A series of actions taken in January by the People’s Bank of China (PBoC) and State Administration of Foreign Exchange (SAFE), not only surprised the market, but also demonstrated China’s determination to stabilize its capital account and its currency in the long term. It is likely that direct intervention in the CNY/CNH market, together with more restrictive foreign exchange (FX) purchase requirements, will become the preferred strategy for keeping the renminbi stable.

In early January, SAFE tightened FX purchase rules for Chinese citizens, officially banning them from using the exchanged foreign currencies to buy real properties and securities. On top of retail investors, PBoC also used moral suasion tactics on some banks to maintain a positive FX position. That means that capital outflow through banks should not exceed the amount of capital inflow. In mid-January, PBoC pushed up the renminbi exchange rate in both the onshore and offshore markets a few times.

Chinese economists are positive and supportive of this strategy. “The main idea is that PBoC is trying to reverse the expectation that there will be a sudden and significant capital outflow in January,” explains Mo Ji, chief economist Asia ex-Japan at Amundi, in an interview with The Asset. With regard to currency manipulation, Ji says, “I highly support and agree with what they are doing at the moment. Actually, I consider it as a gift that the Chinese government is giving to Donald Trump.”

Currently, each Chinese citizen enjoys a US$50,000 foreign exchange quota per year. However, people tend to use up all their quota at the beginning of the year in light of an expected depreciation of the renminbi. In this sense, even a small number of Chinese citizens flooding to purchase FX can cause the FX reserve to disappear in no time – something Chinese authorities are preventing from happening.

“The authorities will want to keep this in a controlled manner to create a stable environment for the Party Congress,” notes Aidan Yao, senior emerging Asia economist at AXA Investment Managers. “Something will have to give between preserving near-term stability and liberalizing the capital account. We think the former will take priority when push comes to shove, meaning that more capital controls and FX intervention will be deployed in times of market jitters.”

In December 2015, PBoC introduced a CFETS (China Foreign Exchange Trade System) basket to the market to track the renminbi exchange rate against the main currencies. However, many investors wonder whether the proposed basket can help them guide their expectations on renminbi developments. The recent introduction of 11 additional currencies in January has added even more confusion to CFETS’ actual role in the PBoC toolkit.

A research report from Natixis states that investors should look at CFETS as part of the PBoC’s exchange switching regime to maintain competitiveness when the US dollar becomes too expensive. In the second half of 2016, in particular, the US dollar appreciated by 7% against a basket of currencies.

“It (the new FX regulation) should limit outflows, but only temporarily, as the Chinese people will find other ways to move their savings out. Furthermore, this regulation does not affect corporates but households, so corporate related outflows such as repayment of debt and outward foreign direct investment could still be massive,” says Alicia Garcia Herrero, chief economist of Asia Pacific at Natixis, in an interview with The Asset.

