Tighter US monetary policy could signal increasing risks to emerging East Asia's local currency bond markets. This warning comes as the credit spreads might widen ahead of the US Federal Reserve's raising interest rates and a stronger US dollar is making it more costly to service foreign currency debts. In addition, the falling oil prices might hurt highly-leveraged oil and gas companies in the region.

According to the latest issue of Asia Bond Monitor released by the Asian Development Bank (ADB) on March 17, the days of easy liquidity for the region's bond markets look set to end with the US Fed expected to start raising interest rates. "There is likely to be a reduction in the flow of funds searching for yields," the ADB says. "Furthermore, foreign investors are likely to become more discerning in their choice of investment destinations in the region. The result could be wider spreads between high quality and low quality bonds."

The report notes the recent strength of the US dollar has highlighted the risk of borrowing in foreign currency. Issuers will find that the cost of servicing US dollar-denominated debt has increased, especially unhedged debt, and refinancing those debts will likely become more difficult.

The sharp fall in oil prices has drawn attention to the debt obligations of oil and gas companies in the region. As the ADB points out, the decline in revenues from lower oil prices could hamper oil and gas companies' ability to service their debts, particularly those companies with high leverage. Oil and gas companies that are increasingly turning to US dollar financing could also find the environment for refinancing more difficult.

| Foreign holdings of LCY government bonds (% of total) |

|

|

Notes: Data as of end-December 2014 except for Japan and South Korea as of end-September 2014; Data for Malaysia based on AsianBondsOnline estimates Source: AsianBondsOnline. |

But amid these concerns, the amount of local currency bonds outstanding in emerging East Asia continued to grow in the fourth quarter of 2014 to reach US$8.2 trillion as at end-December. Government bonds outstanding totaled US$4.9 trillion, up 10.9% year-on-year, while corporate bonds grew 10% to US$3.3 trillion.

Local currency bond issuance amounted to US$1 trillion in the fourth quarter of 2014, less than the US$1.1 trillion issued in the previous quarter, but more than the amount of issuance in the same period of 2013. Corporate entities sold US$323 billion worth of bonds in the fourth quarter.

China bond market dominated the region in terms of size, accounting for 63.4% (or US$5.2 trillion) of the region's total bonds as at end-December 2014, followed by South Korea with US$1.7 trillion and Malaysia with US$316 billion.

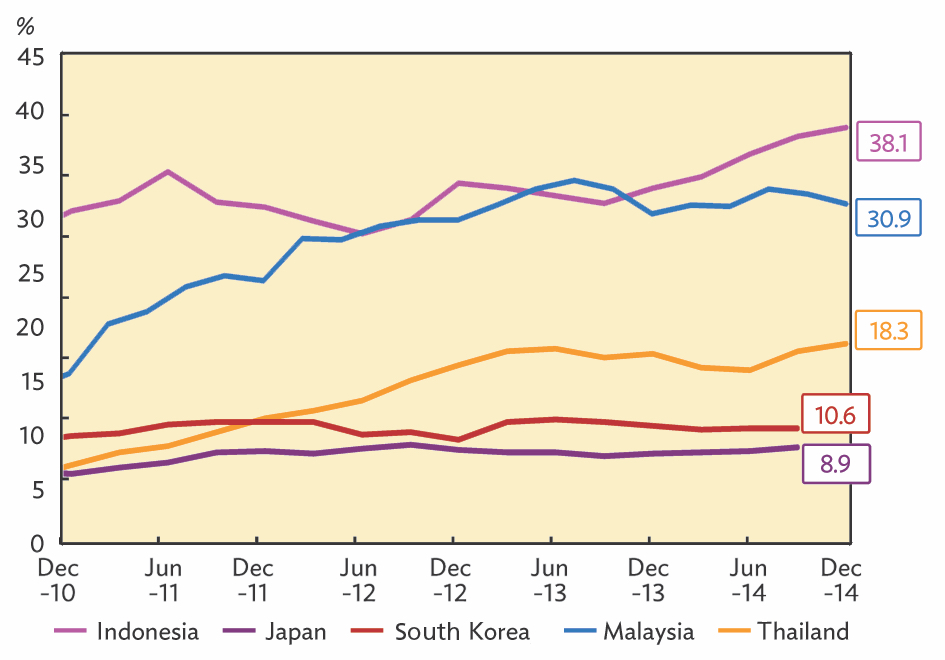

Meanwhile, foreign holdings of local currency government bonds remained strong in most government bond markets in emerging East Asia in the fourth quarter of 2014, with shares climbing in Indonesia and Thailand, and held steady in South Korea. The only exception was Malaysia where foreign holdings of ringgit-denominated bonds declined in the fourth quarter of 2014.

As of end-December 2014, foreign investors were the largest investor group in Indonesia, accounting for a 38.1% share. Foreign funds remain attracted to rupiah-denominated government bonds, which offer the highest yields in the region. For instance, Indonesia's 10-year government bonds fetched a yield of 7.8% as at end-December.

The rising trend in foreign holdings continued in 2015, with offshore investors raising their stakes in rupiah-denominated bonds further to 39.6% as of February 20.