In a year that saw record inflows globally, Asian hedge funds are facing their toughest battle yet. Despite the return of appetite for this asset class, which has topped US$3 trillion in total assets under management (AUM) for the first time since the global financial crisis, Asian funds have struggled to keep the pace.

|

|

| Smith: Institutions don’t want to invest in small start-up businesses |

With over 60% of the universe of Asian funds with AUMs no more than US$150 million, the relatively small size is possibly the biggest hurdle facing these funds. “It’s all about brand now,” says the CEO of a Singapore-based hedge fund. This has left unknown and smaller funds with AUMs of around US$50 million-US$150 million cut out from new allocations.

According to eVestment, a hedge fund data provider, the industry saw inflows of over US$113 billion year-to-date to September 2014, which has not been seen since 2008. However, inflows into Asian managers was a mere US$330 million. This is in stark contrast to the US$7.6 billion registered to Asian funds for 2013.

“Institutions don’t want to invest in a small start-up business but [prefer to] invest in a ready-made significant business of size,” explains Paul Smith, managing director of CFA Asia-Pacific and former CEO of Triple A Partners, in an interview with The Asset.

“Funds that are starting below US$50 million [AUM] take a long time to get over the hurdle,” agrees Candy Cheung, co-head of Asia investments at fund of hedge funds firm SAIL Advisors. “Below US$50 million, it is too small for many investors. They can’t size the investment meaningfully.”

|

|

| Cheung: Large institutions have no choice but look at bigger funds |

As the bulk of investors into hedge funds are still the large institutions from the West, Asian managers may also need to rethink their approach to fund-raising. “If you ask most Asian hedge funds, the average answer would be that they get 20%-30% of their money locally and 70% of their money from the US,” says Smith.

Cheung advises that smaller funds should begin to target certain types of investors. “They [large institutions] have no choice but to look at the bigger funds. Family offices, on the other hand, may have fewer investment constraints.”

Ironically, the record inflows globally come at a time when the industry is facing questions. Relative to the benchmark S&P 500 Total Return, which is up 8.35% year-to-date, eVestment’s Hedge Funds Aggregate has underperformed, returning 2.88% during the period to September 2014.

Appetite for alternatives

The unprecedented low-interest rate environment as a result of pump-priming by central banks, especially in the developed markets, has driven investors to seek out alternatives – including hedge funds – to achieve better investment returns. But the same policy has also fuelled a boom in equity and bond markets. The S&P 500, which touched a low of 676 points in March 2009 at the height of the global crisis, now regularly flirts with 2,000 points.This is what has been behind the rise of exchange-traded funds (ETFs), a low-cost, open-end alternative that tracks an index or a basket of assets similar to an index fund. According to ETFGI, a research and consultancy firm, the total AUM of ETFs has grown to US$2.6 trillion, rivalling the rise of hedge funds during the past five years.

.jpg) |

|

| Seaman: Regulations making it more difficult for smaller hedge funds |

Cost was indeed what’s behind the decision of the California Public Employees’ Retirement System (CalPERS), one of the world’s largest pension funds with AUM of over US$300 billion and an opinion-shaper in the investment world, to wind down US$4 billion completely from hedge funds due to high fees and poor performance in the past few years. CalPERS’ hedge fund portfolio returned 4.75% which was 240bp below its internal benchmark.

The ability to achieve outperformance or the so-called alpha will be vital especially for the smaller-size Asian funds. The prevailing market condition, however, with volatility at a record low level, is not helping.

Traditionally, smaller hedge funds are more nimble and able to take bets and achieve a higher performance of around 10%-20% annually. “If you go back to pre-2008, smaller hedge funds have always outperformed larger hedge funds,” recalls Smith. On the other hand, the larger hedge funds were defensive as these are concerned about retaining their AUM and returning around 5%-6% per annum.

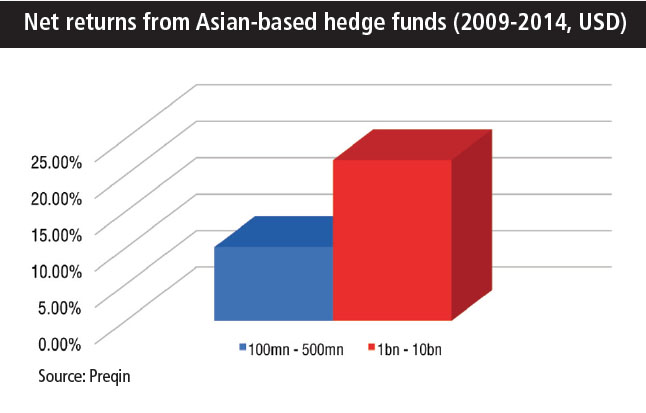

In recent years, they have switched places with large funds performing just as well or even substantially better than their smaller counterparts. Over the past five years, larger hedge funds (US$1 billion-US$10 billion) based in Asia have performed considerably better than their smaller counterparts, returning around 22.05% on average, according to Preqin, an alternative investment data provider.

|

|

| Net returns from Asian-based hedge funds (2009-2014, US$) |

On the other hand, smaller managers (US$100 million-US$500 million) have made 10.12% on average over the last five-year (2009-2014) period. This has made it tough for the smaller hedge funds to stand out in an already competitive industry. “If you are a small hedge fund with US$20 million AUM and you are producing 5% per annum, no one cares,” Smith points out. “If you are a US$2 billion hedge fund producing 5% per annum, people who invest in you will say that is very good.”

