The Bulls

|

Edwin Chan

UBS

Neutral to positive |

|

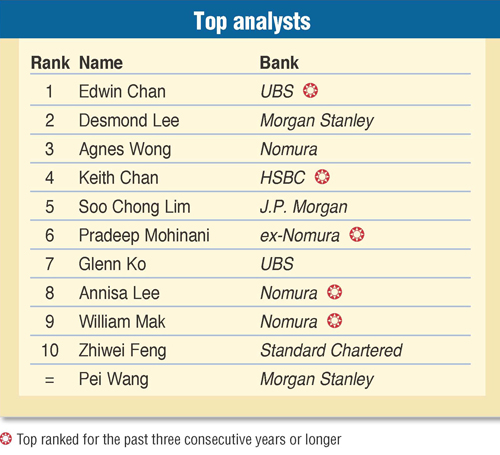

| Top analysts (Click to enlarge) |

The potential rise in US treasuries (UST) yield is negative to total return, but considering Asian dollar bonds are trading at wider credit spreads over US composites (e.g. c100bp for investment grade), this should help cushion some of the negative impact and deliver excess return.

Pradeep Mohinani

ex-Nomura

Positive

Credit spreads across a number of geographies and sectors in Asia still remain higher than developed market (DM) spreads and offer additional room to tighten. Despite concerns of US Fed (Federal Reserve) QE coming to an end and expectations of rising rates in 2015, the general market liquidity will continue to be supportive with the ECB (European Central Bank) and BoJ (Bank of Japan) seen to embark on their QE programmes in the coming months. These are likely to offset the Fed’s QE coming to an end. Similarly, default rates are unlikely to pick up sharply, remaining below the 20-year average. The two caveats to the positive outlook are: 1) geopolitical risks with the unstable situation between Ukraine and Russia persisting, and in the Middle East with ISIS at some point causing economic damage through either higher oil prices or terrorist attacks; and 2) China’s growth coming unhinged from current expectations.

Shankar Narayanaswamy

Standard Chartered

Positive

Asian G3 credit spreads are currently trading at tight levels. In our view, we could see a further spread tightening over the next 12 months, given the abundant liquidity in the system. The ECB is the latest central bank to join the QE bandwagon and this is likely to support demand for Asian credit in the medium term. This is especially true for the high grade (HG) sector, which is trading wider than similar rated credits from the US and Europe. From a fundamental perspective, Asian credit metrics are stabilizing as corporates reduce their leverage and earnings improve. Even from a sovereign perspective, structurally weaker sovereigns like Indonesia and India are better prepared to withstand any withdrawal of liquidity. Given the supportive fundamental and technical backdrops, spreads could be tighter in a 12-month timeframe.

Aileen Ngui

Deutsche Bank

Positive

The reasons for my positive outlook on Asian G3 bond market:

• Given low yields in Europe, there has been increasing interest from European real money for higher-rated Asian paper. Expect this trend to continue as the ECB has only just started its private QE.

• EM funds have been underweight Asia on the whole and there is more dedicated focus on Asian credits by these funds. This is evidenced by these funds setting up Asian operations and/or expanding their existing Asian teams. Even if there is just a slight increase of asset allocation to Asia, the collective amount is potentially sizeable.

• Geopolitical risks in other parts of the emerging markets (i.e. outside Asia) still remain volatile and may spike again and investors may prefer to invest in the relatively more stable Asian region.

• Default rates in Asia continue to be visibly lower vs. those in wider EM, including sovereigns too. Expect this situation to persist in the next 12 months.

|

Kaushik Rudra

Standard Chartered

Positive

I expect the next 12 months to be positive for risk assets. While the US Fed is anticipated to withdraw its monetary accommodation, other major central banks – including the ECB, BoJ and the People’s Bank of China – are likely to maintain their easy money policies. These, combined with easing fundamental concerns about some EM and Asian countries, should support Asian credit markets. We recognize, however, that Asian credit spreads are relatively tight and could see a period of consolidation, especially when faced with excessive supply at times.

Archie Sy

ANZ

Positive

Doom and gloom market predictions are easiest to convey at a time when Asian credit spreads are tight, coupled with strong equity performances (US, Southeast Asia, etc.). Asia credit spreads will remain closer to tight for the most part of 2015. While the US is expected to exit accommodative policies and go the other way, this will be gradual and well communicated for markets to remain calm and collected (unlike in 2013).

