|

|

You have found yourself in the same situation time and again. In the freezing December cold, you stand at Beijing’s commercial district and try desperately to flag down a taxi to no avail. Empty for-hire taxies are running past you on the way to pick up passengers that call a cab service by using mobile app Didi Taxi. At a movie theatre in Shenzhen, you might feel cheated that the ticket price you just paid is 2x higher than the person sitting next to you simply because he orders the ticket through mobile app Mtime. That’s how the online-to-offline (O2O) business – said to be the next trillion yuan value industry – changes one’s life China, and this is something beginning to be commonplace in the mainland.

Premier Li Keqiang states in his government work report that China will develop the “Internet Plus” action plan to integrate the mobile internet, cloud computing, big data and the so-called “Internet of Things” with modern manufacturing.

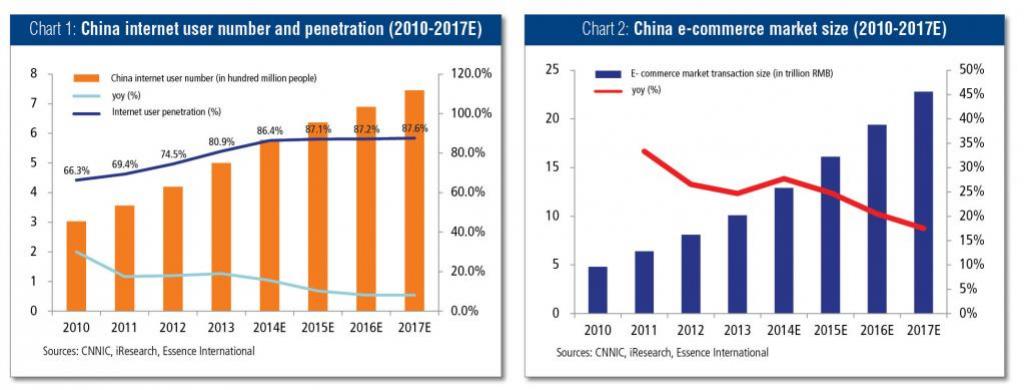

Statistics show how fast the mobile internet and e-commerce are growing. As of end 2013, the number of China’s internet users has reached 620 million, accounting for 45.9% of the country’s total population. Five hundred million or 81% of the users have access to mobile internet (See chart 1).

The mainland’s e-commerce market is indeed developing very quickly. In 2013, China’s e-commerce transactions increased 25.2% year-on-year to 10.1 trillion yuan (See chart 2), following the introduction of the government’s 12th Five Year Plan on E-commerce released in March 2012 and the Implementation Suggestions to Promote E-commerce in November 2013.

Interestingly, among the 1.89 trillion yuan of China’s online shopping market in 2013, 14.4% were done from mobile devices, with the transaction value rising nearly 300% from a year earlier.

