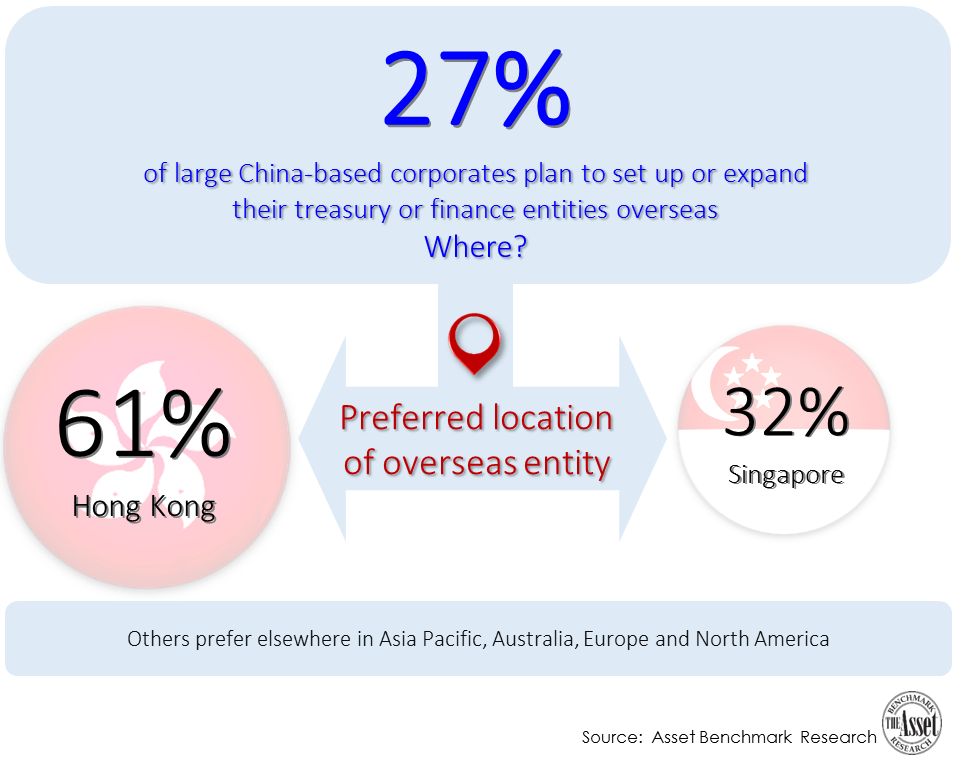

Roughly one in four large Chinese companies (27%) plan to set up or expand a treasury and finance team overseas, Asset Benchmark Research finds. When companies with annual revenues of below US$1 billion are included in the analysis, that percentage is still 15%.

521 China-based corporates participated in Asset Benchmark Research’s 2016 Treasury Review conducted in the first quarter of 2016. While mainland financial centres Shanghai and Beijing have been deemed suitable locations for a number of MNCs to establish their regional headquarters and treasury centres, many domestic Chinese companies do not appear to be convinced. As they grow their business outside of the mainland, they prefer to manage their regional (and increasingly global) treasury and finance operations from outside their home market as well.

Hong Kong is the preferred location for 61% of Chinese corporates looking to set up treasury units outside the mainland, while Singapore is the choice of 32%. Both jurisdictions are more aggressive in attracting companies looking to regionalize their treasury and finance functions, mostly through tax incentives. While Hong Kong is still debating a reduced 8.5% tax rate on treasury related income in its legislative body, Singapore adjusted the tax that treasury centres in the city-state pay on similar income to 8% in June.

For Chinese companies, however, tax on income derived from intercompany loans (among others) is not the primary concern. Indeed, 46% of respondents cite “hedging market exposure” as the primary purpose of their planned or existing overseas treasury centre, garnering most votes. “Funding overseas operations” and “providing overseas trading partners with more convenient payment accounts” follow in the list of important tasks.

As these companies expand overseas, fewer of them will continue to manage transactions, funding and hedging from within China. Proximity to their headquarters is not the most important factor in their choice of location for treasury centres, although Hong Kong’s location vis-à-vis Singapore clearly matters to them. Access to liquid FX markets and the freedom to deploy advanced liquidity management instruments are qualities financial centres must offer to this group of companies. Additional reporting by Jacky Fung

To learn more about Asset Benchmark Research, please click here.