ASIAN local currency bond investors generally agree that US interest rates continue to overshadow short-term rates in Asia. But domestic liquidity in Asia is having an increasing impact on the direction of rates in local markets. Unlike during the Asian financial crisis of 20 years ago, Asia is standing on its own.

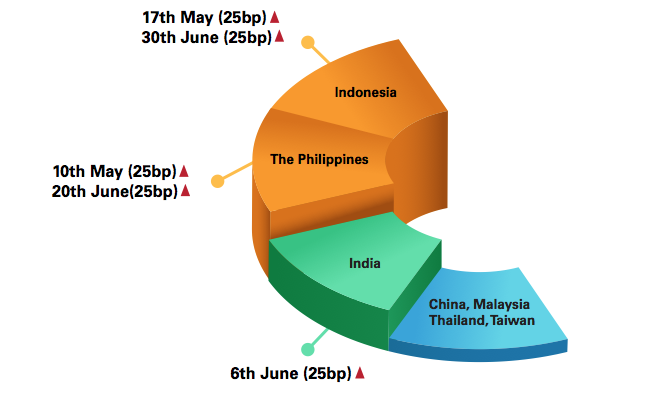

In the wake of US Federal Reserve rate hikes, some emerging markets (EM) in Asia are showing signs of stress. In May, Indonesia faced a market sell-off. Its central bank increased interest rates to defend the rupiah. Benchmark interest rates were also raised in India, with central bank governor Urjit Patel saying the Federal Reserve may go slow on shrinking its balance sheet.

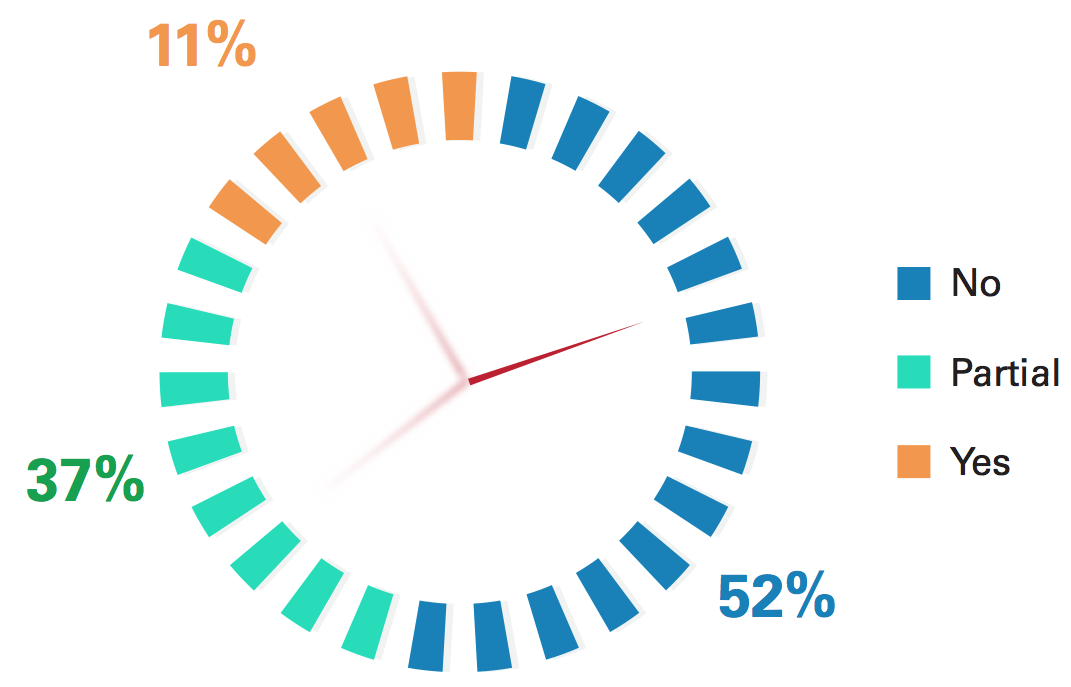

Asset Benchmark Research (ABR) asked the region’s Astute Investors for their views on the potential decoupling of interest rates between emerging markets and the US. More than 200 Astute Investors participated in the survey. The majority (52%) of investors say that rate decoupling is not happening. Yet a substantial group (37%) of investors sees US interest rates as one of the factors, but not necessarily the dominant one influencing emerging markets rates.

