It used to be that a CEO of a listed company only cared about two things: their share price and the next deal. These days, going green has become a third area of focus. Green bond issuance has reached a high of US$63 billion year-to-date as of the third quarter according to Moody’s. This far exceeds the total of US$42 billion in 2015. Chinese issuers have accounted for 32% of the total issuance volume globally as of Q3, the majority coming from financial institutions.

Ricco Zhang, director at the International Capital Markets Association (ICMA) explained the reason for the explosive growth of this market in China: “This is encouraged by regulations to be very honest. The Chinese authorities are well-aware of the pollution.” Speaking at a recent bond summit led by The Asset, Zhang notes that China “was obviously looking for financing” to address the problem.

In July of last year, the country issued its first green bond and in December they were the first country to issue official domestic rules on the green bond market.

Globally, large asset managers like Aberdeen, BlackRock and TIAA Global Asset Management – the largest holder of green bonds – retirement funds including CalSTRS, corporates such as Apple and private banks have invested in these environmentally-friendly securities. The UN Principles for Responsible Investment (UN PRI) Initiative listed 1,500 investor signatories representing approximately US$62 trillion in assets under management as of April 2016.

Bernard Wee, executive director, Financial Markets Development and Payments and Technology Solutions at the Monetary Authority of Singapore said during the bond summit that out of the 40 large global asset managers that are in Singapore, 36 of them have signed up to the UN PRI. These investors have publicly committed to incorporate environmental, social and governance (ESG) factors into their investment decisions and green bonds meet these objectives.

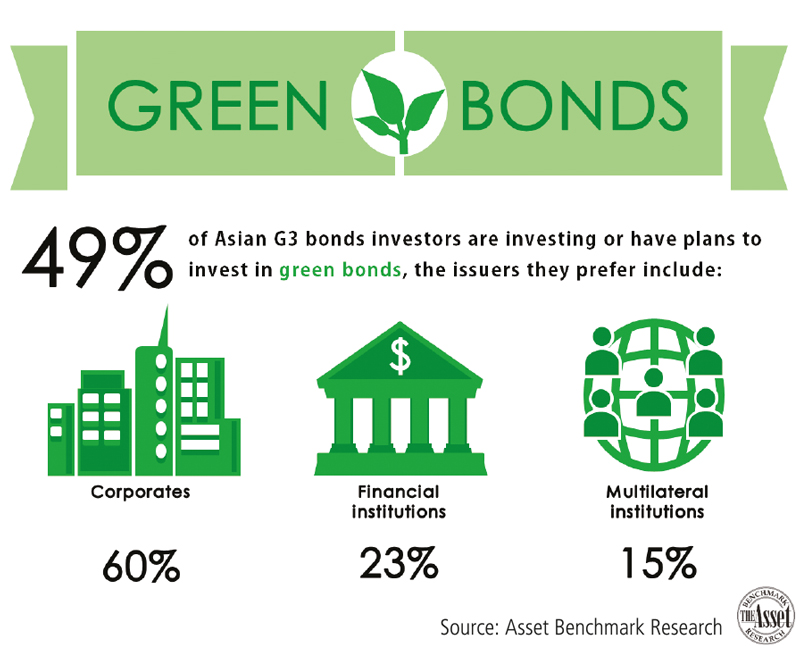

Given the media frenzy over the green security, is interest in green bonds just hype? The results of a poll by Asset Benchmark Research finds that 49% of Asian G3 bond investors said they had invested or planned to invest in green bonds. This compares with only 20% that could say the same about project bonds.

Moreover, investors say they prefer green bonds by corporates (60%) the most. Financial institutions was the choice by a fifth (23%) of the respondents and multilateral institutions by 15% of respondents.

“We’ve been spreading the good news,” says Benjamin Lamberg, the Asian syndicate head at Credit Agricole CIB about green bond issuance in the region. “We’ve organized six events this year in Asia, mainly in Singapore, Hong Kong, Beijing and Korea where we invited investors and issuers alike, to promote and discuss the SRI concepts underlying the issuance or investment in green bonds. These events, which traditionally targeted issuers, have seen last year a very sharp increase of investors attending. Asian investors, which two years ago were still showing polite interest but no concrete plan, are now embracing this market.”

However, not all investors are optimistic citing the price of bonds as a major concern. “It’s a marketing gimmick,” a global portfolio manager based in Singapore says. “At the end of the day, it comes down to: Does it fit the portfolio? Does it fit the investment returns?”

A senior portfolio manager at another international shop in Singapore believes green-focused funds in Asia are still in the early stage, but the issue around pricing has not prevented the firm from gaining exposure to green bonds. “There must be specific instances where the valuations are okay, because we would only buy it based on valuations. We’re not forced to buy it because it’s a green bond,” he says.

Although the scope for these securities is growing, the market for green bonds is still nascent in the region. “You’re dealing with a bunch of different jurisdictions, a bunch of different currencies and a bunch of different laws. It’s so difficult already to invest in Asia,” says Wee. He argues that a top-down regulatory approach is needed to uplift the local issuing community, with local standards being put into place as the first step to solving this problem.

All things considered Lamberg says the potential for growth in these securities is huge. “Yes, it’s a niche market, but it’s an extremely fast-growing niche market. If you don’t join the train of green bonds now, you have an asset class which you’re missing.”

.jpg)

.jpg)