the lack of supply from the Philippine market. “We took advantage of that latent demand,” he adds. “The banks were hungry for it and needed to subscribe to the idea.” In reality, he notes the banks were taking a risk that they already have taken. “A lot of them were bondholders [of ICTSI] holding longer duration.”

A total of 24 banks participated including six local banks and 11 Taiwanese banks. Given the overwhelming response from the market, Consing says this helped to ease the bank into the structure. “None had to take a big US$50 million slug; each was taking US$10 million to US$20 million each. There is also no issue with respect to single borrowers’ limit.”

With the loan programme format now successfully concluded, he believes other borrowers similarly should be able to achieve the same outcome. To bundle that with an incurrence-based regime in a loan format can also done any time for the right issuers. For example, it may not be possible for a trading company to do so.

He says that it was important for a company looking to replicate what ICTSI has done to have a strong stakeholder programme. “At every level of our capital structure – banks, creditors, bond holders, equity holders; hybrid bond holders, we have a strong relationship with all of them,” he notes. “If you look at our capital structure, it is now practically all off-the-shelf. If you want to do a bond, MTN programme; if you want to do a loan, loan programme; this way, the treasury and finance team can focus on analytics.”

.jpg)