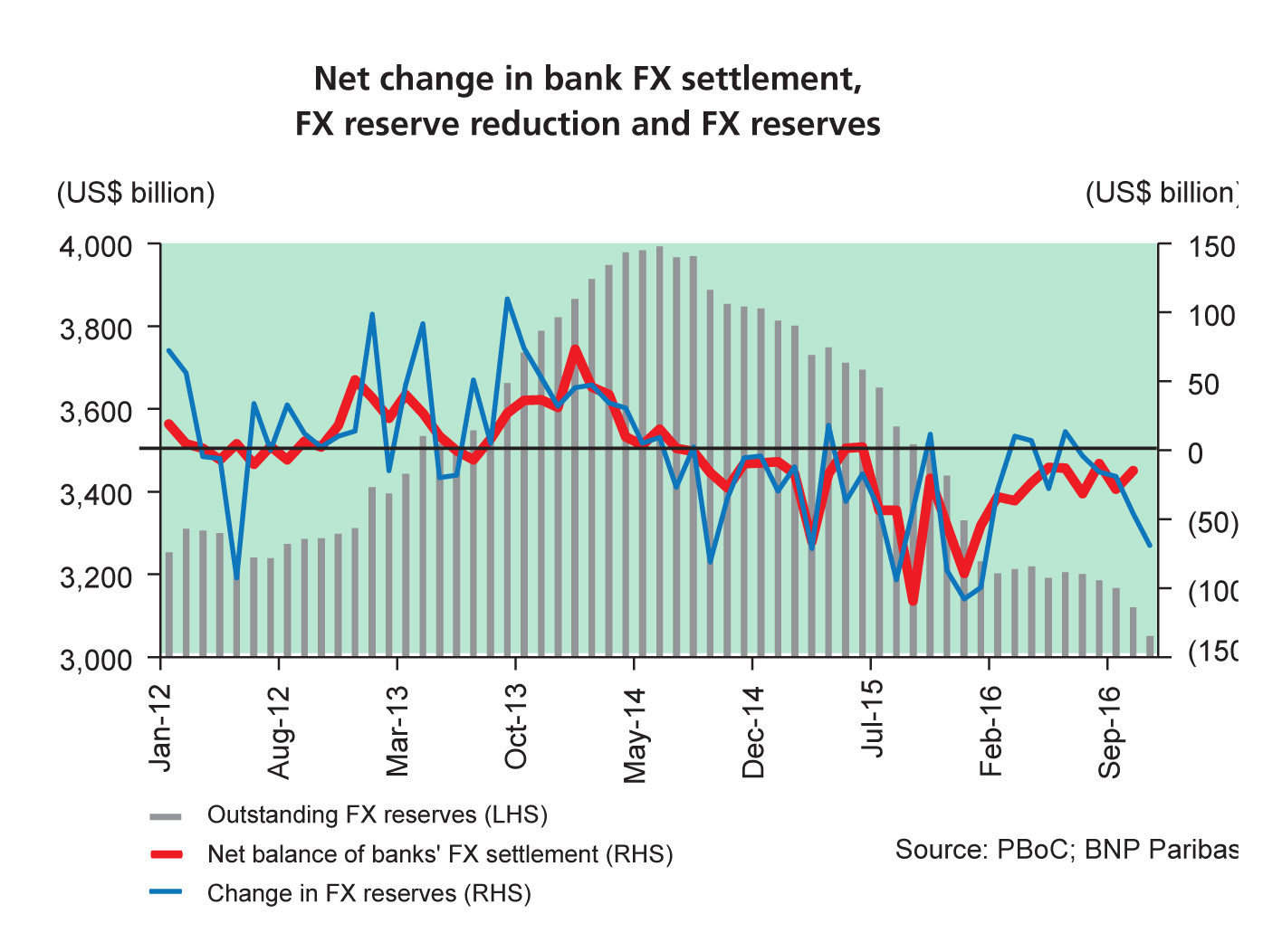

According to a report from PwC, China’s outbound M&A activities reached a record level in 2016. The total number of outbound M&A deals has grown from 362 in 2015 to 923 in 2016. While the report expects a slight decline in 2017, the outflow pressure to China’s capital account still remains inevitable. Currently, China’s foreign exchange reserve is below US$3 trillion, which is regarded as the psychological level by Chinese analysts.

Slower renminbi internationalization

The clampdown of capital outflow has clashed with the efforts in recent years by China to push for the internationalization of the renminbi. It followed a robust effort by companies to set up renminbi cross-border cash pools, and integrate the currency to become part of global treasury management structures. However, many experts agree that the renminbi internationalization is slowing down.

“The renminbi internationalization is actually facing a temporary setback from a slowdown of GDP growth,” says Ji. “When you think about a less sophisticated financial system and the institutional sector in China, you will agree that it is not appropriate to bolster renminbi internationalization too quickly.”

“But the way to view it is not to treat it as a crisis, or a meticulous control over the pace of depreciation. The right way to view it is that the depreciation is in line with the economic growth slowdown. In other words, a stabilized economic growth can result in a more stabilized currency,” says Ji.

China has been taking various measures to drive economic growth. The Q4 data from the National Bureau of Statistics shows that the service sector has become a driving force for China’s GDP growth, with an 8.3% increase from Q3. In the Central Economy Work Conference held at the end of 2016, President Xi Jinping put forward three economic focus for 2017: a stabilized monetary and fiscal policy, supply-side reform and financial risk management.

“They (the monetary policy and FX policy) will need to continue to be lax as corporates’ health is really weak, and they cannot afford an increase in rates with the corresponding impact on their interest rate burden,” says Herrero.

In a bid to reduce the financial pressure of Chinese corporates, China expanded the VAT (value-added tax) reform to a wider range of industries, including financial service sectors, in 2016. In addition to the new tax regime, the reform of the state-owned enterprises (SOE) has also gained momentum in a mixed-ownership programme. The SOE reform is expected to improve the efficiency of Chinese state-owned enterprises, the most essential component of China’s economy.

“If the central bank wants its currency to stabilize in the longer term, authorities should further cut tax and speed up the supply side reform to enhance the productivity,” notes Zeping Ren, chief economist at Founder Securities.

“The depreciating trend of the renminbi is normalizing,” says Ji, “only a large crisis in China can cause another significant drop in renminbi. We do not see any hard landing risks in the near term.”

.jpg)

.jpg)