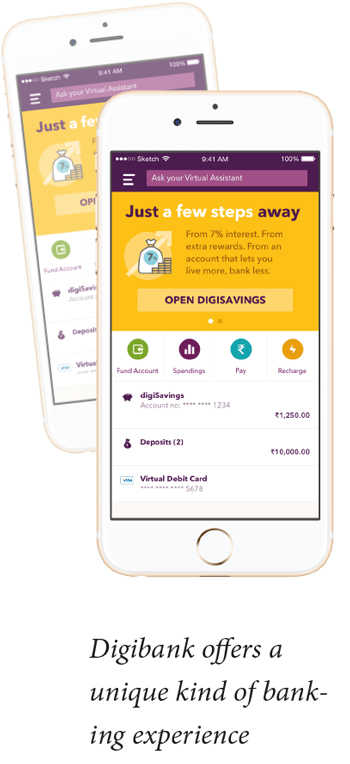

Looking to create a different kind of banking experience in India, DBS’ Digital Bank team set out on a challenging task of creating a completely mobile bank called Digibank. With an eye on experimentation, the team at first laid technical foundations for a mobile app that could provide similar services to a physical branch. While most other banks in the market simply created a mobile channel on top of their existing platform, Digibank was designed to be a completely new banking platform.

“We began work on the digibank build in mid-2014, commencing with the integration layer on top of our core services. We knew right from the start that we were aiming for a fully digital bank, so having a fully API-enabled platform would be critical to our ability to integrate with partners and give us flexibility at the presentation layer,” explains Olivier Crespin, group head of digital bank at DBS Bank. India represented a prime environment for DBS Bank due to the flexible size of their business in the country.

“There were a few reasons why India was a great first location for our digital banking offer. Firstly, the Indian government is highly supportive of the digital agenda, and as part of that support they have rolled digitally-enabled Aadhar ID cards across the nation. This means we can verify our customers’ IDs using government-managed biometrics databases linked to their Aadhar cards,” states Crespin. In addition, we had a comparatively smaller footprint in India, with 12 branches and a relatively small retail customer base, so we were not at risk of cannibalising our existing branched-based business as we grew our digital business.”

After countless hours of tweaks and customer feedback evaluations, the team eventually launched the platform last April and soon saw encouraging numbers. According to DBS the app saw close to half a million downloads in the first few months of official operations. Moreover, the bank was able to add over 275,000 new accounts in the first five months of operation.

The growth of bank account numbers in India can be mostly attributed to the ease in which customers can be onboarded to the platform. The DBS team claims that it takes around 90 seconds for a person to open a simple e-wallet, which can hold S$400 without having to sign any physical forms. The e-wallet can be used for payment activities including utility payments and insurance premiums.

Aside from the paperless on-boarding process the Digibank also has a personal finance manager that helps users track expenses and analyze purchasing patterns. The Digibank possesses an embedded soft-token two-factor authentication process. Customers facing troubleshooting issues can access Digitbank’s AI powered virtual assistant developed by Kasisto. “We have a virtual assistant powered by Kasisto software that has substantially reduced the need to customer service staff. Over eighty percent of our customer contact is being handled via the digibank app using our virtual assistant,” explains Crespin.

In terms of execution the team had to do “a lot of beta testing to make sure all potential risk and scam opportunities were locked down before we publically released the application. We then released the app in a gradual manner to the public so we could ensure everything was executed properly,” states Crespin. “As a bank, you can never lose your customers’ trust.”

Through the Digibank exercise DBS’ Digital Bank team learned a number of valuable lessons especially when it came to designing a product that had started with defining who their customers were. Internal processes were re-evaluated as well resulting in quarterly release cycles and six month lead times.

While the Digibank app has changed the way some users in India interact with their bank, technology has room to expand and influence the rest of the DBS’ capabilities across its footprint. Since India the DBS’ Digital Bank team has released Digibank in Indonesia. In terms of new capabilities the team is looking at offering investment functions and loan applications in 2017 in hopes of enriching the customer experience.

“The digital bank program has been a change agent in DBS’s digital transformation. Through the programme, we have been experimenting and delivering new capabilities and business processes. For example, this was the first time we enabled the on-boarding of new customers without ever seeing them face to face, which required the implementation of a wide range of new technology, policies and processes. We have learned a lot from the whole program,” highlights Crespin.

.jpg)

.jpg)