Securing a credit rating is the norm for issuers tapping the bond market. But is removing compulsory rating necessarily a step back in the development of a market?

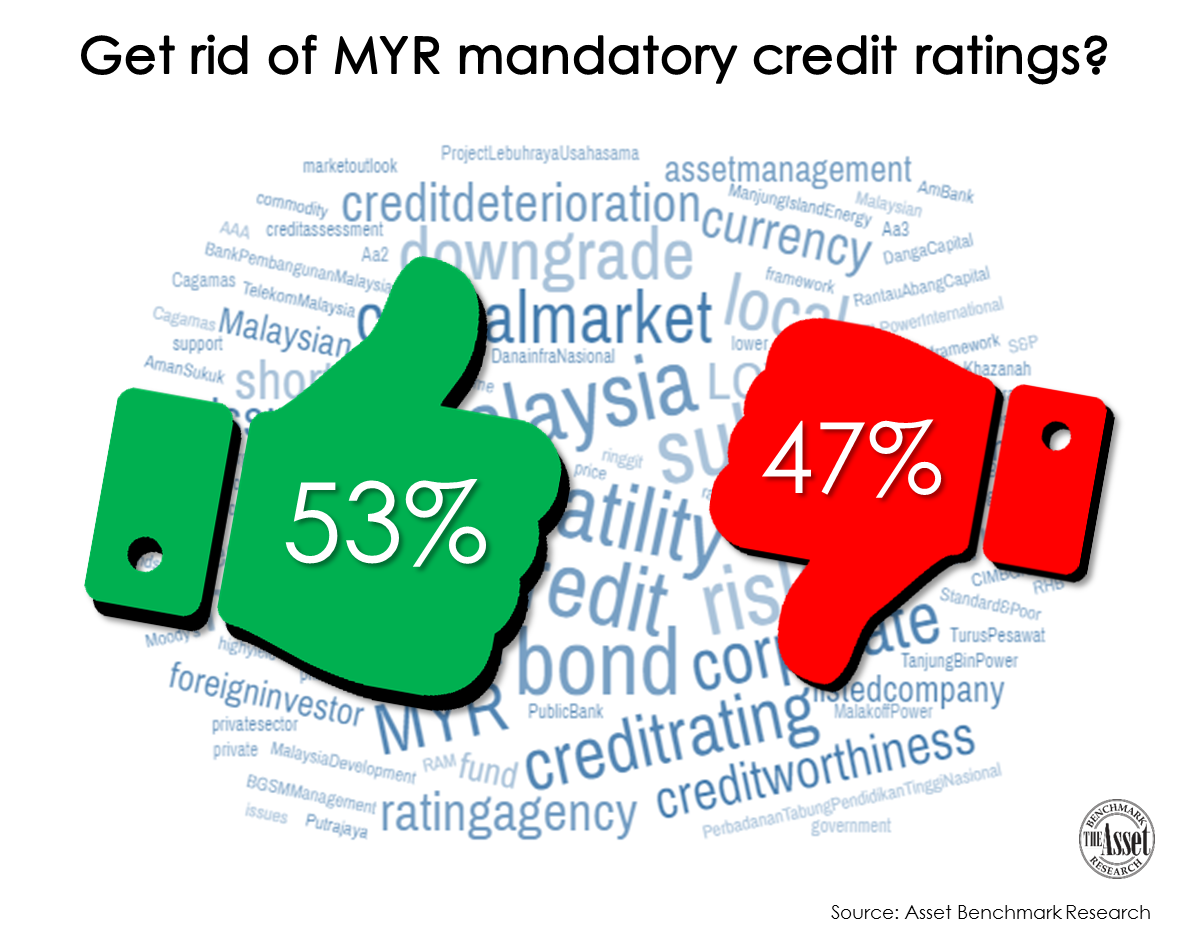

Malaysia's decision to scrap compulsory rating has sparked an interesting debate on what it may mean for the market's standing. A recent survey from Asset Benchmark Research (ABR) finds that investors in Malaysian ringgit bonds are closely split between those who see it as a positive and those that think otherwise. Only 53% of fund managers are in support of this development, the ABR survey indicates.

One portfolio manager at a large local fund house explained: “We have seen local rating agencies' vigilance in downgrading issuers’ outlooks as well as ratings more aggressively lately.” Such worries over credit deterioration could be further exacerbated without ratings providing some barometer of credit worthiness.

Investors were also concerned about the need to meet institutional investment mandates. The head of fixed income at a large insurance company was critical about the move: “We have certain restrictions in terms of how much we can invest in rated versus non-rated corporate bonds. For corporate bonds that are rated, they will definitely attract a lower risk charge. So actually if we were to invest in non-rated issuances of corporate bonds, it would limit us, I mean it becomes a more expensive asset to keep and the yield may not justify that exposure.”

Another portfolio manager at a domestic asset management house, however, was more optimistic. He explains: “This move is generally positive for asset managers with strong credit research team support. Even though it’s an unrated credit, we can still price the risk that comes with the credit fairly accurately so its gives a niche to us for price discovery and what not.”

For a Singapore-based fund manager at a global asset management firm the removal of ratings actually meant very little: “It’s irrelevant. Most of the time the corporate bonds or corporate sukuk are rated by the local rating agencies. And to be honest they are not that objective. We make our own credit assessment.”

In any case, domestic fund managers will need to establish a readily available internal credit-scoring framework in preparation for the 2017 move. Whether they do so happily or not is another question.

Prime Minister Najib Razak first announced the decision to scrap mandatory rating in June 2014. Many saw it as a signal that the country’s capital market had matured. Corporates wanting to issue would have lower issuance costs and face fewer compliance hurdles.

Investors would be sophisticated enough to conduct their own credit assessments and would have greater flexibility in choosing companies with a more diverse set of risk profiles.

The Malaysian government began to develop the bond market during the early 1990s. In 1992, it enforced the compulsory rating requirement for new issues. Companies issuing bonds also needed to have a minimum rating of BBB or above. This not only helped to advance Malaysia’s rating agencies RAM and MARC but more importantly assured issuers.

The scrapping of compulsory rating comes just as the negative macroeconomic backdrop clouds Malaysia's outlook and the fact that corporate defaults are rising. Investor confidence in Malaysia has also been affected by the recent 1MDB scandal as well as increasing ringgit volatility, low external demand, negative consumer sentiment and falling commodity prices.

ABR’s annual survey probes into the product needs of fixed-income investors and the market penetration of banks active in Asian local currency bonds.

To read more about Asset Benchmark Research, please click here.

Additional reporting by Jacky Fung