A new dawn begins in the Philippines. While it sounds like a cliche to suggest that when a change in government happens, this time prospects of real change is palpable. The landslide victory of President Rodrigo Duterte in May 2016 sends an unequivocal message that the country wants a new beginning.

Duterte's economic agenda is perhaps among the most progressive declaring the need to amend the constitution to liberalize foreign investment that no other candidate dared to espouse during the heated presidential race. One of his twitter hashtag says it all: #changeiscoming.

But considerable on-the-ground challenges remain. The new government will need to continue to focus on the country's inadequate infrastructure; enhance the investment environment to further attract foreign direct investments, reduce bureaucratic red tape, improve tax collection and most of all, broaden development beyond the national capital and encourage countrywide development.

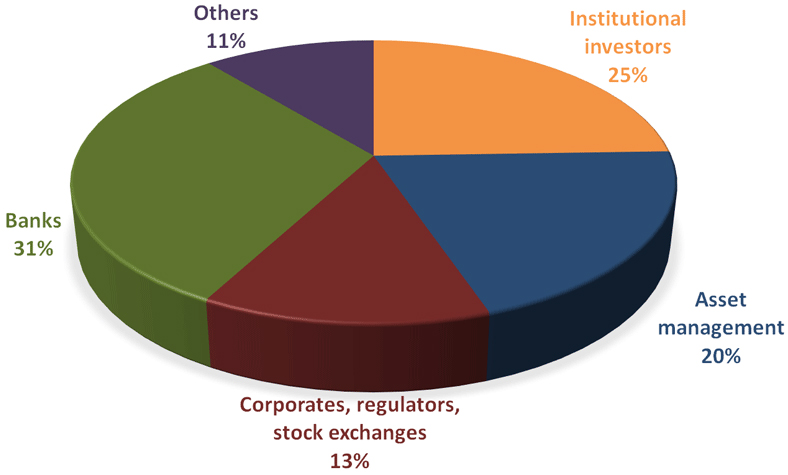

Now in its 11th year, The Asset Philippine Forum is the longest-running conference shining the spotlight on the Philippines' economic, financial and capital markets development. Organized in conjunction with the Fund Managers Association of the Philippines, the event will bring together the key stakeholders across the country to discuss issues, challenges and opportunities for countrywide development.

.png)

.png)

Sponsoring or exhibiting at The Asset 11th Philippine Forum 2016 is a prime opportunity to put your products and services in front of key industry players and decision makers.

Depending on your goals and level of sponsorship required, a benefits package can be designed to target a particular audience or broad group. Features include prime speaking positions on the main programme, a large exhibition in the main networking room offering suppliers a platform to network and showcase their solutions and intimate roundtable discussions, enabling vendors to promote their services and expertise in interactive sessions.

As our Event Partner you have the opportunity to create new industry connections and generate new business opportunities. You meet relevant decision makers, professionals and finance industry leaders.