|

|

With improving living standards and generation of wealth, the Chinese emerging affluent have increasingly looked at investment as a way to sustain their lifestyles and prepare for the future. A Boston Consulting Group study predicts that in 2020 there will be 280 million new affluent individuals in China, more than double the number recorded in 2012.

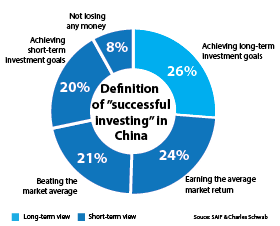

While the growth of this segment gives rise to opportunities, it also reveals the lack of knowledge and understanding this demographic have regarding investing. According to a joint survey conducted by the Shanghai Advance Institute of Finance (SAIF) and Charles Schwab, Chinese emerging affluent had varying definitions for “successful investing”.

The majority (74%) of Chinese new wealthy polled in the survey appeared to take a short-term view on investing. For them, “successful investing” meant either “beating the market average” or “simply achieving their short-term goal”.

The varying classification of successful investing seems to stem from the fact that many Chinese emerging affluent have unrealistic expectations about what they can achieve through investing.

“In the US, for instance, if you have a well-balanced portfolio that is achieving about a 6.5% return on average, we think that is a great return. When you talk to a Chinese investor 6% return is not great,” says Lisa Hunt, executive vice president, international services and special business development at Charles Schwab. “There really is a disconnect between realistic expectations and this notion of guaranteed investing.”

When approaching overseas investment, Chinese emerging affluent seem to be quite reserved. The SAIF and Charles Schwab survey shows that only 8% of participants had overseas investments. As for reasons why they normally don’t invest abroad around 71% said that they were unsure about the overseas market and regulations. Others (51%) shared that they were worried about foreign exchange risk.

Despite the exciting growth in this segment, there is still much to be done regarding investor education. “First and foremost before you start transacting you got to have a long term plan,” notes Hunt.