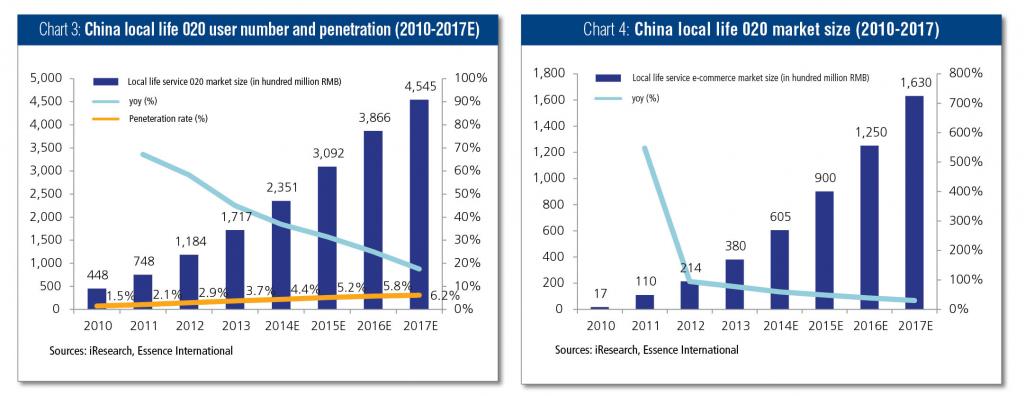

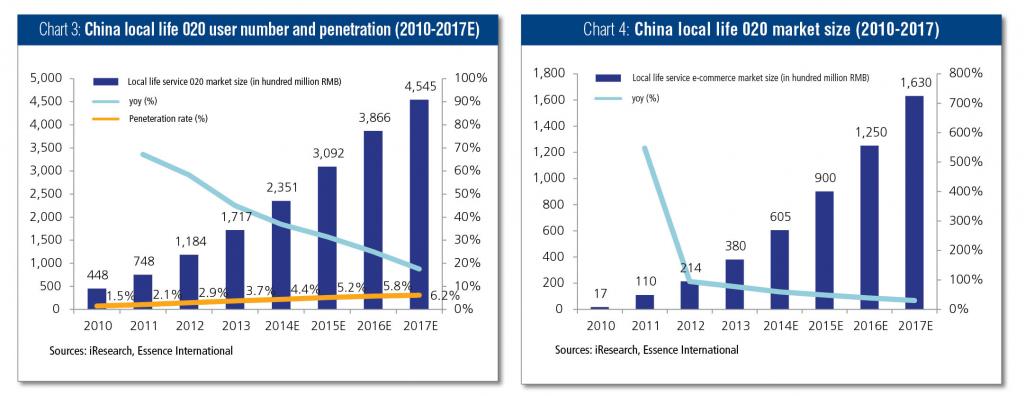

In particular, the homegrown O2O market, a way for consumers to buy with their handsets, rose 45% in 2013 to reach 170 billion yuan (See chart 3), including 37% in catering, 28.5% in recreation, 28.4% in hotel, 2.5% in parenting, 2.3% in beauty care, and 1.4% in wedding events. The O2O user number in China was 190 million in 2013, or 31.4% of the total number of internet users (See chart 4). Internet research institution iResearch (艾瑞咨询) and Chinese brokerage house Essence International (安信国际) estimate China’s O2O market value to reach 454.5 billion yuan by 2017.

|

|

Giant player

Seeing the big potential, Wanda Group, the world’s largest offline consumer network, with 1.5 million customers in 2014 and an estimated 6 billion customers by 2020, together with two Chinese internet giants Tencent and Baidu, set up an O2O e-commerce company in August 2014 in Shenzhen. Wanda Group controls a 70% stake in the venture, while Tencent and Baidu each hold 15%.

Observers note this is a smart strategy to shun direct competition with Alibaba Group which controls 95% of China’s C2C market and about 60% of the B2C market. Wang Jianlin (王健林), Wanda’ chairman and also the richest man in China, states, “O2O will be the largest portion in the pie of the e-commerce market, but it has not been carved up yet. So for now, the opportunity is fair for every participant. We are willing to make efforts to build a comprehensive platform which has not been formalized in the country.”

In December 2014, Wanda Group acquired a controlling stake in China’s fourth ranked online payment platform 99Bill, assuming control of an important payment platform to advance its e-commerce and finance-related businesses. This acquisition, in tandem with free wi-fi coverage and pilot beacon technology trials completed, a large data centre in construction, and several O2O software services under development, means Wanda e-commerce is setting a strong pace for O2O and is expected to be fully operational in the fourth quarter of 2015, according to a company statement. In January 2015, two internet investment funds offered one billion yuan for a 5% stake in Wanda e-commerce, quadrupling the value of the four month-old business to 20 billion yuan.

In terms of the partnership, Wanda seeks to have Tencent contribute its access to Wechat (400 million users) and QQ (800 million users), while Tencent anticipates Wanda shoppers to use Wechat as their payment channel. Baidu can provide the internet portal via its search engine and cooperate with Wanda shop owners through its Baidu Map and online group shopping services.

|

|

O2O development

When the penetration rate of mobile devices reaches 25%-50%, a major development in mobile games and video will be seen. When the rate grows to over 50%, local commercial, life and location-based services (LBS) will see a boom, Essence International says in a research report.

Typically, a “local-life” O2O business runs nine processes. (1) Negotiation between merchants and the O2O platform provider on cooperation mode, product for sale, profit sharing, etc. (2) Display of products on the platform. (3) Checking of information by consumers. (4) Consumers placing orders and making online payments. (5) Order confirmation via consumers’ online account or mobile message. (6) Sending of physical or electronic consumption vouchers. (7) Consumers receive the vouchers. (8) Transaction settlement between the O2O platform and merchants. (9) Consumption at the merchant’s physical shop.

The development of China’s O2O business has gone through three phases, Essence International research shows. First, a boost in 2010-2011 with the launch of several special O2O websites and the e-commerce channel at online portals. As of end 2010, there were over 2,000 O2O service platforms in the country. Second, a cooling-down period from end 2011 to 2012 when most of the websites were forced to close due to the over-heated competition. Third, rational development after 2013 as the major O2O service providers together established industry standards and promoted a healthy development of the sector.

From 2012, China’s three leading internet companies accelerated their foray into the O2O market through investment and acquisitions. Now, Baidu has established its O2O platform that developed from its mapping service. Tencent has built up its O2O ecosystem based on the social networking portal Wechat while Alibaba has a wider variety of product lines including food and beverage, taxi and online shopping (See table 1).

Among various local-life applications, movie ticket booking, restaurant vouchers and cab or car hiring are the most popular O2O services, with property seen as a promising segment to develop (See box story).

With about five years’ development behind it, China’s O2O market looks still fragmented but firmly controlled by a number of providers in each sub-sector. A source who used to work for a major online group buying company in the mainland who left the industry tells The Asset that the profits of O2O platforms are comparatively low and most of the big merchants have a close circle of O2O partners. This represents a major challenge for newcomers.

The business model of Wanda is unique as it aims to integrate the existing traditional merchants with the O2O platforms that are becoming more and more popular among young consumers. However, even Wanda is not fully confident that it can convince and negotiate well with traditional merchants in its shopping malls to join the programme. The same source indicated concern about a potential bubble in the industry that has drawn too much investment. The O2O market needs a more thorough look. While it is promising, it is still in its infancy stage and will sure to have birth pains.

.jpg)

.jpg)