We are nearly 500 days into the term of President Rodrigo Duterte. As perhaps the most unorthodox leader ever elected to the highest office in the Philippines, Duterte has embarked on an economic agenda that is far more audacious than seen in the past decades.

Having secured a solid election victory, Duterte is using the mandate to empower his economic managers to leverage on the government’s fiscal headroom. At the centre of the economic agenda is infrastructure. The government has dubbed it as the “build, build, build” programme.

The strategy is to deploy government budgetary allocation together with Official Development Assistance to make up the bulk of the financing. This strategy departs from that of the previous government, which had opted for private-public partnership as the model of choice. The government has set aside 7.125 trillion pesos for its public investment programme from 2017 to 2022.

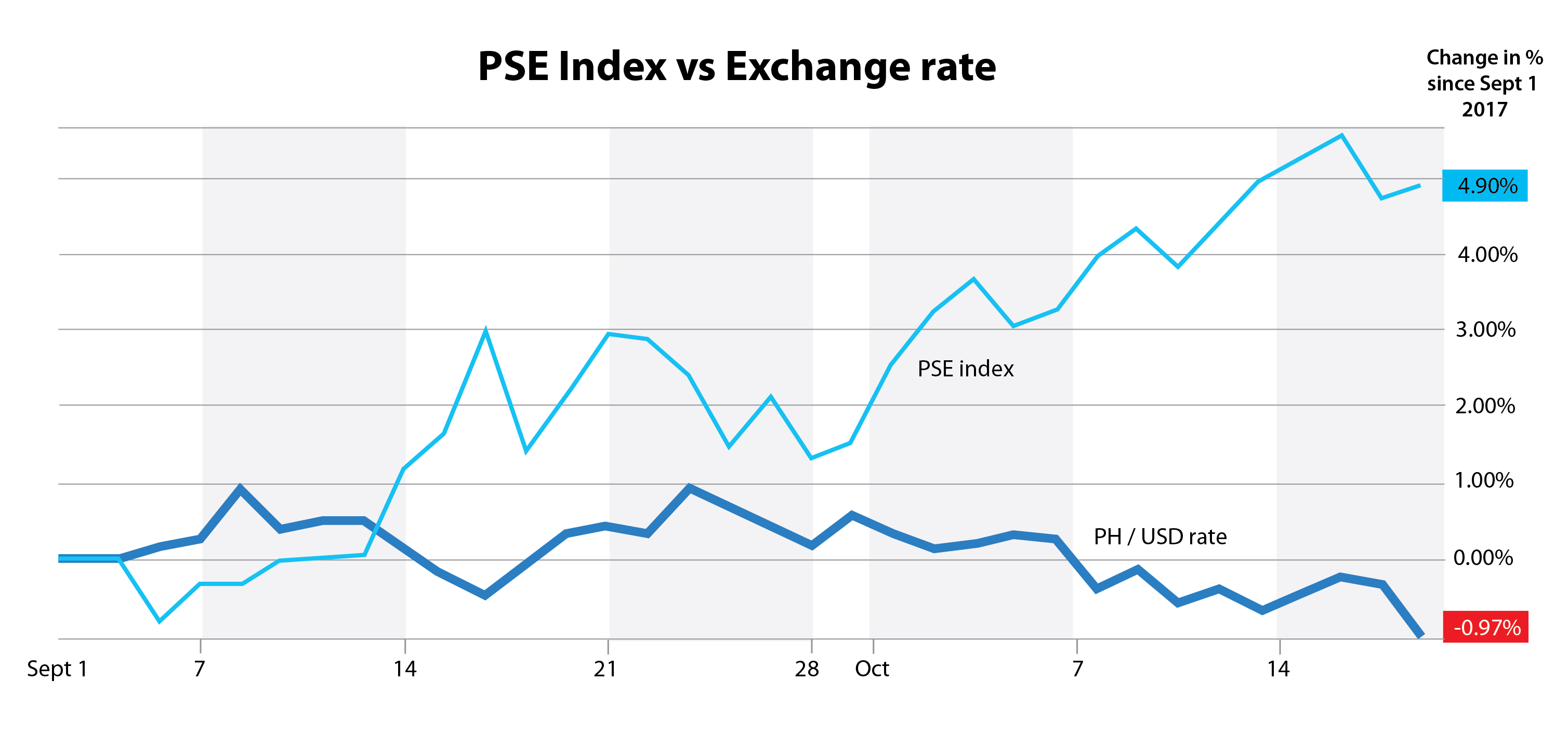

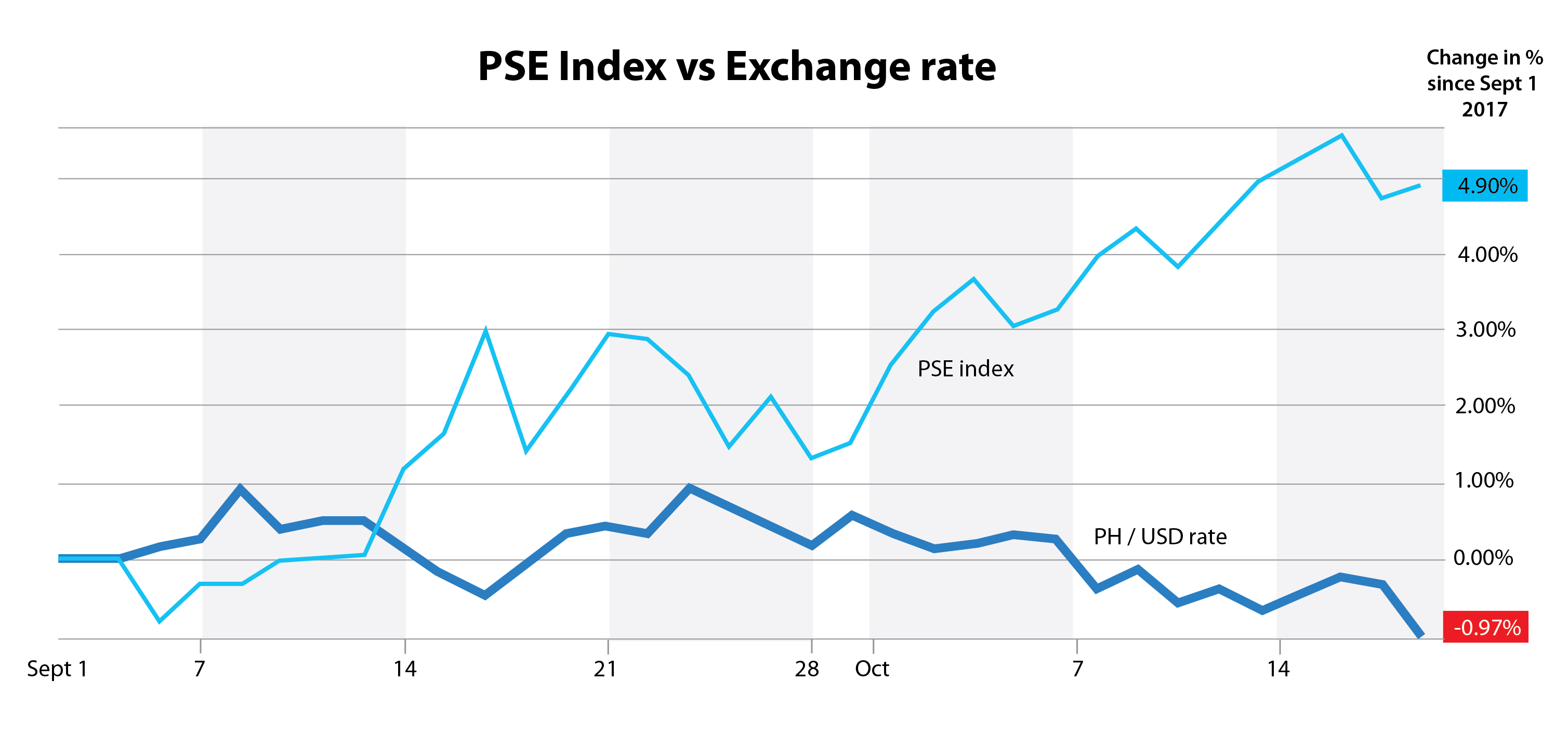

With the new strategy, the government’s infrastructure spending has jumped to 5.3% of GDP during 2016 from an average of 2.9% during the previous government. The ceiling on the budget deficit has been adjusted to enable a further increase in infrastructure spending to more than 7% by 2022.

Another pillar of the government’s strategy is the comprehensive tax reform programme that realigns taxation to reflect the current realities by giving wage earners a break. The overriding goal is to lower tax rates while at the same time broadening the tax base. They include the lowering of personal income tax rates and the reduction of value-added tax exemptions. Excise taxes will be adjusted for fuel and also for automobiles.

