“Daylight was fading on that chilly afternoon of December 22 1998 in London...”

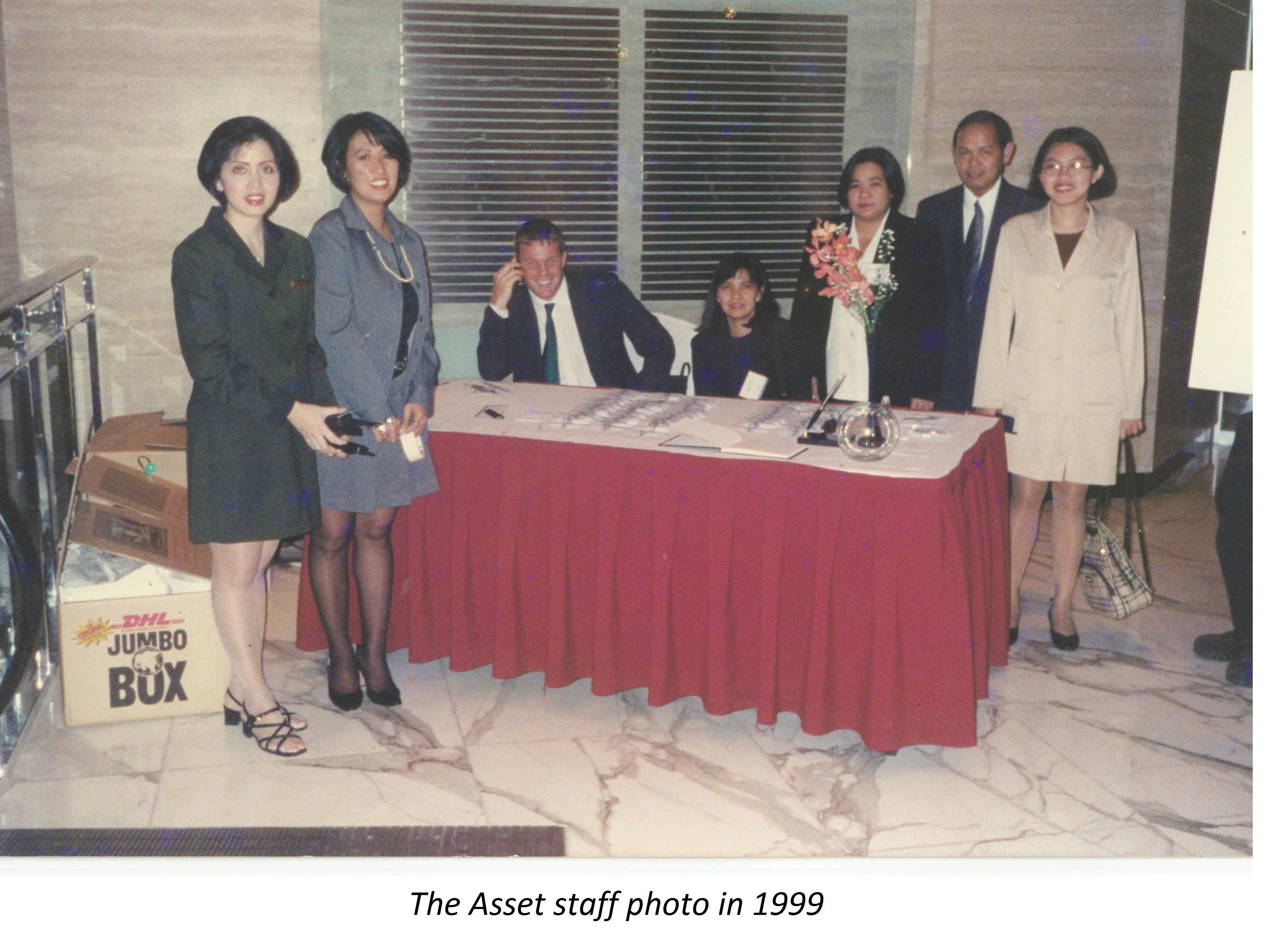

These were the opening lines of The Asset cover story in its inaugural issue in March 1999, which I co-wrote with our editor-in-chief Daniel Yu, and which I always recite when people ask me what I remember the most about the start of The Asset journey.

