Following years of trying to keep pace with the relentless growth on the business side, CFOs and treasurers in Asia are seeing a new more deliberate phase of growth. While the slowdown can be a source of worry, it has also opened up a number of possibilities: the opportunity to examine the inner workings of the organization, sharpen focus on efficiency, and a greater incentive to look for new markets.

If 2016 was the year of the unthinkable (Brexit, Trump, et al), 2017 could turn out to become the year of change and a new world order. Caught between the two T’s of Trump and technology, the treasury function will need to be both agile and adaptable. The business ramifications of both will have a lasting impact on how companies in this region operate and how they are able to navigate the terrain in the years ahead.

Indeed, the function of treasury is entering a new world order. How will these changes shape the coming 12 months and beyond? What are the opportunities and challenges that are considerations for the CFOs and treasurers in the evolving landscape? What tools are available that will help to drive efficiency, improve controls, and increase the visibility?

The Asset Events proudly presents its 3rd Asia Treasury and Trade Summit, a strategic one-day event which will bring together the region’s most innovative and influential CFOs and treasurers to highlight the key trends and innovative solutions that are reshaping corporate treasury in the region.

The Asset events are the perfect size to offer the best of both worlds to our delegates, our conferences are highly interactive and each offers a unique forum where both speakers and delegates can contribute and learn and our clients can forge new and profitable business relationships to help the industry advance.

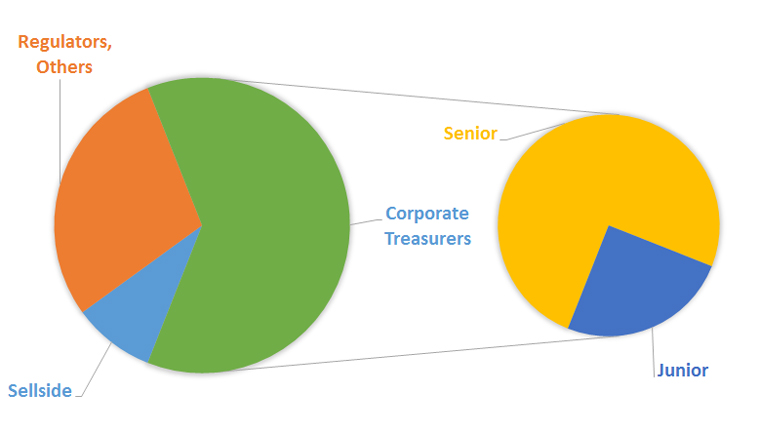

Sponsoring or exhibiting at The Asset 3rd Asia Treasury & Trade Summit 2017 is a prime opportunity to put your products and services in front of key industry players and decision makers.

Depending on your goals and level of sponsorship required, a benefits package can be designed to target a particular audience or broad group. Features include prime speaking positions on the main programme, a large exhibition in the main networking room offering suppliers a platform to network and showcase their solutions and intimate roundtable discussions, enabling vendors to promote their services and expertise in interactive sessions.

As our Event Partner you have the opportunity to create new industry connections and generate new business opportunities. You meet relevant decision makers, professionals and finance industry leaders.