It is with this energized backdrop that The Asset is hosting the 12th Philippine Forum to showcase the country and identify the interesting opportunities and the challenges ahead. The theme for this year’s event is Reform and Transform, taking a closer look at how Duterte is defining new dimensions in development.

The Asset Events gathers our best-in-class editors in leading the conversation with the financial industry's brightest minds and most influential decision-makers. Our conferences, awards and strategic forums offer unique trends and insights and genuine peer audience engagement that are crucial in the transformation of businesses, industries and economies.

These discussions are showcased on The Asset's multi-media platforms before print and digital audiences of 130,000.

Engage audiences across Asia and demonstrate expertise by becoming an event sponsor at The 12th Philippine Forum 2017. The Asset Events offers a benefits package designed around your organization's engagement goals and positioning requirements. These may include prime speaking opportunities at the event, an exhibition on the main networking area, or a separate strategic forum tackling specific topics or themes that promote engagement and enhance the experience of participants.

As our Supporting Partner, you have the opportunity to establish new industry connections and business opportunities. You can also engage with Asia's top decision-makers, professionals and industry leaders at our events.

Limited number reserved exclusively for the chief financial officers, chief investment officers, and heads of relevant departments of corporates, institutional investors (SWF, pension funds, insurance), commercial and retail banks, private banks and family offices, and asset management firms

Senior representatives of management companies, investment banks, technology providers, rating agencies, business consultancies, and law firms

*A US$200 early bird discount applies for paid registrations before September 8 2017.