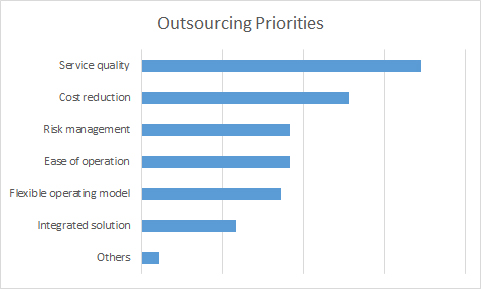

Risk management services were the top consideration for respondents from Australia, Taiwan and the US. Asset managers in Thailand pointed to cost reduction as their top priority, while those in Indonesia chose the ease of operation. Respondents from Malaysia, Philippines and Vietnam ranked agility- allowing a flexible operating model - as their top choice.

All three groups of asset managers ranked service quality as the main priority, on average, with global asset managers pointing to cost reduction as their second choice. Risk management is also of importance (ranked third) to global asset managers, while agility is important to domestic asset managers. The alternative asset managers point to risk management as their second and ease of operation as their third choice.

The survey, Asset Servicing Insights Asia 2016, was conducted in March and April 2016. Among the respondents, the majority identified themselves as global asset managers - long only. The rest are domestic asset managers - long only, alternative asset managers, and other companies. Almost a quarter of respondents stated they were located in Hong Kong, and a fifth in Singapore. Other markets represented were India, Thailand, China, Taiwan, Indonesia and Korea. ABR received input from individual respondents in Malaysia, Philippines, Vietnam, Australia and the US.

The online questionnaire included questions on industry trends in asset servicing, the needs of asset managers and the degree to which providers meet them. Additional questions addressed asset managers' practices in portfolio lending, collateral management and utilization of Asia's fund passporting schemes.

The Asset will publish comprehensive results of the survey in The Asset July-August issue.