Once an afterthought to the corporation as a legal entity – or merely a pesky compulsory module sitting alongside the ‘serious stuff’ of finance and law degrees – ethics is now back on the table.

Once an afterthought to the corporation as a legal entity – or merely a pesky compulsory module sitting alongside the ‘serious stuff’ of finance and law degrees – ethics is now back on the table.

In the assessment of Asia’s Best Companies in ESG this year, participating corporates to The Asset Corporate Awards were asked about the factors driving their interest in ESG. The majority of the corporates that won in Asia’s premier and longest-running ESG awards say ethical values and parameters have shaped their decisions to focus on ESG this year.

Other factors include regulation and legal requirements, stakeholder and community demand, as well as positive environmental or social impacts. Another factor was the belief that ESG plays a key role in broader financial performance.

For now Asia lags its Western counterparts when it comes to ESG, but is quickly catching up. Stephen Liberatore, managing director and fixed income portfolio manager at TIAA Investments, an affiliate of Boston-based Nuveen, said one ESG driver in the region is the ‘concept of transformation’.

“There’s been tremendous growth in Asian opportunities. We’re seeing the advent of renewable companies and traditional issuers attempting to become ‘more green’ coming to the market. Asia is rapidly catching up with the US. That’s driven by the concept of transformation – moving away from fossil fuel as a main generation source. But also because they’re seeing what the demand is from the investor base,” says Liberatore in a podcast interview with The Asset (theasset.com/esg-podcast).

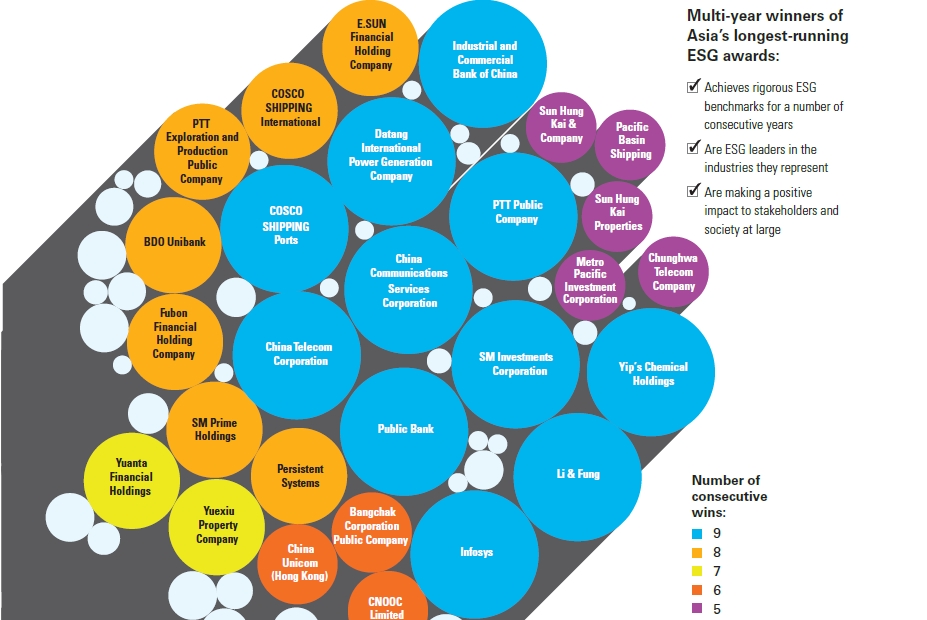

Now in its 17th year, the awards by Asset Benchmark Research (ABR) assesses winners using an online questionnaire submission and supplementary information companies provide. The factors taken into consideration range from an evaluation of financial performance, management, corporate governance, social and environmental responsibility as well as investor relations.

This year ABR awards 54 companies with Platinum and Gold awards. Some of the companies have gained the highest levels of recognition consistently since 2000. The Asset Corporate Awards ranking of Platinum, Gold and Titanium was introduced in 2009 and since then companies like Li & Fung, Infosys, PTT Public Company and SM Investments Corporation have outperformed in ESG against their peers even in a difficult macro environment.

