|

|

| Concepcion: The last 12 months presented both opportunities and challenges for us |

2014 has been rather difficult for the palm oil industry. The price of crude palm oil (CPO) has declined about 30% since the start of the year, hitting a three-year low. Several factors brought down the price of CPO – better-than-expected weather conditions; an abundant supply of soya beans, a rival source of edible oil; rising output of palm oil in Indonesia and Malaysia, which together account for 86% of global production and a slowing demand from China, the world’s largest importer after India.

As such, the performance of Golden Agri-Resources, the largest plantation group in Indonesia and the third biggest globally in CPO production, has been affected. While making a strategic shift to expanding its downstream business, the company is confronted with a volatile commodity price environment and overcapacity in the palm oil refining sector.

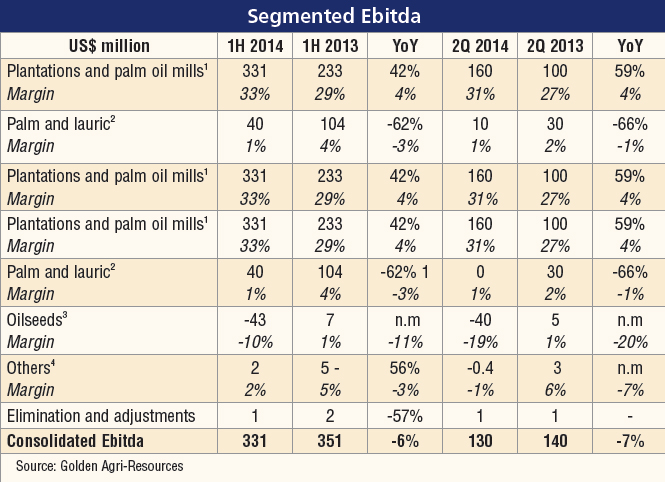

In the first half of 2014, despite a revenue growth of 27% year-on-year (yoy) on the back of higher production, the company saw its Ebitda (earnings before interest, tax, depreciation and amortization) and net profit decline 6% and 17% respectively.

Upstream business remained strong. The group’s plantations have a favourable age profile – the average age is 14 years, with 46% falling into the prime mature age category of seven to 18. But its downstream business suffered from higher raw material costs and intense price competition as a result of overcapacity.

Nonetheless, the downstream segment experienced volume growth as its refineries boosted their capacity. The palm and laurics segment, which focuses on processing and merchandising palm-based products, saw a revenue growth of 41% yoy.

However, revenue from the oilseeds segment fell 27%, and the company attributes this to reduced utilization of its China facilities in an effort to manage costs.

The Ebitda margin of the plantation and palm oil mill business in the first half of 2014 stood at 33%, up from 29% in the same period last year. In comparison, margins of downstream businesses dropped significantly, with Ebitda margin at the palm and laurics segment declining 1% from 4% the previous year, while the oilseeds segment saw a whopping 10% loss, compared with a gain of 1% a year ago.

The lower levels of margins in the downstream business pushed down Golden Agri’s consolidated Ebitda margin in the first half to 8.3% from 11.2% in the first half of 2013.

“The last 12 months presented both opportunities and challenges for us,” says Rafael Buhay Concepion Jr, executive director and CFO of Golden Agri. “Our performance was highly affected by the volatility in commodity prices, which is primarily due to globally restrained economic growth and excellent weather conditions.”

Despite the overcapacity in the refining sector, Concepcion notes that Golden Agri’s vertically-integrated business model, the new technologies used in its refineries and its strategic locations give the company an edge over its peers. “We are also pursuing destination sales by increasing distribution and logistics capabilities,” he adds.

In China, he informs, the company has the flexibility to reduce the use of its crushing capacity to cut costs during difficult market situations. “We are exploring strategic sourcing opportunities to achieve competitive raw material cost. We are also leveraging on our strong distribution network in China to sell higher margin products such as specialty fats. We continue to enhance relationships with end customers by providing additional services.”

“China remains the largest and fastest growing edible oil consumer market. It is our view that in the longer term, the current market conditions will improve.”

|

|

| Segmented Ebitda (Click to enlarge) |

Positive long term

Concepcion notes that while the price of CPO will continue to be volatile in the near term, given the prevailing global economic conditions, inventory levels and crude oil prices, the long-term prospects for CPO price and the industry in general continue to be positive.

Over the long term, CPO demand from large developing countries such as China, Indonesia and India, will remain robust. Support is also expected to come from the increasing use of palm oil in the alternative energy sector, particularly in biodiesel.

Last year, Indonesia increased the mandate for biodiesel to be blended with fuel to 10% from 7.5% previously. It will likely take two to three years for this to be fully implemented as the supporting infrastructure is still being built.

“Our positive outlook on the CPO price is supported by its continuing strong fundamentals such as its being the lowest-priced edible oil. It is also the highest yielding compared to other edible oils, which means that it has the lowest production cost,” Concepcion remarks. “The outlook is also supported by the high barrier of entry in the industry and a long lead time required to increase production.”

This year, Golden Agri plans to invest US$250 million in the upstream business to expand its plantations by 20,000 to 30,000 hectares through organic growth and acquisitions. It currently has a combined plantation area of 470,600 hectares in Indonesia.

For its downstream business, the company will spend about US$300 million to expand its processing capacity in strategic locations, extend its product portfolios and widen its distribution coverage and logistics facilities.

Its expansion of downstream processing and value-added operations over the last few years enabled the segment to increase its revenue contribution to 41% from just about 37% in 2012. Golden Agri currently generates about 38% of its revenue from CPO and 16% from soya bean products.

The company has increased palm oil refining capacity to 2.28 million tonnes from 1.4 million tonnes in 2011, after the Indonesian government lowered the export tax for refined palm oil products to encourage the industry to shift to value-added production.

A higher working capital needed to support the company’s expansion has resulted in higher debt levels. At the end of June 2014, Golden Agri’s debt to Ebitda ratio stood at 4.7x, up from 4.3x at the end of 2013, and a significant rise from 2.7x at the end of December 2012.

Despite its temporary impact on its financial and credit profile, the expansion of its downstream business should result in a more balanced business model, providing the company with better margin stability in the long run.

Analysts expect the group’s financial profile to gradually improve over the next couple of years, driven by expectations of higher plantation productivity and amortizing debts.

Asked about the company’s near-term fundraising plans, Concepcion says the company is comfortable with its current debt levels, which at the end of June 2014 stood at US$2.85 billion.

“However, our total debt may increase in line with the expansion of the company, with the downstream business recently having increasing needs for self-liquidating, short-term trade and/or working capital facilities in line with the growing volumes. These working capital facilities are self-liquidating with the account receivables and inventory of the business. We may also add long-term funding should there be any substantial M&A transactions,” he points out.

Along with its expansion plans, the company has been diversifying its funding sources, which include issuing Malaysian ringgit sukuk, rupiah-denominated bonds and US dollar-denominated convertible bonds. On April 2014, it established a US$1.5 billion multi-currency MTN programme.

Concepcion says the firm has been “refining our hedging programmes, and also ramping up our treasury technologies to efficiently manage information, risks and cash within our supply chain. Our efforts towards becoming the best in class treasury management are yielding positive results.”

.jpg)

.jpg)