Alternatives continue to gain share in portfolios, but institutional investors are becoming more selective about where and how they deploy their capital,” says a BNY Mellon senior executive.

Frank La Salla, CEO of Alternative Investment Services and Structured Products at BNY Mellon says that as a result “investors are demanding greater transparency from their alternative fund managers.”

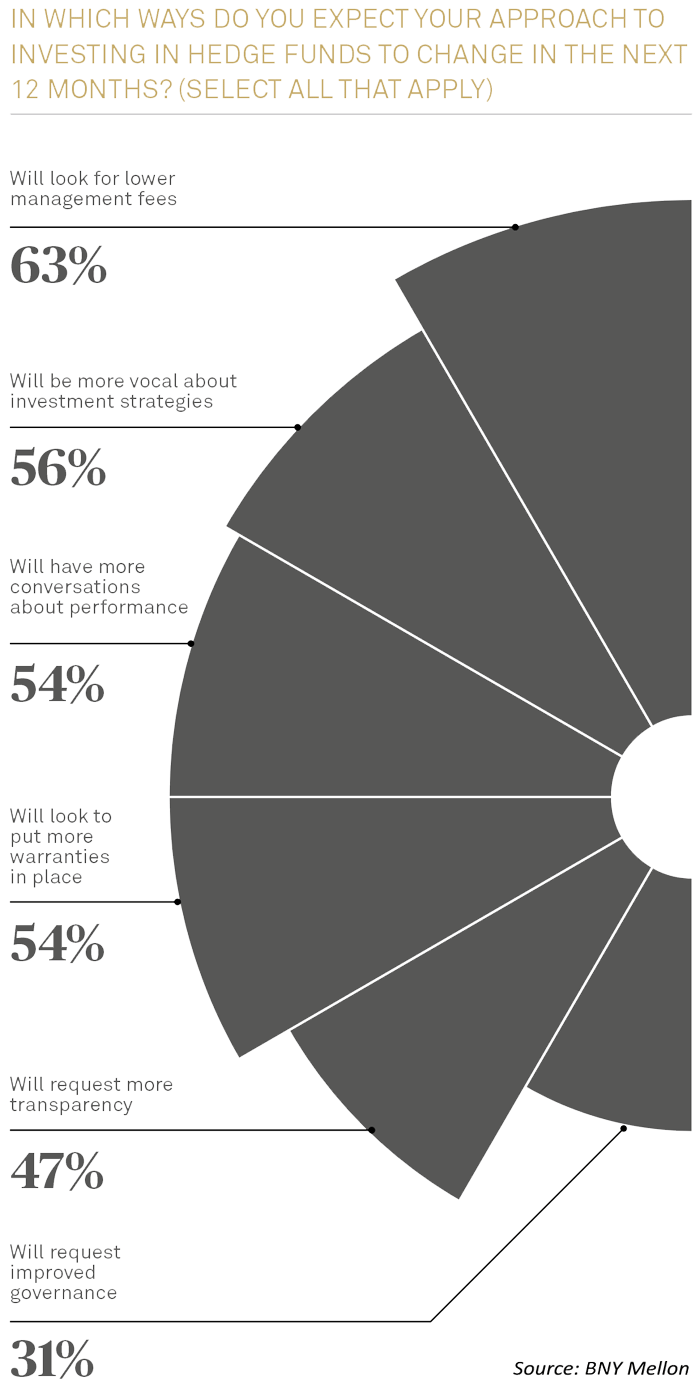

Institutional investors demand greater transparency and lower fees. Currently, high fees and a lack of transparency threaten to disrupt investment in alternatives. In BNY Mellon’s survey, 63% of respondents had indicated that they will seek to lower management fees. Fifty-six percent say they will be more vocal about investment strategies. Nearly half will request for more transparency.

Already some institutional investors have considered or pulled out of alternatives citing management fees. In April, New York City’s pension fund for civil employees announced that it was discussing the liquidation of its US$1.5 billion hedge fund portfolio due recent poor performance. Last month, insurance giant MetLife planned to allocate two-thirds of its hedge fund investments elsewhere. The insurance company has approximately US$1.8 billion in its hedge fund portfolio.

Information from hedge fund data provider eVestment shows that hedge funds on average have been having a lackluster year so far returning 0.83% YTD April 2016.

But the quest for higher returns in a low interest rate environment are driving interest in alternatives. BNY Mellon’s survey shows 39% of respondents said they will increase their allocations to alternative investment types with only 6% stating that they would moderately decrease it.

In terms of alternative investment type, the majority (37%) of institutional investors active in alternative investments were looking at allocations in the private equity. This was followed by infrastructure (25%), real estate (24%) and hedge funds (14%).

Institutional investors such as the Massachusetts state pension fund are gearing up for a boost in its alternative portfolios. The US$60 billion US-based pension fund recently included hedge fund managers Contrarian Capital and IPM Informed Portfolio Management into its hedge fund portfolio. The same push can be seen here in Asia with the likes of Qatar Investment Authority and Thailand’s Government Pension Funds (GPF) indicating plans to increase their exposure to alternatives. Qatar Investment Authority (Qatar’s sovereign wealth fund) for example made headlines recently when it paid US$3.4 billion for Singapore’s Asia Square Tower 1 from Blackrock.