To illustrate, Li & Fung, one of the world’s largest sourcing and logistics companies, is embracing technology and innovation to better its operations. Its corporate training extends to suppliers and industry peers equipping them with online learning tools on how to comply with global industry regulations and standards. The company released public videos in 14 languages on compliance and operational procedures on YouTube. They also conducted 2,304 operational training sessions across 15 countries covering its global supply chain.

Its charitable foundation, the Li & Fung Foundation, is involved in sponsoring girls’ education in China, empowering them with vocational training in China. In 2016, the foundation collected over 775kg of waste from coastlines and cityscapes and planted over 5,000 trees, as well as held workshops to raise awareness about the environment.

Infosys, one of India’s largest IT services companies, is one of the first in India to have taken initiatives in terms of corporate governance standards and promoting quarterly reporting. Roughly 45% of Infosys’ electricity requirements come from renewable energy sources. They are providing solar-powered electricity to villages in the Ladakh region of Jammu and Kashmir. In addition they have a water conservation strategy that has resulted in an 8.3% reduction in their per capital consumption of water from 2015.

PTT Public Company, the largest oil and gas company in Thailand, has a policy of rotating their senior management frequently to ensure checks and balances. The firm met their strategic target of greenhouse gas intensity reduction by 5% four years ahead of their target in 2016, compared to the base year of 2012. PTT has also been investing in new technologies, including electric vehicles and biofuels. Last year, they launched six pilot electric vehicle charging stations with plans to launch a solar-powered one in the future.

The charitable foundation of SM Investments Corporation, a holding company in the Philippines with interests in retail, property and banking, provides a 12-week farmer training programme for both rural and backyard urban farming to promote food sufficiency and proper food nutrition in the communities where they are present. In 2016, they trained over 2,000 farmers in 60 municipalities. Last year the company also conducted 107 medical and diagnostic missions serving over 95,000 patients across the country.

Encouraging numbers

Historical metrics used for the evaluation of companies awarded this year paint an encouraging picture. The proportion of companies that have a social responsibility policy included in the board’s corporate strategy has increased from 76% to 92% over a three-year period since 2015.

International Container Terminal Services (ICTSI), for example, has social responsibility targets that include education, community welfare assistance such as waste management projects, coastal clean-up and a community electrification project, training and capacity development involving disaster preparedness orientation as well as sports development assistance promoting amateur golf and girls softball. ICTSI runs a scholarship programme for 120 indigent college and high school scholars as well as school building construction projects.

In 2017, the percentage of companies that pay attention to their carbon footprint has also risen. Seventy-eight percent of companies say they are calculating and recording greenhouse gas emissions, savings and offsets this year, up from 76% in 2016 and 67% the year before.

Moreover, more CEOs are also being compensated based on their commitment to a firm’s key performance indicators. Close to 40% of companies participating in the awards link between over half to three-quarters of their pay to their stated KPIs.

For some companies, CEO and COO performance evaluations are based on a balanced scorecard that includes safety and ESG as well as considering their technical and behavioural competencies, including adhering to the company’s code of conduct and business ethics, good governance and environmental, safety and health policies.

In terms of the percentage of women that sit on the board, corporates in the region are gaining ground, however still have a way to go. This year, 78% of companies have a board where one or more women are board members. For 31% of them, the proportion is one or two women for every eight male board members. Taiwan’s Fubon Financial Holdings and Hong Kong’s Link Reit lead Asia in ensuring diversity in the boardroom. Fubon has four women in the board and offers female employees solid benefits that support them in advancing their careers in the company.

ABR data of investment practices from fund managers in the region is also telling. As part of its annual Asian Local Currency Bond Benchmark Review, portfolio managers across eight Asian countries including Hong Kong and Singapore were asked how they will promote the integration of ESG into their investment decisions.

The majority of fund managers suggested encouraging ESG disclosure and high standards of ESG performance among the corporates they are invested in.

In terms of how fixed-income investors are adopting ESG in their investment decisions, managers say avoiding controversial and unethical sectors is one way to keep investments in line with ESG standards. Some are systematic in including ESG factors into traditional financial analysis, while others suggest selecting companies for their positive ESG performance relative to industry peers.

“Effectively what we’re looking at is a true leadership group in ESG. It’s not from picking winners, it’s from avoiding the losers,” says Liberatore.