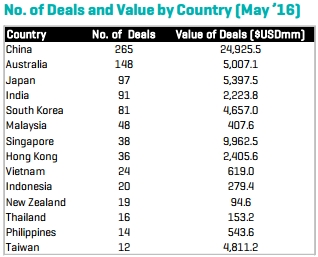

Despite a frenzy of M&A deals in Asia-Pacific, deal flows amounted to US$302 billion in the first five months this year – a 22% decline from a year ago.

Key deals for 2016 so far include Toshiba’s US$5.9 billion deal to sell its medical unit to Canon and Taiwanese Advanced Semiconductor Engineering’s merger with Siliconware Precision for an estimated US$4.3 billion, data from S&P Global Market Intelligence show.

China still remained a bright spot in the region recording a 31% increase in deal flows in the period. Dalian Wanda’s business units kept the Chinese markets busy with a pair of landmark deals last month. Early May, Wanda Cinema Line, China’s largest cinema chain operator acquired Wanda Media for US$5.8 billion. A couple of weeks after, Dalian was on the move again this time acquiring an additional 14.4% stake in it’s Hong Kong entity (Dalian Wanda Commercial Properties) for US$4.43 billion.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence “Chinese investors were extremely active in Q1 as they looked beyond their own borders for growth opportunities, supported by government-led initiatives to diversify the economy,” explains Michael DeFranco, global head of M&A at Baker & McKenzie. “This was after a record year for Chinese investment into the US and EU in 2015.”

In terms of industry focus, industrials and telecom services witnessed a significant drop in deal flows. Deal values declined 80% and 70%, respectively. Areas such as consumer discretionary and energy were M&A growth areas with the former notching up US$43.9 billion in deal value up 98%.

Already in the early days of June, there has been quite a bit of M&A deal activity, Dah Sing announced the sale of its insurance unit for US$1.4 billion to Fujian Thai Hot Investment. In Australia, laboratory-testing group ALS is currently evaluating a US$2 billion purchase offer from private equity firms Advent International and Bain Capital.