The global economy will remain lethargic enough that major CBs of the world will take the place of the Fed in providing easy money to the system. Within Asia itself, there has been considerable wealth creation in the last five years that money pouring into fixed income will remain strong despite the risk of higher yields. These are all positives for credit, but I would agree that valuations aren’t anywhere close to being cheap now, broadly speaking. It’s best to get into select new issues and spread widening when that happens. Besides, the only sure thing that has an upward trajectory has been the amount of issuance, so we will all get our fill for sure.

Neutral

Zhiwei Feng

Standard Chartered

Neutral |

|

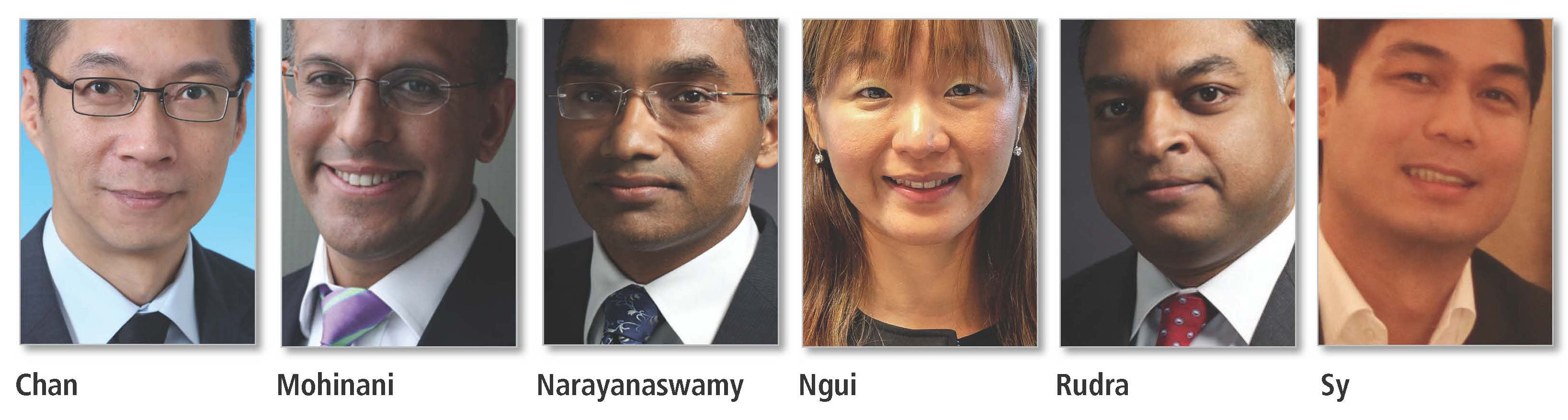

| Top economists and credit strategists (Click to enlarge) |

I have a neutral view on the Asian G3 bond market in the next 12 months. The easing credit environment will likely continue globally. Most Asian countries are fundamentally stronger than DM and other EM regions. While there is no immediate upside catalyst for Asian bonds and supply pressure remains, I do not expect an oversupply, and the risk of a large fund outflow in the following 12 months is low.

As a result, the carry investment theme will persist into 2015. That said, hiccups are still likely.

Krishna Hegde

Barclays

Neutral

Compared to the supportive backdrop that enabled spread compression in 2014, we expect a more mixed backdrop for Asian credit in the next 12 months. Total returns for this asset class are likely to be challenging. While the US Fed is poised to start hiking rates, we do not expect a disruptive move upwards. Continued easing from the ECB and BoJ should blunt the effect on spreads somewhat and support market technicals.

At a fundamental level, we see growth continuing to slow in China and the effects are likely to be felt across a broad swatch of issuers geared to investment-led growth in the mainland. We expect India and Indonesia to benefit from better investor perception following the completion of the political cycle in both countries.

Annisa Lee, William Mak and Agnes Wong

Nomura

Neutral to slightly negative

Overall, we are neutral to slightly negative on Asian credit over the next 12 months. Credit fundamentals of bond issuers are at best stable, with certain sectors such as China property set to further deteriorate. Technical factors like bond supply and fund flows into the region may not be in our favour. With our house view that China GDP growth may fall to 6.8% in 2015, which seems conceivable considering recent weak macro data, more Chinese corporates will likely tap offshore markets to raise new, or refinance existing debt. This, together with more Indian corporates going offshore due to the change of withholding tax regulation, is likely to increase bond supply risk.

|

Simon Moore

Standard Chartered

Neutral

I see 2015 as a coupon clip year, which isn’t necessarily a bad thing. A lot has gone right for Asian credit this year, and it’s hard to see a scenario (barring another UST rally) with double digit returns. The swing factor, as always, is China. It remains cheap on a spread to ratings basis, but will likely continue to. There are simply too many China bears among global PMs, while cross-over interest from US high grade accounts has underwhelmed and supply will be constant. In other words, the bulk of the supply in Asia will likely keep coming from where it’s wanted least. The other key risk in 2015 is any policy/growth misstep in India. This is clearly not baked in at current valuations. On the flipside, Asia should continue to benefit from macro and geopolitical noise in other corners of EM credit. A bull could also argue that spreads in Asia are still significantly wide at pre-Lehman levels, at a time when most “developed” markets are back at those levels. So it’s still a decent backdrop for Asian credit and returns in the next year should, in turn, be decent.

