Touted as a “giant leap” in China’s capital account opening, the launch of a new scheme that gives nearly all foreign institutional investors access to China’s interbank bond market (CIBM) has so far attracted limited applications. BNP Paribas executives are optimistic, though, in light of relative yields of China’s sovereign debt and ancillary access to the interest rate market.

In February, China’s central bank granted all offshore medium and long term institutional investors unrestricted access to the country’s vast onshore bond market, ranked as the third largest by size in the world. The prospect of unlimited investment into the market, coupled with less restrictive repatriation rules, stirred market participants at the time. Six months on, though, only one asset manager is known to have successfully applied for access under the scheme (being Insight Investment, owned by BNY Mellon).

CG Lai, BNP Paribas’ head of global markets for Greater China, maintains that the scheme is more than just another access channel to the bond market. “What people miss is the fact that [it] has created a platform for offshore investors to gradually tap into the domestic currency and interest rate markets,” he says during a press conference in Hong Kong.

“The whole idea behind the CIBM opening is that it gives people a platform to deal with onshore investment products, [such as] onshore IRS. [In our investor education] we will not just look at the onshore bonds, but a number of extensions of this programme.”

Investors eligible for the new scheme can trade bonds in the interbank market and also enter into hedging transactions including bond lending, bond forwards, forward rate agreements and interest rate swaps (IRS). Repo agreements in the onshore markets, as well as direct access to the onshore FX market through the China Foreign Exchange Trade System and National Interbank Funding Center (CFETS), are only available to central banks and other foreign reserve managers.

While access to the onshore rates derivatives market is open, “on the currency side, it is slightly trickier,” Lai notes. “If the investor insists on [investing in the bond market on] a fully hedged basis, then it will not be interesting…because of the currency [hedging] cost.” Investors would need to combine onshore IRS with offshore CNH forwards to create a hedge resembling a cross-currency swap. “The cost is an issue,” he concedes.

Other issues delaying stronger uptake of the new scheme are the facts that UCITS funds will need to seek domestic regulatory approval from their home jurisdiction and that dealing in China’s onshore rates derivatives market requires the signing of an ISDA equivalent Master Agreement with the National Association of Financial Market Institutional Investors (NAFMII).

Furthermore, as Linklaters partners point out in a recent client bulletin, offshore investors may not be able to clear derivatives in a Chinese clearing house, unless the same has been recognised by their home authorities. While the US Commodity Futures Trading Commission has approved the Shanghai Clearing House, no such mechanism by the European Securities and Markets Authority exists. This means that at this point only US banks can clear their proprietary trades with Shanghai Clearing as a direct clearing member while conforming to home regulations.

Yet, despite these challenges Lai maintains that “even at this junction, purely from a yield perspective, there are enough clients eager to invest through the CIBM.”

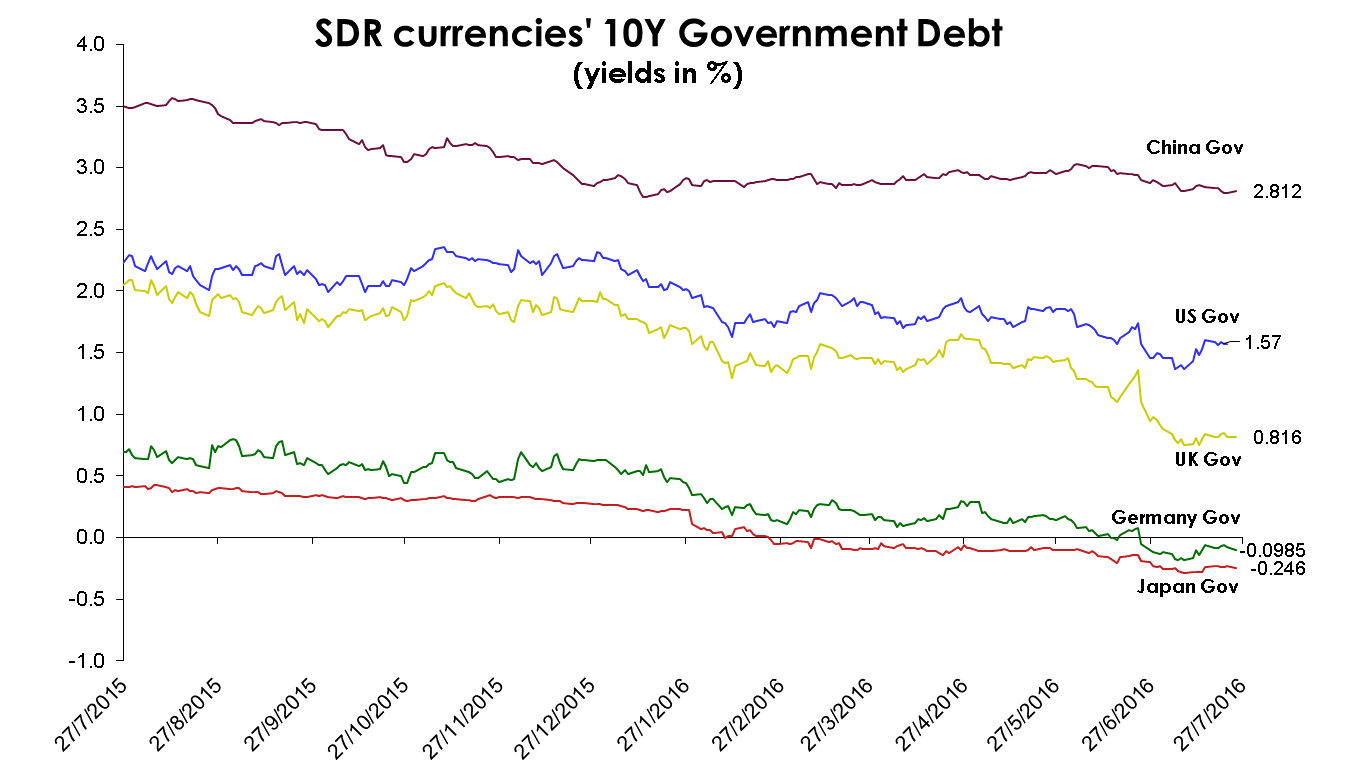

“Asia has become a safe haven for a lot of investors [after Brexit]. They are now looking at the CIBM more and more at an absolute yield play because if you look at the SDR currencies [and the RMB], the renminbi is the highest [yielding]. Hence, the opening is very timely.”