|

|

When in spring this year no less than ten Chinese real estate developers ventured offshore to raise USD high yield debt, the market assumed that the Kaisa shock had been digested. All transactions were comfortably oversubscribed, in some instances like CIFI Holdings over five times, illustrating the continued demand for incremental yield propositions in the Asia-Pacific fixed income universe.

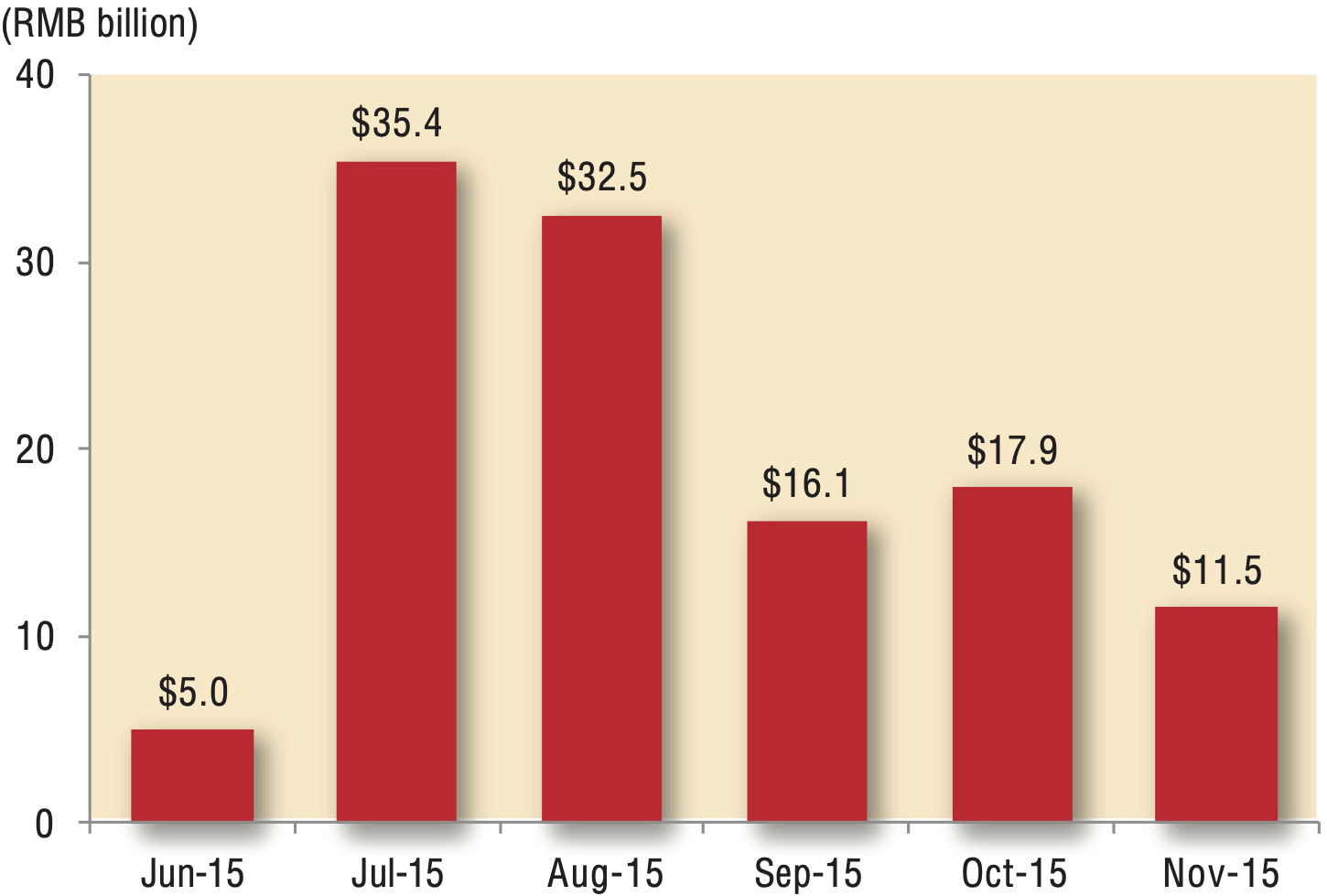

In June, something remarkable happened: after a six-year hiatus, the first Chinese red-chip developer, Evergrande Real Estate Group, obtained approval to issue up to 20 billion yuan of onshore bonds on the exchange bond market. As a first step, the company sold 5 billion yuan five-year notes with a coupon of 5.38%.

China domestic corporate bond issuance

Given the large difference between this onshore funding level and the 12% coupon the very same issuer had paid in February in the offshore USD market, plus the tax deductibility of interest expenses onshore, the author of this essay suspected back then that Evergrande’s onshore funding success might be a "game changer" for Asia’s high yield market. And so it turned out, names like Longfor, Guangzhou R&F and Times Property followed suit.