Andy Seaman, chief investment officer at Stratton Street Capital, a fixed income specialist with US$1.3 billion AUM, believes that stricter investment rules are also barriers for newer funds to break into the market. “Regulations are making it more difficult for smaller hedge funds to get their message across to investors, he notes.

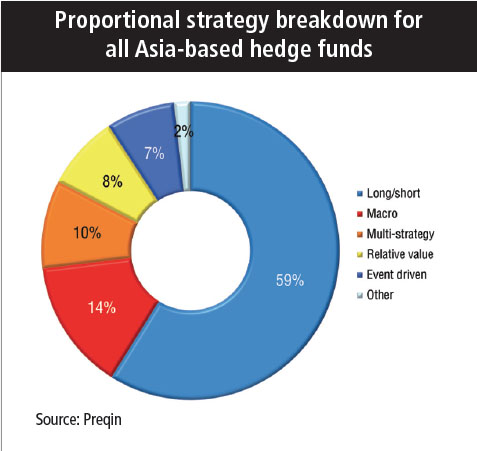

Lack of diversification is yet another issue. According to Preqin, 59% of funds in Asia still use the long/short strategy while the macro (14%) and multi-strategies (10%) are distant second and third, respectively. “It is slightly disappointing,”

|

|

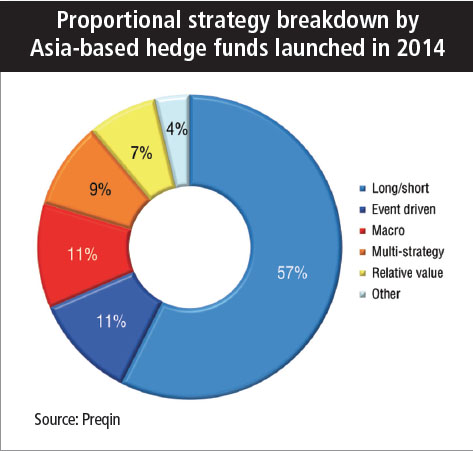

| Proportional strategy breakdown by Asia-based hedge funds launched in 2014 |

adds Smith. “You would have hoped the money over the last 20 years would have gotten spread more evenly; it is still overwhelmingly an equity business.”

SAIL’s Cheung believes that it is a matter of time but this is slowly changing, “In recent years, we have started to see more credit, relative value and macro funds,” she notes. “I believe that trend will continue as the capital markets continue to develop in Asia.” Preqin’s information suggests likewise with new funds launched this year shifting focus towards event driven and macro funds.

For Asian hedge funds, however, it is not necessarily growing to the size of the mega funds such as those in the US as a measure of success. For one, the capital markets in the region are not as developed and as deep as in the West. Smith’s view is that if you are planning on investing in Asian small caps, you should have an AUM of between US$250 million-US$400 million; for Asian large caps, US$500 million-US$1 billion; and for fixed income, US$400 million-US$500 million.

Stratton Street Capital’s Seaman believes that as “most hedge funds run a niche strategy, they will be constrained on the amount of capital they can run; there will definitely be a sweet spot size for them to manage”.

|

|

| Proportional strategy breakdown for all Asia-based hedge funds |

As opportunities in the region open up – especially with increased cross-border investing such as the Hong Kong-Shanghai Stock Connect and the Asean Trading Link, the setbacks facing Asian hedge funds may be a temporary phenomenon. “I think the smarter investors are seeking out the managers they have not heard of, the ones that are more nimble since their AUM is smaller,” Seaman observes.

This more nuanced approach to identifying where Asian hedge funds invest mirrors the fund selection process of SAIL Advisors. The fund of funds evaluates returns on firms that are of similar size. “Not all long/short funds are directly comparable given their different characteristics,” Cheung states. “Based on our bottom up knowledge of the funds, we try to identify their true peer group for more in-depth analysis and comparison.”

Nor is cost such a major issue on its own. “What’s important is not how much fees you pay but how much your after-return fee is,” Smith states. “As an investor, if my return is better than what I could’ve gotten elsewhere, then I don’t care.” For Cheung, it is about “focusing on alpha generation and selecting fund managers that generate alpha”.

.jpg)

.jpg)