A report from credit insurance firm Coface finds that companies operating in Asia were experiencing higher instances of overdue payments. According to Coface data, 7 out of 10 respondent companies experienced overdue payments in 2015, with around 52% of them citing “customer financial difficulties” as the reason for delayed payments.

Within Asia, large markets such as China saw a deterioration in its payment terms. Average credit terms offered by companies in China rose to 66 days in 2015 compared to 63 days in 2014. Moreover, there was a 1.7% increase in overdue amounts from 56.4% in 2014 to 58.1% in 2015.

It’s a similar case in neighbouring India where there was a significant increase in overdue experiences over the last couple of years. In 2013 around 6 in 10 companies had to deal with overdue payments, this has jumped to 8 in 10 companies in 2015.

“With mounting global uncertainties linked to China’s growth moderation, the fiscal difficulties experienced by oil exporting countries and US monetary normalization, overall company payment experience in Asia is likely to remain weak in 2016,” explains Jackit Wong, Asia Pacific economist at Coface.

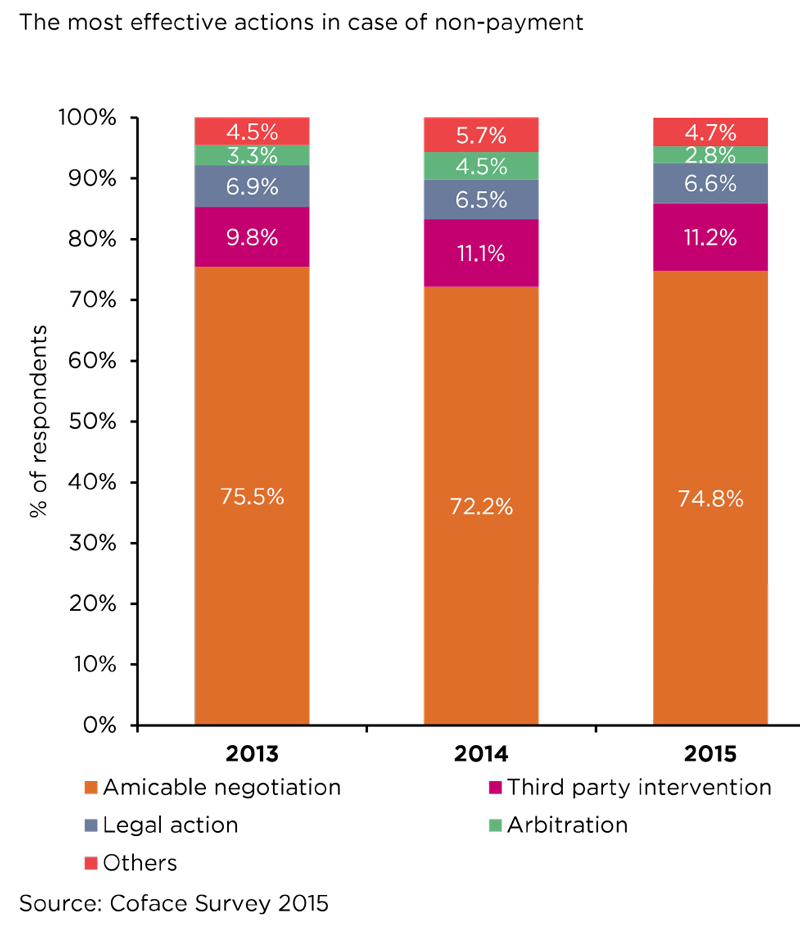

In terms of dealing with non-payments, a majority of Asian companies (74.8%) still opted for “amicable negotiations” or a discussion over repayment schedules. Cautious about the customer relationship, only a small handful of companies (11.2%) wanted to seek a third party to intervene in non-payment.

“The use of credit management tools reduces the risks of non-payment, to a certain extent, while amicable negotiations remain the most effective solutions for non-payment,” states Wong.

While the slowdown in Asia in evident, companies are still relatively split on the economic outlook of 2016 with 56% of respondents believing that the global economy is unlikely to pick up in 2016. Indian companies are the most optimistic in the region with 84% of survey participants expecting economic growth to accelerate in 2016. Last year the Indian economy grew faster than China reporting a GDP growth rate of 7.5% compared to China’s 6.8%. The Indian finance minister Arun Jaitley has reduced lending rates in the country to maintain growth prospects.

.jpg)