When the People’s Bank of China weakened its daily reference rate for the renminbi against the US dollar by 1.9% in August, sending both spot and offshore rates sharply down, real estate developers were made acutely aware of the necessity to reduce or hedge currency risk.

Incentivized by substantial cost savings and catalyzed by the depreciation of the renminbi, developers applied in droves for the coveted onshore issuance approvals. While the onshore activity triggered discussions on the increase of structural subordination of offshore noteholders, the replacement of very expensive onshore trust loans and – prior to step-up features kicking in – perpetual securities, had also positive effects on corporate balance sheets. These include improved coverage ratios as well as increased financial flexibility of the issuing property developers.

| China domestic corporate bond issuance | |

|

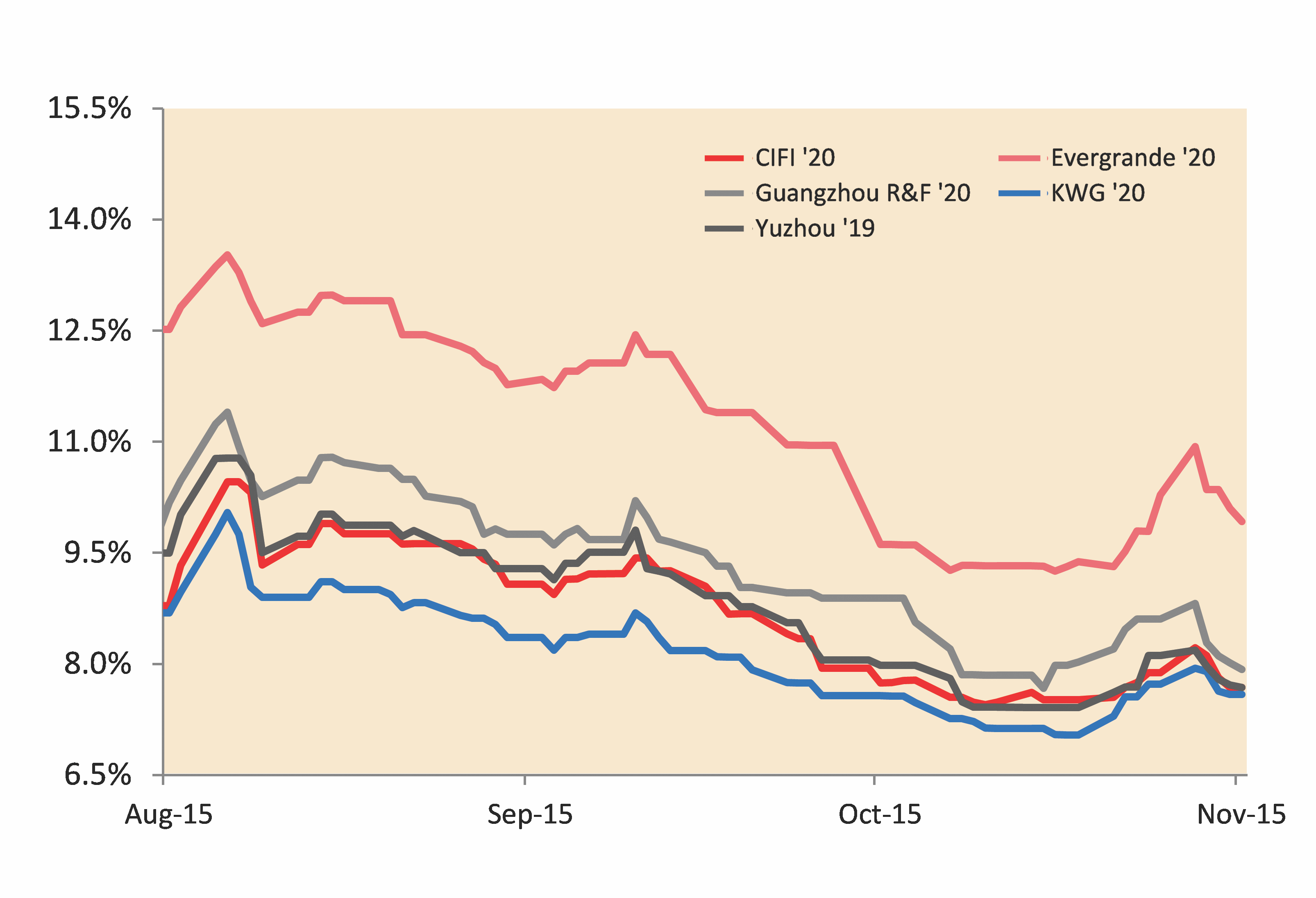

The great demand-supply distortion

The impact of the opening of China’s onshore bond market on the offshore Asia-Pacific high-yield landscape was remarkable. As primary supply dried up, investors searching for assets drove secondary yields down which, in turn, enticed developers to exercise call options on their highest coupon bonds. China Aoyuan, for example, lately called half of its US$225 million 13.875% due 2017, Yuzhou Properties called its entire US$250 million 11.75% due 2017 notes. Other developers are mulling similar plans, suggesting that the outstanding USD debt stock in Asia’s high yield market will not only remain stagnant, but might actually decline.