Dean Wang

Morgan Stanley

Neutral

I am not too sure if the secular tightening in credit spreads has more room to run without a significant re-pricing of credit markets. Reforms in China will continue to dampen sentiments and cloud longer term views.

Chong Hui Chin

Bank of America Merrill Lynch

Negative

Rewind a year back, the idea of credit putting in another strong showing simply went against the grain, so was the idea of emerging markets again outperforming developed markets. One of the reasons for the solid performance in credit is the mixed bag of economic data this year. Data was just positive enough to drive up stocks, but not enough to drive down credit. We are seeing volatility in rates but current UST levels are still below consensus expectations at the end of 2013. Geopolitical risks weighed on EMEA, but outflows there benefitted other EM markets including Asia. 2014 was widely anticipated with a number of watershed elections, and India didn’t disappoint. Polls produced a clear mandate with the landslide election of Narendra Modi and Indian investment grade credit spread broadly tightened 75bp-100bp. The election victory of Jokowi Widodo also kept Indonesian credit spreads tight this year. The stable economic and geopolitical backdrop in Asia has enabled supply to exceed that of last year.

All said, the same conducive conditions for Asian outperformance will not be expected to last. In the next 12 months, we should continue to see rates creeping up. Already, fund inflows are slowing. I expect investment grade spreads will come under increasing pressure, while investors seek higher yielding spreads and good quality high yield paper.

|

Marcus Corrigan

ex-BNP Paribas

Negative |

|

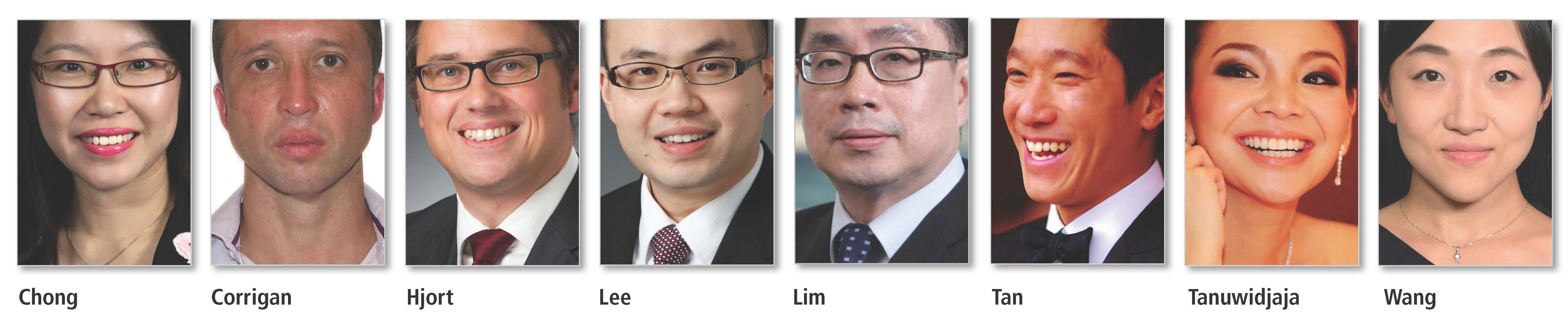

| Top salespeople (Click to enlarge) |

It’s difficult to get excited about the market when credit spreads are very close to the year’s tights and well through that over the last five years. Post FOMC (Federal Open Market Committee), the market feels good but supply is large and will only grow over time. There is not much of a buffer in spreads and there is plenty that can go wrong over the next 12 months – 1. Rates will be on the rise. 2. China is stimulating the economy again as performance has been poor. Will this be enough? I tend to think we will get the usual hard landing fears returning to the market next year. 3. The credit cycle has peaked in my view in the US and will deteriorate slightly. 4. Global inflation among others. The lack of volume over the last three years has been well below the norm and this year even more so. At some point, this is likely to normalize.

