The inauguration of Rodrigo Duterte as the 16th president of the Philippines on Thursday, 30 June 2016, is promising to usher in renewed confidence in Philippine business. Fearless forecasts suggest the country may grow by as much as 8% during his term. But will his tenure have a positive impact in the development of the capital market?

Investors have long complained that the peso corporate bond market lacks diversity of issuers. Five business groups own or control 17 out of the top 30 issuers. The five groups are Ayala, SM, First Pacific, San Miguel and Metrobank. Their units and subsidiaries account for more than half of the total bonds outstanding.

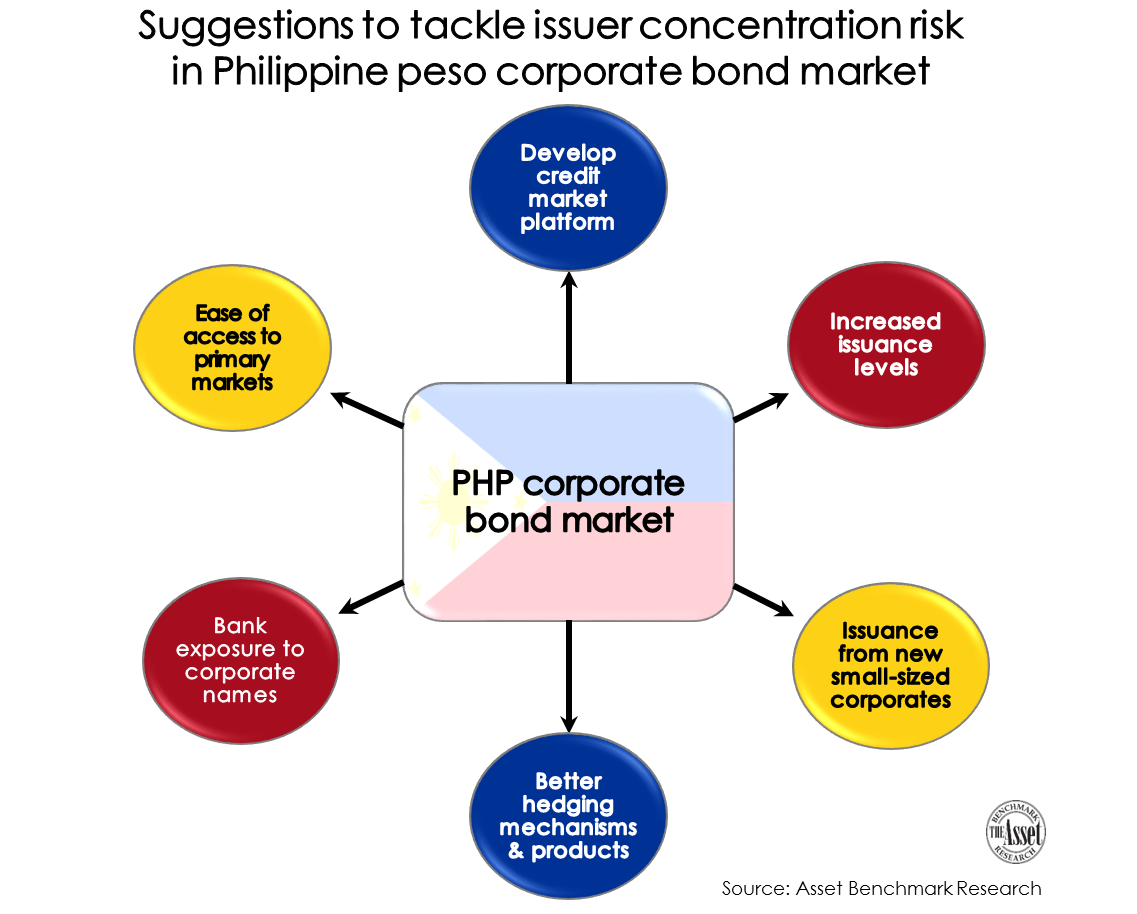

Asset Benchmark Research (ABR) asked institutional investors how this issuer concentration risk in the peso bond market could be tackled as part of the 2016 Asian Local Currency Bond Benchmark Review. Fund managers gave diverging views.

However, the common theme was to encourage new names to consider coming to the market. Among the suggested remedies include improving the ease of access to the primary market and developing a credit platform; banks gaining exposure to more corporate names; better pricing; new hedging mechanism and products. In short, measures that will help any bond market develop.

During the fourth quarter of 2015, corporate bond issuance was 29 billion pesos (US$616 million). On a year-on-year basis, it grew by 5%, outstripping the growth in the government bond market, which grew by 1.3%. Real estate companies dominate new-issue activity accounting for 83% of the total.

“In the past, only a few corporate names had the reputation necessary to fetch better funding costs via the bond market,” explains an investor. “In the past couple of years, however, we have seen a record amount of issuance and new credits.” Some of these new names that are not real estate-related include a hybrid rice company, SL Agritech Corporation and an oil company, Phoenix Petroleum Philippines.

Duterte, a lawyer by training, has indicated that he is no expert in finance and economics preferring to leave his team led by incoming Finance Secretary Carlos “Sonny” Dominguez to take charge. But he also is pushing for development to spread beyond Metro Manila. Dominguez, on the other hand, is a big believer in agribusiness having been the agriculture secretary previously. As Duterte’s campaign line is 'change is coming', it may be that the issuer diversification that investors are hoping for could become a reality. Additional reporting by Jacky Fung

To read more about Asset Benchmark Research, please click here.