I was fortunate enough to have been invited to join The Asset from day one and what a ride it has been. From a market backdrop recovering from the Asian financial crisis in 1997-1998 to the epidemic caused by severe acute respiratory syndrome, or Sars, in 2003 and to the global financial crisis in 2008, The Asset survives and continues to thrive as an integrated multimedia company serving a community of leading corporate and financial decision-makers in Asia.

Back to our first cover story. The article was all about the sale of the crown jewel of one of the South Korean chaebol back then, Hansol Paper, which fell prey to the Asian financial crisis. It was a case of paying the price for the excesses of past years, and with Korea among the hardest-hit economies of the financial meltdown, even the strongest Korean chaebol had been seriously affected.

That deal, though, was not the end for Hansol, but rather an opportunity to form a strategic alliance that would make the company a part of one of the world’s strongest and most efficient paper producers.

The Hansol restructuring saga was the first of the many stories that graced the pages of The Asset during its initial years as we chronicled how corporates across the region attempted to resuscitate and resurrect from the ashes of the Asian financial crisis.

Several financial institutions never survived the brunt of the crisis and were permanently closed or taken over by governments in Indonesia, Korea and Thailand. Some foreign buyers also stepped in and acquired stakes in commercial banks not just to rescue them, but to gain a foothold in the markets, such as in Thailand, where United Overseas Bank of Singapore acquired Radanasin Bank and Standard Chartered bought into Nakornthon Bank.

In Indonesia, the government as part of its restructuring programme initiated the merger of four state-owned banks that failed in 1998 – Bank Bumi Daya, Bank Dagang Negara, Bank Expor Impor and Bank Pembangunan Indonesia – creating one of the country’s largest commercial banks today, Bank Mandiri.

In many ways, the Asian financial crisis was the catalyst that underpinned The Asset’s push to champion a number of issues that impact the development of the debt capital markets in the region and cover ways on how to manage companies, many of which were family-controlled.

Foremost among them was the importance of bolstering the local currency bond market as a funding avenue, which is showcased in our signature event of the year – The Asia Bond Markets Summit – which is held twice a year in China and Singapore, and now in London, in collaboration with the Asian Development Bank.

One of the main culprits of the crisis was the withdrawal of foreign funds from the region. Investors and firms got panicky and fled as the financial meltdown unravelled. The local currency bond markets foster financial stability by providing a stable domestic source of long-term capital, while mitigating foreign exchange rate risk among the local borrowers.

Having the local currency bond markets as alternative financing avenues for issuers and borrowers as well as investors also reduces the high demand for US dollar funding. So from a volume of US$33.23 billion in 1997, the total issuance of local currency bonds in Asia, ex-Japan and Australasia surged to almost US$1.40 trillion in 2018, according to Refinitiv. The increase was more pronounced in China as the issuance climbed from US$646.6 million to US$1.12 trillion during the same period.

Another issue that was catapulted to the front burner in the aftermath of the Asian financial crisis was the importance of corporate governance, which The Asset highlighted in its third cover story “Shaking up Corporate Asia” in May 1999. It cited the 10 key issues of corporate governance in the region, including stricter regulations on related-party transactions and that non-executive directors should be completely independent.

.jpg)

Large family-owned business groups are prevalent in Asia and the problems that emerged in the wake of the crisis brought corporate governance to the centre stage of the Asian corporate landscape. Good corporate governance demands transparency, independence and accountability to shareholders and other stakeholders – something that was inadequate back then.

