The launch of credit derivatives used for risk transfers and hedging played a significant role in distributing credit risk and reducing systemic threats to China’s financial and economic systems.

As China develops its credit derivatives market (CDM), measures aimed at broadening participation and promoting product innovation have become necessary. The growth of CDM in developed economies offers a glimpse of how China’s credit market could evolve.

At the initial stage of development, the market is likely to have commercial banks as its principal participant. For now, banks dominate China’s CDM. But it may not be for long. In more developed markets like the US, measures aimed at diversifying market participants have attracted other players including insurance companies, investment banks, mutual funds, hedge funds, non-financial enterprises. Because of their varying risk appetite, their participation is helping spread risk in CDMs.

At the initial stage of development, the market is likely to have commercial banks as its principal participant. For now, banks dominate China’s CDM. But it may not be for long. In more developed markets like the US, measures aimed at diversifying market participants have attracted other players including insurance companies, investment banks, mutual funds, hedge funds, non-financial enterprises. Because of their varying risk appetite, their participation is helping spread risk in CDMs.Enhancing the capability of credit derivatives valuation and pricing is also a step in the right direction. Due to a lack of data that include probability of default, loss-given default, and market transaction information, mature credit default swap pricing models cannot be directly used for pricing of credit derivatives in China. But increasing default cases make data and information vital for CDM development.

Derivatives have evolved from an instrument that was basic initially to one that became more complex, before reverting to its current simple form. Following the 2008 financial crisis, nearly all speculative derivative portfolios with a very complicated structure have disappeared. In the initial stage of market development, therefore, basic credit derivatives should be developed progressively with the practical aim of playing the credit risk management functions of financial institutions.

In addition, market supervision is of paramount importance. There are lessons to be learned from the financial crisis. One idea stands out: in the innovation and development of credit derivatives, China must strictly control the leverage ratio of market participants. The government should also improve the transparency of CDM by improving the information disclosure system, including the adoption of transaction information registration and central counterparty clearing, thereby strictly preventing systemic risk.

Counterparty clearing

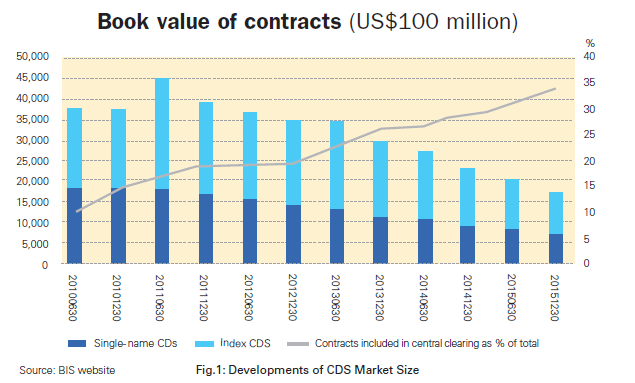

The financial crisis is proof that under-regulated use of credit default swaps (CDS) pose systemic risk to the economy. For this reason, the US and EU have included credit derivatives in the products subject to mandatory clearing. CDS have been standardized increasingly to create conditions for central counterparty (CCP) clearing. Such clearing mechanism will benefit CDM.

The financial crisis is proof that under-regulated use of credit default swaps (CDS) pose systemic risk to the economy. For this reason, the US and EU have included credit derivatives in the products subject to mandatory clearing. CDS have been standardized increasingly to create conditions for central counterparty (CCP) clearing. Such clearing mechanism will benefit CDM.

The centralized management of CCP information allows market participants, policy makers and researchers to collect relevant information to better assess the impact of the latest market developments on positions of individual participants.

Moreover, market liquidity and activity are enhanced with such mechanism. The CCP clearing mechanism boosts trading efficiency notably. Contracts on transactions between market participants can be replaced by contracts with CCPs to remove counterparty risk and increase market liquidity.

The CCP clearing mechanism also can enhance the supervision of over-the-counter derivatives trading to prevent systemic risks. The central clearing organization and the central trading platform – which are market infrastructures and auxiliary management entities between the government and the market participants – should assist the government in managing market participants. For OTC derivatives that are not well regulated by the government, the CCP clearing mechanism will become a crucial tool to supervise such products.

The article has been translated from Chinese and edited for style and clarity. This is an excerpt of the original article that first appeared on the Financial Market Research, a magazine sponsored by China’s National Association of Financial Market Institutional Investors (NAFMII). The author is a legal manager at the Shanghai Clearing House.

.jpg)

.jpg)