Some investors in the minority group foresee decoupling of interest rates in the future. “From time to time, EM via central bank policies are no longer implicitly following US interest rates specifically as countries become less and less dependent on US policies in terms of trade. That said, at the moment, pressure is still there as investors are still using the US as the benchmark economy to base rates in, until such time as another reliable alternative exists, that should be still in place,” says an investment department head of a trust based in the Philippines. Porntipa Nungnamjai, a fund manager in Krungsri Asset Management in Thailand, also shares this view: “For the long-term view, interest rate should be more dependent on each economic fundamentals, which lead the direction of interest rate policy rather than capital flow.”

Robust fundamentals buttress the decoupling notion. “EM countries with stronger economic fundamentals are better placed to withstand US rate hikes compared with weaker peers, and even benefit from it if they are seen as a safe haven,” explains a fund manager at an insurer in Malaysia. Sharing a similar perspective, Peerapong Kitjakarn, a senior analyst in Krungthai Asset Management points out currency strength as a delineating factor. “US rate hike will decrease carry trade flow which will have a negative impact on local rates especially in the short end. However, if the market still has the positive outlook on the countries, especially in the countries that tend to have strong currency view, those markets tend to decouple from US interest rates.”

Source: ABR

Investors believe onshore liquidity, oil price, and inflation rates are also increasingly influential to movement of local market rates.

“EM interest rates should not decouple from US interest rate hikes, since Malaysian government bonds were also reacting to some of the sell-off in US treasuries. That said, the extent of the selling in Malaysia seems manageable because of the number of onshore investors searching for yield,” says Michael Chang, chief investment officer, fixed income at RHB Asset Management.

Thailand’s liquidity also seems sufficient to handle disruptions from foreign capital outflow. “Growth differential between EM and DM (developed markets) still prevails. Take Thailand, where the current account surplus equates to 8% of GDP along with abundant onshore liquidity. This caps long-dated yields. One concern is the rising oil price, which prompted a 40-45bps increase in the two-year THB rate,” notes Arsa Indaravijaya, head of investment at the Government Pension Fund, Thailand.

Pramook Malasitt, senior vice-president, Kasikorn Asset Management, echoes this concern. “Rising US rates, if too fast, may impact all Asian local currency bond markets. Rising oil prices are another headwind.”

Investors think the experience gained by governments from the 1997 Asian financial crisis is helping. “I do not think EM rates will completely decouple from the US rates but the degree may vary for some EMs. Some countries have learned from the 1997 crisis and have bigger buffers (higher reserves, lower external funding),” says a fund manager in Thailand.

Source: Trading Economics

Not everyone believes that local conditions are more pertinent. “EM markets will be impacted by US interest rate movements with reduced premium, on the narrowing of the interest differential between local and US rates,” says Alfred Mui, head of Asian credit, HSBC Global Asset Management, Hong Kong. But he believes that domestic macro factors like inflation, growth, currency, external positioning and politics will determine how well a particular EM handles greater US interest rate volatility.

Another investor shares this view. “Decoupling can come only in scenarios of adverse monetary policy divergences between DM and EM — which I am not seeing,” notes Alvin Maala, senior portfolio manager, Nikko Asset Management, Singapore.

Following interest rate increases in India and Indonesia, the central bank of the Philippines raised its key overnight reverse repurchase rate by 25bps to 3.5% on June 20, in line with market expectations.

Steady interest rates in China, Malaysia, Thailand and Taiwan suggest that these markets are resilient to external shocks. The abundant liquidity in Malaysia and Thailand elicit the possible scenario that local investors have parked their funds in Asia, and their capital will continue to stay in Asia, showing a picture of Asia investing in Asia.

Background

The survey on interest rate decoupling is part of the Asian Local Currency Bond Benchmark Review. It covers 10 markets: China (onshore; offshore), Hong Kong, India, Indonesia, Malaysia, the Philippines, Singapore, Taiwan and Thailand. We have conducted it annually since 2000. We provide data on the product needs of investors and the market penetration of banks active in local currency bonds. The survey analyses investor buying behaviour when selecting counterparties, giving unprecedented access into the minds of investors.

Note: 285 investors responded to the survey (May 2018) including this year’s most Astute Investors, who are ranked based on their knowledge of issuers and markets, trading skill plus acumen in making investment decisions.

.jpg)

.jpg)