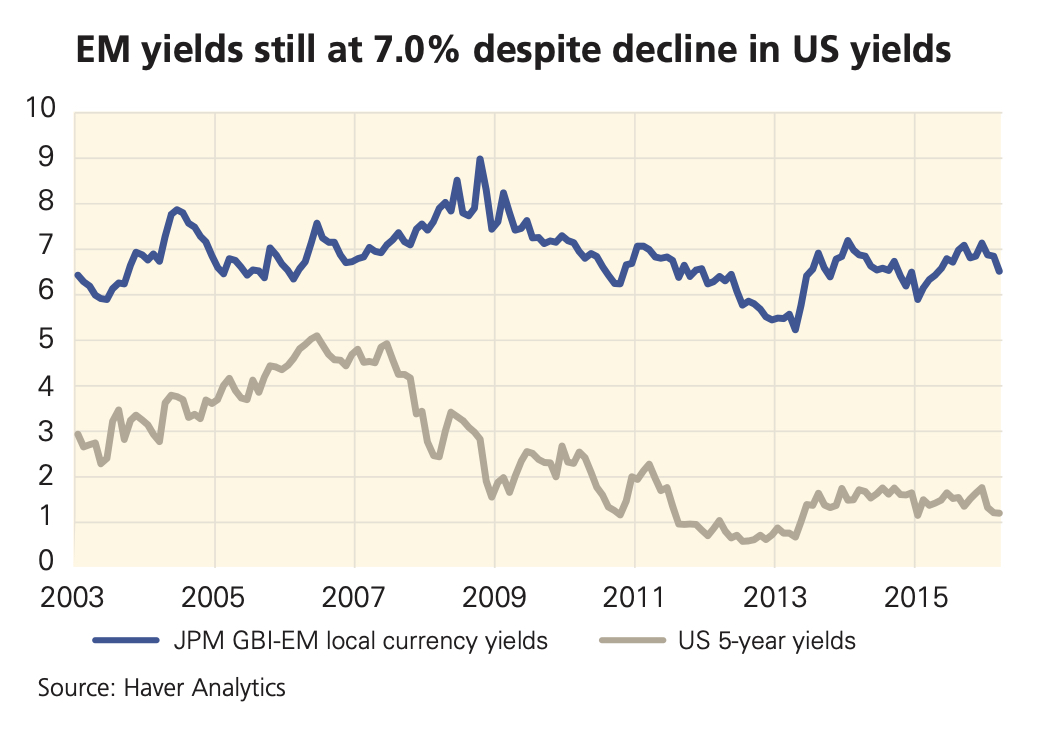

Emerging market (EM) bonds offers the best opportunities currently in the fixed income space, providing yields of 7% per annum in a world where sub-zero yields are not uncommon and low yields have become the norm.

The strong performance of EM bonds ex-China comes despite the fact that every other bond asset class from asset backed securities to JGBs have rallied to a certain degree.

“We seemed to have moved from lower-for-longer to lower-forever this year,” says Paul McNamara, investment director and lead manager on Emerging Market bonds and currency long only and hedge fund strategies for GAM, referring to the fixed income yield curve.

“We seemed to have moved from lower-for-longer to lower-forever this year,” says Paul McNamara, investment director and lead manager on Emerging Market bonds and currency long only and hedge fund strategies for GAM, referring to the fixed income yield curve.“Emerging markets local currency bonds are up 7% this year which is way ahead of hard currency bonds. The back end of the yield curve have rallied very aggressively so emerging market bonds really stands out not just in terms of high nominal yields but high real yields which suggest that these bonds are very cheap,” McNamara says. China is not included in the universe of EM bonds followed by GAM because the firm does not consider China bonds as an investible asset class since it has restrictions for foreign investors.

McNamara attributes the strong performance of EM bonds to the stabilization of new credit in these markets this year while in the previous five years the level of new credit has been shrinking annually.

“We don’t need new lending to increase, we just need it to stop falling and that’s pretty much the point where we’re at today. Typically once the credit growth and nominal GDP growth are at the same level credit stabilizes. That means emerging market bonds start to outperform,” McNamara says.

An indication of growth in emerging markets is that for the first time in four years car sales in emerging markets ex-China are rising faster than car sales in developed markets.

Car sales provide reliable data on economic growth because cars are easy to count, provide timely data, and also provides a good indication of investment sentiment.

“People only buy a car when they’re reasonably confident about the future. The fact that emerging market car sales are now growing faster than developed market car sales is something new,” McNamara says.

In terms of asset allocation GAM is overweight on emerging markets such as India, Mexico, Poland, Hungary and Thailand since these countries are expected to benefit from lower commodity prices. Also, these countries benefit both in terms of exports and imports plus they seen smaller devaluations of their respective currencies and relatively low inflation when compared to other emerging markets.

GAM is underweight on emerging markets whose currencies have not yet adjusted including Brazil, Colombia, South Africa, Peru and Turkey.

“If we get a stabilized situation where emerging market growth goes up to 4.5% to 5%, this would be pretty good since most of the developed world (US, Europe, Japan) is growing at 2% or less,” McNamara says.