|

|

After reaching a trough in 2011, the USD gained 31% to the end of March 2015. While the dollar has given up some of those gains against the major currencies, it has remained strong against most Asian and emerging market (EM) currencies.

The recent growth scare in China and emerging markets has contributed to dollar strength against Asian and emerging market currencies, particularly commodity sensitive currencies. This fear was exacerbated by the recent Chinese currency devaluation, even if that was not the key motivation for the policy decision.

Dollar shortage in emerging markets has also been a key driver, even in current account surplus countries. The big picture question is where are the investment opportunities in Asian and emerging market foreign exchange following the recent episode?

Before we answer that question, there are two important observations to note on the dollar shortage. First, the USD funding position used to support local investments has reached US$4.3 trillion according to the Bank of International Settlements. USD inflows into emerging markets had been motivated by low US rates and the relative interest rate carry (returns) offered by many emerging markets.

In the post crisis regime, prior to the taper tantrum in 2013, local interest rate and foreign exchange volatility was also rather low making the carry attractive in risk adjusted terms. However, the anticipated shift in US policy - the Fed's balance sheet and short term interest rate policy - shifted short rate expectations, increased foreign exchange volatility and underpinned dollar strength.

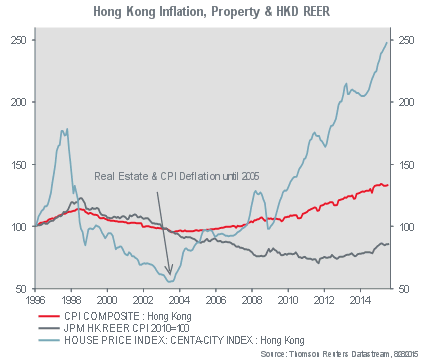

Second, domestic emerging market credit has grown even faster than the inflow of foreign capital. This also applies to current account surplus countries who explicitly peg or manage their currencies against the USD. In a pegged or managed exchange rate regime, when the central bank accumulates foreign exchange reserves (USD) this leads to an increase in the domestic money base. While most of this money is often sterilized (held within the banking system) in many cases it enabled local banks to channel credit into local investments at a very low cost of funding. Most notably real estate in Hong Kong, Singapore and elsewhere in Asia.

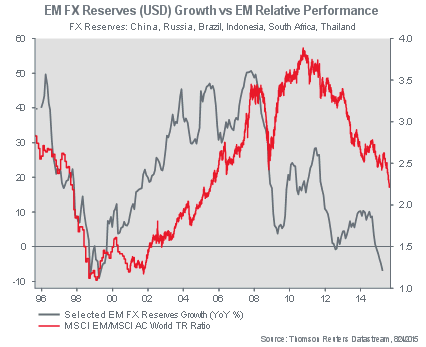

The big picture point is that an increase in foreign exchange reserves tends to ease monetary conditions in emerging markets. In contrast, a decline in foreign exchange reserves tends to tighten liquidity. This likely explains why the change in EM foreign reserves tends to lead the relative performance of EM equities (chart 1). It also likely explains the performance of local real estate markets during phases of dollar strength and weakness (chart 2).

|

||

|

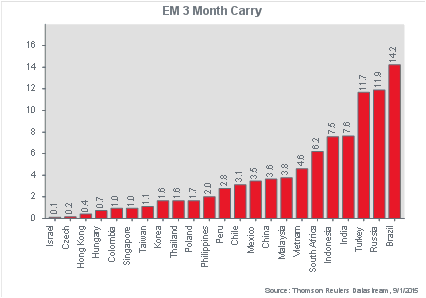

Turning back to the question of the opportunities in EM currencies, three key factors drive our decision on whether to take a position. First, we assess whether the currency is trading expensive relative to its long term valuation. Second, we assess whether the interest rate carry compensates our portfolio for the risk (chart 3). Third, we review key sovereign risk metrics such as the external funding and liquidity position.

|

In Asia, India, Indonesia and Vietnam offer the most attractive interest rate compensation for risk, in our view. In the case of India and Vietnam, currency valuation is inexpensive and external funding positions have improved. Malaysia is now undervalued on the IMF real effective exchange rate and interest rate carry is similar to Vietnam. However, the external funding position has deteriorated following the decline in exchange reserves and the fall in national income due to the decline in commodity prices.

Nicholas Ferres is investment director, Global Asset Allocation at Eastspring Investments