|

Viktor Hjort

Morgan Stanley

Negative |

|

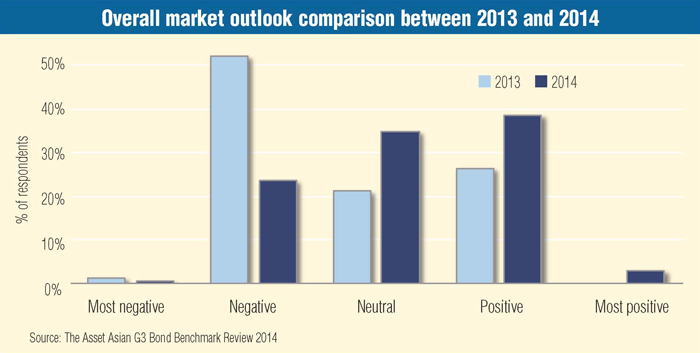

| Overall market outlook comparison between 2013 and 2014 (Click to enlarge) |

We expect the next six months to be challenging for Asian credit and better entry points than what we have today. Spreads aren’t tight per se, they’re just not wide enough to compensate for the ongoing deterioration in corporate balance sheets and the relatively tight credit conditions. We see the market environment to be less about owning the most carry and more about avoiding fallen angels and stressed credits. In an environment where liquidity is ample, the highest coupon wins; in an environment where liquidity is rationed -- which is what we see ahead – the winners are those with real growth. High yield is where the risks are most skewed to the downside.

Desmond Lee

Morgan Stanley

Negative

Credit spreads are too tight – particularly in lower-rated credits. There isn’t much buffer against any negative developments.

Soo Chong Lim

J.P. Morgan

Negative

The Asian credit market should continue to perform relatively well in the short-term, mostly driven by technicals, as investors continue their search for yield in this low interest rate environment. However, an expected pick-up in UST, as the US economy gains momentum, would eventually create a strong headwind for this market. Credit spreads, which are already trading near the low end of their historical trading range, may not provide the cushion to absorb rising UST yields, especially with Asian credit fundamentals still on the downtrend, albeit not at an alarming rate.

|

Bryan Tan

BNP Paribas

Negative

In the words of famed philosopher David Guetta, Asian credit has been on a resilient run this year: bulletproof, nothing to lose; shoot it down, but it won’t fall: it’s been titanium. Cue the thumping bass beats and the pop of celebratory champagne, as the sceptics among us rub their eyes, attempting to peer through the smoke and disco lights to make sense of the strength. While it feels like the optimistic masses are content to ride the buoyant price action, there certainly still exists a healthy dose of cynicism on the sustainability of the rally. US tapering was rightly the focus coming into 2014, but I suppose this only counts for so much when there are that many other factors to consider.

I am a tad surprised at how well Asian credit has held up this year but frankly, nowadays, nothing surprises me anymore. For a while, every possible situation out there could be spun, tabloid-style, into an argument for why Asian credit was rallying. It’s slightly disconcerting to me that this great run has come amid a smorgasbord of potential geopolitical event and macro risks. In the grand scheme of things, despite a few notable patches of weakness, we have quite non-chalantly bulldozed through every headline and potential catalyst for volatility over the past three years. I cannot help but feel that valuations are rich, and I remain wary.

Sherly Tanuwidjaja

BNP Paribas

Negative

In the past few years, the Asian G3 bond market has benefitted much from loose monetary policy in the US, leading to abnormally low volatility. As a result, Asian G3 bonds, which offered attractive returns and a relatively safe place to park cash, were snapped up by hungry, yield-chasing investors.

As QE in the US comes to an end this year, and we face the high probability of a first post-tapering rate hike there sometime 2015, this change of tone in the US could be quite negative for the Asian G3 bond market, and could even happen sooner than expected. We had a sneak preview of this during the taper tantrum last year with EM bond prices sliding down quickly alongside a huge EM bond fund outflow. This could happen again when the US cycle turns, and to me, it’s just a matter of time. Another big risk to the Asian G3 bond market is if the US were to realize it is behind schedule in ending QE and/or hiking rates, and decides to tighten policy at a faster rate. We are not quite there yet, but if it happens, expect a bigger shock and volatility to EM credit overall.

|

Pei Wang

Morgan Stanley

Negative |

|

| Top trader (Click to enlarge) |

Valuation is already at year-to-date tight while there is no material improvement in corporate fundamentals. Credit conditions across the region are also still challenging. The expected big supply from either AT1 or corporate front will cap the upside of the whole space.

.jpg)

.jpg)