|

|

China eyes the launch a multibillion-renminbi infrastructure initiative with a plan to raise fresh infrastructure capital through the debt markets to boost the country’s sagging economy.

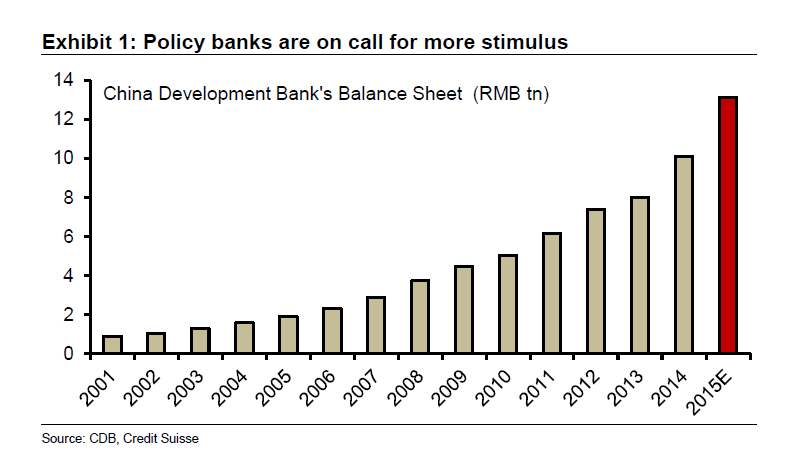

Beijing asked policy banks to raise up to 1.15 trillion renminbi in new capital over the course of three years, local state media reported. The first batch of the bond issuance may come in at around 300 billion renminbi, with China Development Bank raising 200 billion, along with the Agricultural Development Bank bringing in the other 100 billion renminbi.

According to a research note from the China International Capital Group (CICC), the new initiative could potentially boost total investment in the magnitude of around 0.4-1.3% of GDP per year, which is significantly smaller than the country's 2009 investment.

The research note points out that if a 1x to 3x leverage is assumed to apply to the new capital, the country could expect a total boost of investment spending in the magnitude of 300 billion to 900 billion renminbi from the first batch of new funding.

More emphasis on investment efficiency on new projects

In a recent report, the National Development and Reform Commission pointed out that the new investment “should be hand-picked projects with investment returns, and not add to excess capacity or crowd out investment by the private sector”.

According to the research note from CICC, these guidelines, if followed through, could greatly enhance the quality and efficiency of the projects and minimize their inflationary impact. In addition, the low raw material prices will also likely boost investment return this time round. But the level of enthusiasm among local governments has declined notably in the past few years towards government-led investment projects.

The money raised from the infrastructure package will be invested more than likely in public housing, and other important domestic infrastructure projects, the report said. This is in line with the central bank’s plans to create a more targeted monetary policy that stimulates the economy as capital inflows slow down.

The move shows a significant shift towards direct central government backing of infrastructure investment, after years of investment at the local level created an unprecedented amounts of local debt.

China’s slowing economy and slumping stock market

The potential infrastructure investment package comes in the backdrop of a slowing economy, a weakening property market, shrinking industrial production, and a major correction in China’s capital markets.

But according to Chris Leung, senior economist, executive director at DBS, who specializes on China’s macroeconomics, says that the infrastructure investment package could have a “positive” impact on the country’s stock markets, and that the investment package should produce positive outcomes for the country’s economy.

“Rescuing headline growth is easy. Track records of fiscal policy boosting GDP growth in the past two decade were excellent (1998, 2008) but if investment decisions remain mute with respect to risk alongside inadequate cost/benefit analysis of each projects, productivity/efficiency gain can’t be reaped,” Chris Leung tells The Asset.

“And we will eventually be back to square one. If this is not handled well, debt overhang and overcapacity is an endogenously determined outcome. But judging from the fact that the whole deal does not involve the local government, they are fully aware of the mistakes committed before. Assuming the central government knows the tremendous negative impact of moral hazard, the forthcoming stimulus plan shoul reap higher productivity than the one in 2008," Leung says.