The corporate world often has little clue as to what it means to be sustainable, or to be green. And when companies throw around those words to attract kudos or funding, they are accused of over-representing their deeds compared to what they have actually achieved. But the investment community is becoming wise to the ploy of ‘greenwashing’. Some are calling for better third-party authentication; others have established in-house screening to make sure that green really is green.

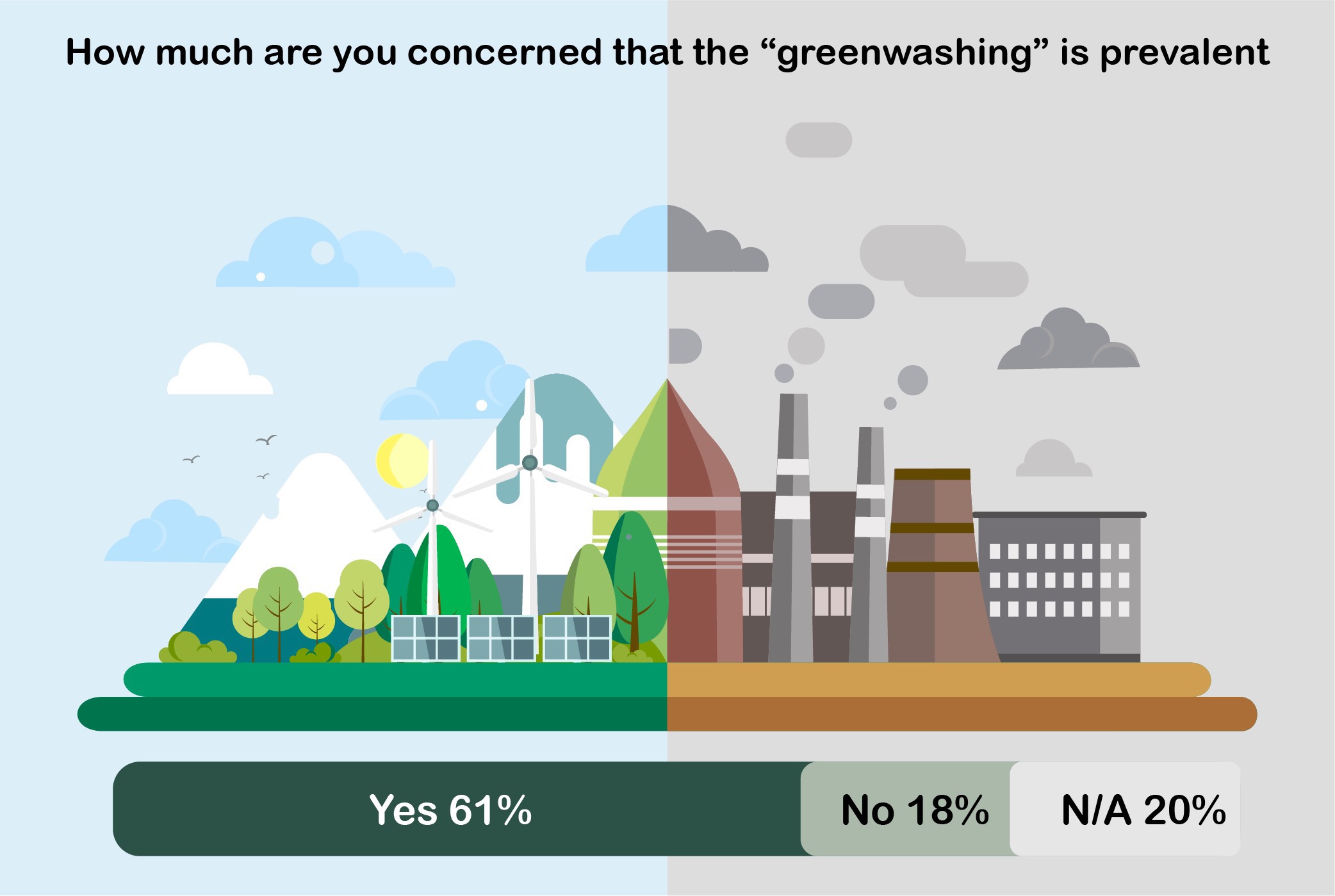

Could green be losing its sheen? Almost two-thirds (61%) of fixed-income investors view ‘greenwashing’ among Asian companies as a major concern, a recent survey by Asset Benchmark Research has shown. The survey of more than 100 investors in Asian local currency bonds suggests that many companies exaggerate their adherence to environmental standards in order to boost their reputation. “This is a big issue, particularly among large corporates which are incentivized to promote themselves as ‘green’ or ‘socially responsible’ to appeal to certain segments of their markets,” says a portfolio manager with a major global institution in the US. “As investors, we need to look beyond the fancy headlines and have our own judgement on how much of these companies’ ‘green initiatives’ have a long-term positive ESG impact.”

Investors argue that the green label is being devalued by its misuse. “I personally am particularly concerned due to the generally poorer quality of disclosure in Asia,” says a senior portfolio manager of a large Japanese investment firm. “The ability of companies to report unverifiable claims therefore reduces the value of 'green' labels.” A Malaysian fund manager is similarly “very concerned that greenwashing is prevalent as it has escalated in recent years as more investors/consumers are willing to invest/purchase green products”.

Some green bonds have been culprits of inaccurate labelling. “We expect the green bond to signal the company’s intention to green its assets over time. But we still see a disconnect between green bonds and the company’s forward capital expenditures that are tilted more towards brown assets. In effect, a green bond issuer becoming more brown,” comments Xuan Sheng Ou Yong, green bonds & ESG analyst, APAC, at BNP Paribas Asset Management.

Impact assessment

In response to the greenwashing problem, many investment houses are increasing their research and due diligence. A portfolio manager in Singapore says that while he is “somewhat concerned” about the exaggerated green credentials of companies, he believes that “with thorough research and analysis, one should be able to objectively assess the company's claims”.

BNPP Asset Management has a similar approach. For example, its green bond fund uses a transparent process of “impact reporting” to indicate how the bonds have a verifiable impact. “Impact reporting,” explains Felipe Gordillo, senior ESG analyst at BNPP AM, “can be shared with clients to demonstrate the amount of carbon that is avoided by investing into a specific bond.” Gordillo defines impact investing by the three widely accepted concepts of additionality, intentionality and reporting (or measurability).

On additionality, the issuer should structure a bond issue to “increase the value of the green assets on their balance sheet”, and drive their business or operations towards greater sustainability. On intentionality, an issuer needs to set goals for their bond and measure progress towards those goals, to demonstrate “how is that bond helping them to become a more sustainable company”.

To translate the concept into action, BNP Paribas Energy Transition fund outlines the tonnes of carbon emission avoided, the megalitres of water saved, and the tonnes of waste avoided and recycled for every 10 million euros (US$11.7 million) invested in the strategy for one year in its extra financial report. The strategy previously known as the Parvest Energy innovators generated a double-digit positive return YTD and over 30% of outperformance compared to the benchmark index.

By going the extra mile in impact reporting, institutional investors purposefully avoid green bonds that are used as pure greenwashing public relations exercises, and quantify the sustainable impacts per dollar. Gordillo describes it as “essential” because “at the end of the day, this is the only way to have proof” that a green bond really is having an impact.

Unfortunately, despite welcome developments around the ICMA green bond principles and the recent landmark moves by China, the global harmonization of sustainable investment and reporting still has a long way to go. In May, the People’s Bank of China excluded the “clean utilization of fossil fuels” projects from green bond financing, yet as Gordillo concedes, “today we don’t have a common protocol for impact reporting for green bond issuers”.