|

|

Traditionally, investors used capitalisation-weighted indices, designed to measure the movement and sentiment of markets, as the reference for their investments, whether they invested in passive strategies (low cost) or active ones (alpha-seeking). Smart beta is an approach to investment that offers an alternative to the more traditional passive and active approaches and bridges the divide between them.

In traditional approaches, stock weights are generally linked to market capitalisation (share price multiplied by the number of shares). In contrast, smart beta aims to capture market performance (beta) through different weighting schemes, while retaining the more attractive elements of passive investment solutions (transparency, low cost, diversification).

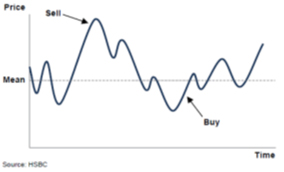

Weighting techniques can be simple (e.g. fundamentally weighted or equally weighted) or more complex (i.e. based on factors such as low volatility, quality, value, growth, yield, size, or momentum). Because they all use different weightings than the market-capitalisation weighting, these strategies regularly rebalance their holding weights, aiming to take advantage of stock-price fluctuations around a perceived “fair value”. This tendency of prices to move back towards the fair value is called “mean reversion”.

The rationale behind this strategy is that traditional market capitalisation based indices overweight the winners: as markets rise, cap-based indices include higher proportions of the stocks that have done well, as the market cap of those stocks has increased. This means that they are biased towards larger-capitalised stocks and the momentum in markets, and are particularly exposed to market “bubbles” – as in Japan’s stock market in the 1980s or the global technology sector in the late 1990s.

As those bubbles reached their peak, cap-based indices were heavily weighted towards the stocks with significant potential for falls in share price, so they were very exposed when these bubbles burst.

The other negative impact of overweighting winners is that it can result in a high concentration in a few sectors or stocks that may not be representative of the underlying economy of a given country or region. As an example, the largest constituent of the FTSE 100 represents 8% of the total index and the five largest stocks represent more than a quarter.

By definition, a key element of smart beta strategies is that, in contrast with cap-weighted approaches, they do not assume that markets are efficient. This relies on the fact that stock prices frequently disconnect from the underlying companies’ fundamentals. Accordingly, some smart beta strategies rely on regular rebalancing to capture the mean reversion in stock prices and drive performance, and weightings are systematically reset to target levels.

By removing the link with price, alternative weighting strategies could help protect investors from behavioural biases and “irrational exuberances” that can push stock values up or down. This also results in a contrarian approach: one that sells stocks that have appreciated and buys stocks that have declined - the frequency of rebalancing being a trade-off between return capture and trading costs.

|

|

Rebalancing has significant value, and this increases with the volatility or “noise” of the underlying market. An increase in market volatility leads to an increase in the potential excess return obtained by rebalancing. However, we should note that rebalancing approaches can underperform the respective cap-weighted index when pricing errors persist. As a bubble forms, for example, a rebalancing approach would sell stocks that would then appreciate further. Eventually, however, one would expect a recovery as the market’s discipline was restored and prices reverted to the mean.

Beyond rebalancing, many smart beta strategies aim to capture a specific risk premium, or “factor”. Factor investing entails constructing a portfolio that has positive exposure to the desired risk premium and, in a similar vein, fundamental indexation – where stocks can be weighted by one or more fundamental criterion that are believed to capture a stock's intrinsic value (e.g. value-added) – also focuses on a systematic rebalancing “factor” in an attempt to take advantage of excess volatility.

Smart beta strategies have grown in popularity over the last few years, supported by investors who consider that in an inefficient “noisy” market, they have more to offer than capitalisation-based approaches.

Alexander Davey is director of alternative beta strategies at HSBC Global Asset Management