It appears that the only incentive for the industry to venture offshore for fundraising is the prospect of refinancing some of the upcoming 2016 maturities to remain connected with the global buyside community, or to fund call options for the retirement of expensive coupons. Future Land and Powerlong’s recent US dollar-denominated transactions need to be viewed within this context.

Both transactions deserve some attention, not only for the unqualified successes they represent (Future Land’s US$250 million two-year deal was ten times oversubscribed, Powerlong’s US$200 million three-year more than three times), but more for the fact that both credits managed to price slightly inside their existing curves. By the time of issuance, the latter’s outstanding 11.25% notes due January 2018 had gained from just above par to 106.375, with a commensurate decline in yield from 11% to 8%.

In other words: at a time when there are little to no good news emerging from China on the macro side with market observers increasingly fearing the impact of a (conceivable) hard landing scenario on the property sector, and in the absence of any positive ratings actions (Moody’s continued to assess the sector as ‘stable’ for 2016), the reward for exactly the same type of risk moved from 11% to 8%

China single-B real estate yield compression

A look at the demand side of this imbalance shows the usual plethora of institutional investors, real-money funds, hedge funds, sovereign wealth, insurances and pension funds searching for yield. It also reveals Chinese institutions willing to provide substantial balance sheet commitments at increasingly aggressive levels to protect their very share in a shrinking bond market they managed to carve out against international investment banking players during the heydays. This investment behavior reminds veteran observers of the off-market ‘relationship lending’ the Asian syndicated loan market thrived on for decades until the Asian and other crises, followed by a lengthy process of disintermediation, eventually helped to develop a more efficient credit culture and discriminate credit processes.

Depressed commodity prices and currency woes exacerbate the problem

The current distortion could be mitigated if China high yield were at least partially substituted with issuance from other geographies. However, this hasn’t happen so far and looks unlikely to happen in the near future: the historically second largest supplier of credit into Asia-Pacific’s high yield market, the mining and mining services industry, is facing massive challenges. With commodity prices stubbornly depressed, the list of distressed names in the sector has grown to include names like Bumi, Berau, Winsway and Hidili while capex and borrowing needs have been reduced.

The most prudent miners conducted liability management exercises with Australian iron ore producer Fortescue at the forefront. A US$2.3 billion 7-year 1st lien secured notes issue in April was used to early redeem US$1.4 billion of notes maturing in 2017 and 2018, and to swap US$450 million of due 2019 notes into the longer tenor. Other exercises were earmarked to reduce offshore debt, thereby exacerbating the overall demand-supply imbalance in the market: once again it was Fortescue which transacted a US$384 million bond repurchase, followed by a US$750 million tender on two series of unsecured notes. Fellow-Australian credits like Barminco, St Barbara and Paladin also transacted buybacks. In neighboring Indonesia, thermal coal miner Indika launched a US$100 million tender in the last week of November.

| China single-B real estate yield compression | |

|

At the same time many non-mining credits from the region, especially those from Indonesia, didn’t fare much better in secondary markets. As the archipelago got caught in the global emerging markets headwinds, the rupiah became yet again a popular target to short which makes rupiah earners less attractive for international credit investors.

Where does this uncomfortable marriage of counterproductive dynamics leave us?

The Asia-Pacific high yield market will see very little supply in 2016. Chinese developers will issue at best to fund some calls. Continuously low commodity prices, capex reductions and prohibitively expensive benchmark yields will prevent commodity names to refinance while emerging market currency risk perceptions will drive many other industries from the region into the domestic markets.

These developments arguably arrive at the worst possible time for the regions high-yield market, at times when many banks are making strategic decisions with regards to the application of risk capital and their commitment to SME lending and high-yield exposure. While these decisions are predominantly driven by regulatory requirements, against the current backdrop they could at worst lead to a marginalization of the product as a whole, implying less coverage, less research, less trading and less liquidity. This is a scenario nobody wants, not least the issuers themselves, who in the absence of a maturing and ever more sophisticated USD high yield market would have to rely on fickle domestic lending or on relatively young and immature local bond markets which more often than not appear to have become laboratories for domestic regulators.

Florian Schmidt is head of DCM at SC Lowy and author of A Guide to Asian High Yield Bonds – Financing Growth Enterprises. SC Lowy is licensed for Type 1 Regulated Activity in Hong Kong and will deal only with professional investors