Treasury units in APAC corporates aspire to be more than mere business enablers, with nearly one third of them looking to become profit centres within three years. That is nearly double the percentage of treasury units that define themselves as such today, Asset Benchmark Research finds.

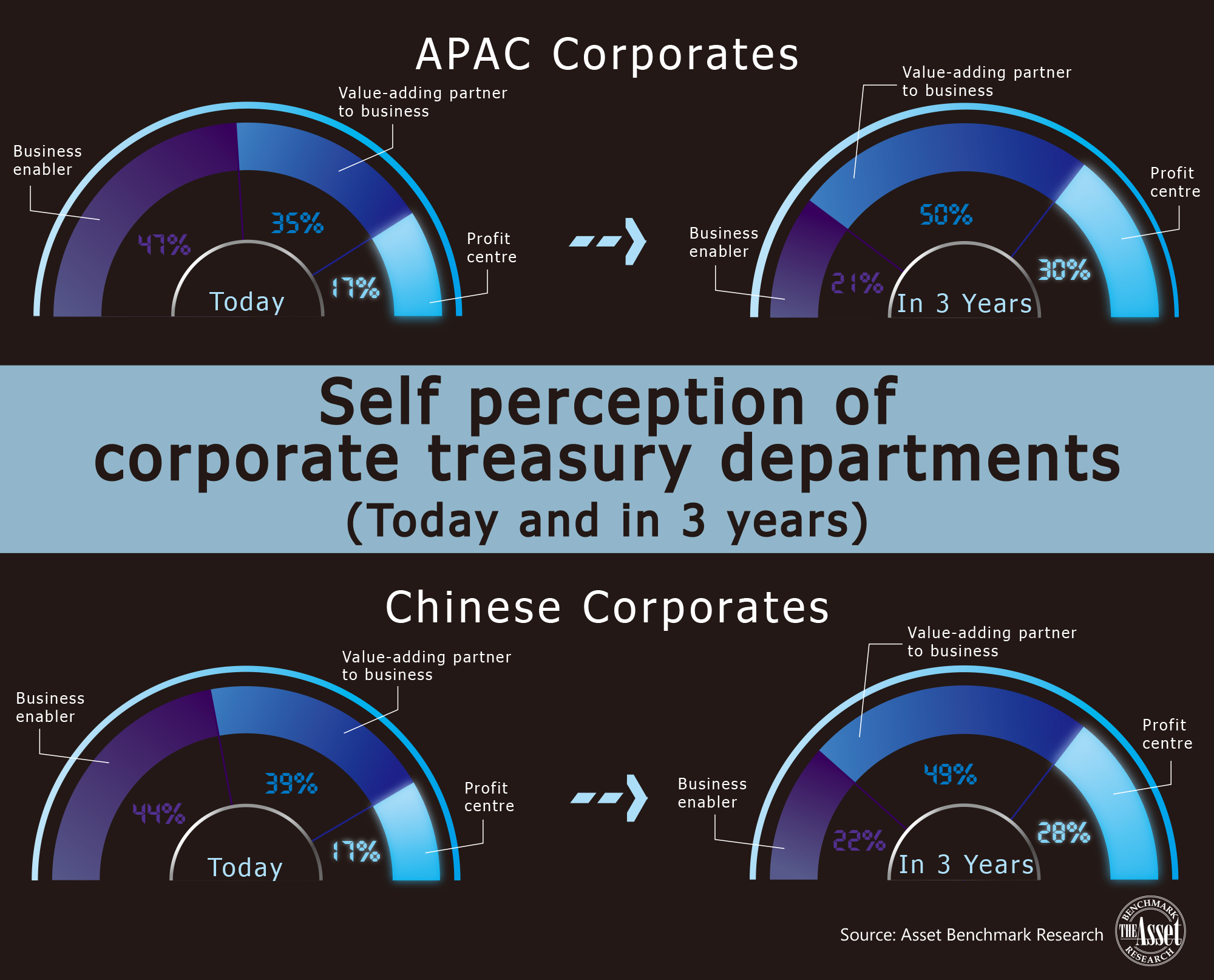

Currently, nearly half of APAC treasurers (47%) view themselves as “business enablers” due to the core cash management and balance sheet services they provide. Fewer define themselves as value-adding partners to the business (35%) and profit centres (17%) today.

This will change, respondents believe. Half of APAC treasurers expect to add value to other business units, moving beyond their back office function. Some companies have started, for instance, to hold weekly meetings with procurement and sales teams to raise awareness of how quickly currency fluctuations can erode profit margins in times of volatile markets.

“It is very important that our treasury becomes a key contributor to the business in terms of working capital, cash management and financial risk management,” says one group treasurer for a MNC based in Hong Kong. “Those are very crucial to our operations, especially during this time because of market uncertainty.”

Another China-based regional treasurer agrees: “Treasury is not just doing hedging. Treasury is doing FX risk advisory work for the business. So we need to know how to price FX risk for the pricing manager to put inside their contracts and calculations.”

Notably, the percentage of corporates that expect to have a profit-generating treasury unit is expected to nearly double within three years. How these companies expect to do so remains subject of further research. If it means acting on convictions in the foreign exchange markets, some companies will likely need to change their internal policies to allow for more active risk-taking in markets.

Among Chinese companies, the drive to become more of an advisor to the rest of the business is similarly large as in the rest of Asia. A fair share of Chinese corporates plan to set up or expand their overseas treasury and finance entities in line with this commitment.

These findings are based on primary research among 1,123 corporates in Asia during the first quarter of this year by Asset Benchmark Research (ABR). To find out more about ABR, click here.

Additional reporting by Jacky Fung and Colleen Tin