Discussions on corporate governance gained further prominence with the infamous Enron scandal, which was highly publicized in 2001. It eventually led to the bankruptcy of the US energy company Enron Corporation, which reinforced the need for new regulations on financial reporting.

Through its enhanced coverage, The Asset contributed to bringing into the main boardroom the discussion on corporate governance as it provides a set of tools for the management and the board of directors to ensure that appropriate operating mechanisms, as well as checks and balances, are put in place to address the interests of all stakeholders and the community where the company operates.

From raising the bar of the standards of corporate governance, the discussion was elevated to corporate social responsibility, which then morphed into environmental, social and governance (ESG) initiatives. This culminated in the establishment two years ago of The Asset ESG Forum – a dedicated website which serves as a platform for the exchange of ideas, insights and inspiration to help drive sustainability in businesses in Asia.

Working with The Asset also gave me a front seat in the evolution of the capital markets in the region. When I first started covering the capital markets as a business reporter at one of Hong Kong’s English-language dailies in the mid-1980s, I was initially writing about Hong Kong dollar floating rate certificate of deposits and syndicated loans, which were then the usual avenues for fundraising.

With such a focus which I fully embraced, I lived and breathed capital markets in my daily existence, keeping tabs on the new asset classes and deal structures that were launched in the market. I witnessed a new wave of asset-backed deals that swept Asia in the late 1990s as asset securitization slowly returned to the region. Discussing the merits of the transactions with the issuers, bankers, lawyers and other related parties, who helped shape and structure the deals, we were able to capture their highlights in our Nuts & Bolts column.

For instance, the Korea Asset Management Corporation launched in June 1999 the country’s first local currency asset-backed bonds amounting to 320 billion won (US$280 million) secured by non-performing loans. Asiana Airlines, also of Korea, in late 2000 raised US$100 million through the securitization of present and future passenger airline ticket receivables – the first such deal in Asia since the Asian financial crisis and the first future flow securitization completed in Korea.

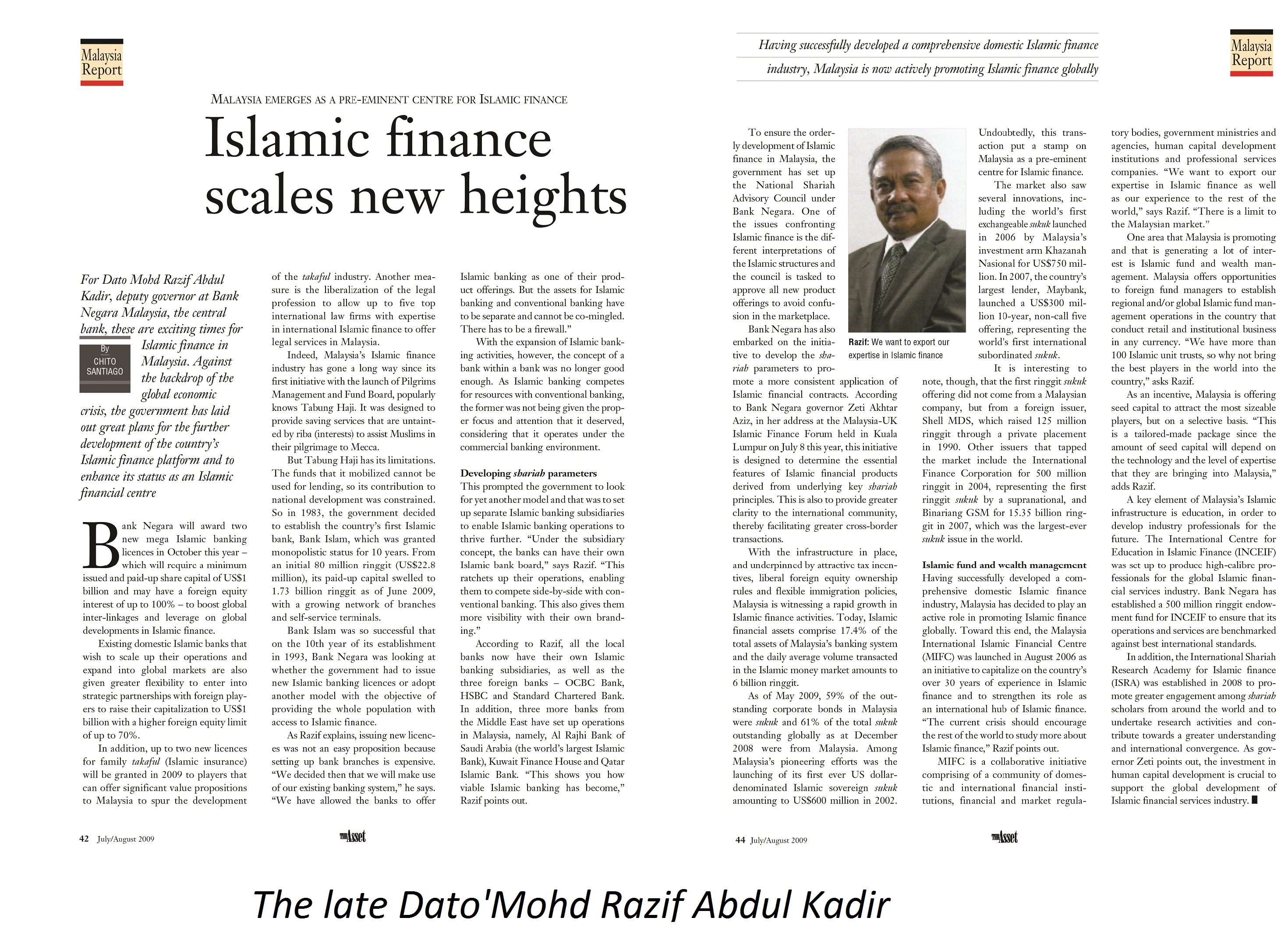

The Asset also stamped its brand in Islamic finance – beginning at a time when it was establishing its place in the mainstream capital markets. It was my interview with the late Bank Negara Malaysia deputy governor Dato’ Mohd Razif Abdul Kadir in the summer of 2009 that stirred my interest in Islamic finance.

Tasked to produce a Malaysia report that included coverage of Islamic banking and finance, I set up an interview with Dato’ Razif. After the usual formalities of introducing myself and stating the purpose of my visit, he asked me: “How much do you know about Islamic banking?” Without waiting for a reply, he invited me to sit down and said, “Let me teach you the 101 of Islamic banking”.

His passion for Islamic banking and finance immediately rubbed off on me and our meeting lasted longer than I had expected, so much so that I had to scramble to my next appointment. Unfortunately, Dato’ Razif passed away in August 2011. To honour his contribution to the industry, The Asset conferred on him a posthumous award during The Triple A Islamic Finance Awards 2012 luncheon held in Kuala Lumpur, which was accepted by his wife and son.

It is also interesting to note that several banks and investment banks, which I used to cover before, are gone for different reasons or have new identities as a result of industry consolidation. Others merely fade away, while the likes of Lehman Brothers simply did not survive the brunt of the global financial crisis in 2008.

Back in 1999, the top arrangers of Asian equity deals were Salomon Smith Barney, Goldman Sachs, Jardine Fleming, Morgan Stanley Dean Witter, Merrill Lynch, Baring Brothers/ING Barings, Lehman Brothers, BNP Prime Peregrine, Warburg Dillon Read and HSBC Investment Bank. Today, banks including Goldman Sachs, Morgan Stanley, CITIC and China International Capital Corp lead the sector.

Just like the ever-evolving world of finance, my journey with The Asset continues. As one of the pioneering members of what I call The Asset family, I look forward to the next 20 years.

Chito Santiago, managing editor, has been covering the capital markets for The Asset for 20 years.

.jpg)

.jpg)