With the rapid development of the sustainable bond market globally, many issuers are asking the question: what are the financial advantages of doing a sustainability-focused bond deal?

Beyond the societal benefits of fixed-income proceeds marked for carbon reduction or the creation of decent paying jobs, companies are starting to examine the financial benefits of going down the ESG (environmental, social and governance) path, particularly when it comes to their fund-raising strategy.

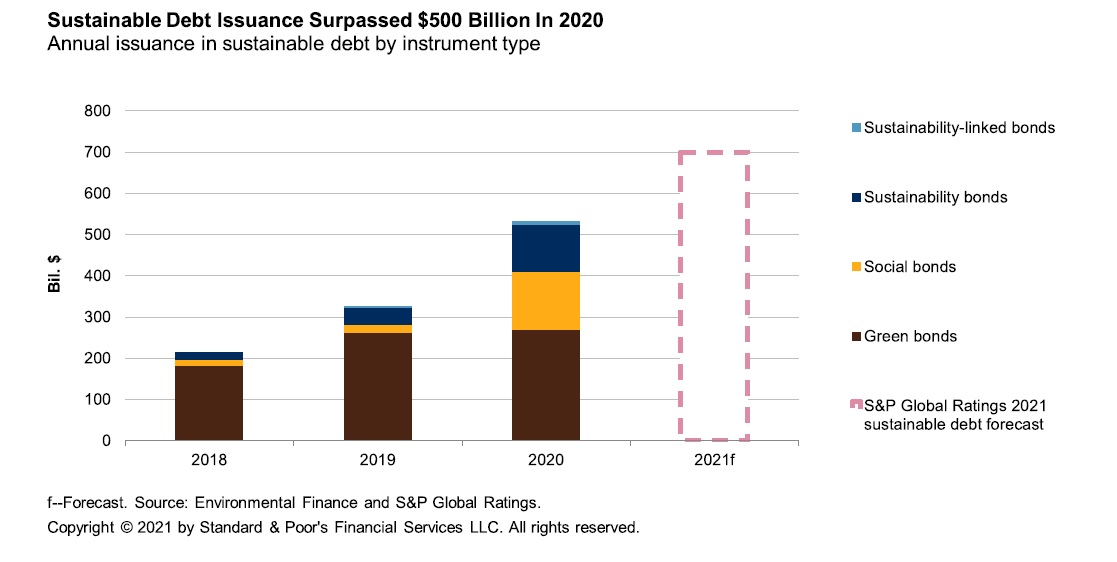

Despite a difficult and volatile 2020, the global sustainable bond market has remained resilient, with social bond issuances growing more than 10 times their 2019 level to raise US$163 billion globally, according to data from international law firm Linklaters. Global green bond issuance reached close to US$230 billion in 2020, surpassing the US$188.3 billion total in the previous year. This is a clear indication that issuers are becoming more familiar with the structure behind sustainable bonds.

Strong momentum

The impressive volumes in 2020 could be attributed to the growing momentum in the fixed-income investor community to allocate additional capital towards sustainable assets to support their respective ESG investment commitments. Back in 2018, IFC and Amundi worked together to close the world’s largest green bond fund, the Amundi Planet Emerging Green One, aiming to deploy around US$2 billion into emerging market green bonds.

Other influential fixed-income investors such as BlackRock early last year signed up to the Climate Action 100+ initiative, in essence pledging that sustainability metrics would be a new standard applied to their investments. Japan’s Government Pension Investment Fund (GPIF) likewise has renewed its commitment to support ESG investing, launching a mechanism several months ago to ensure that indices align with its sustainable mission.

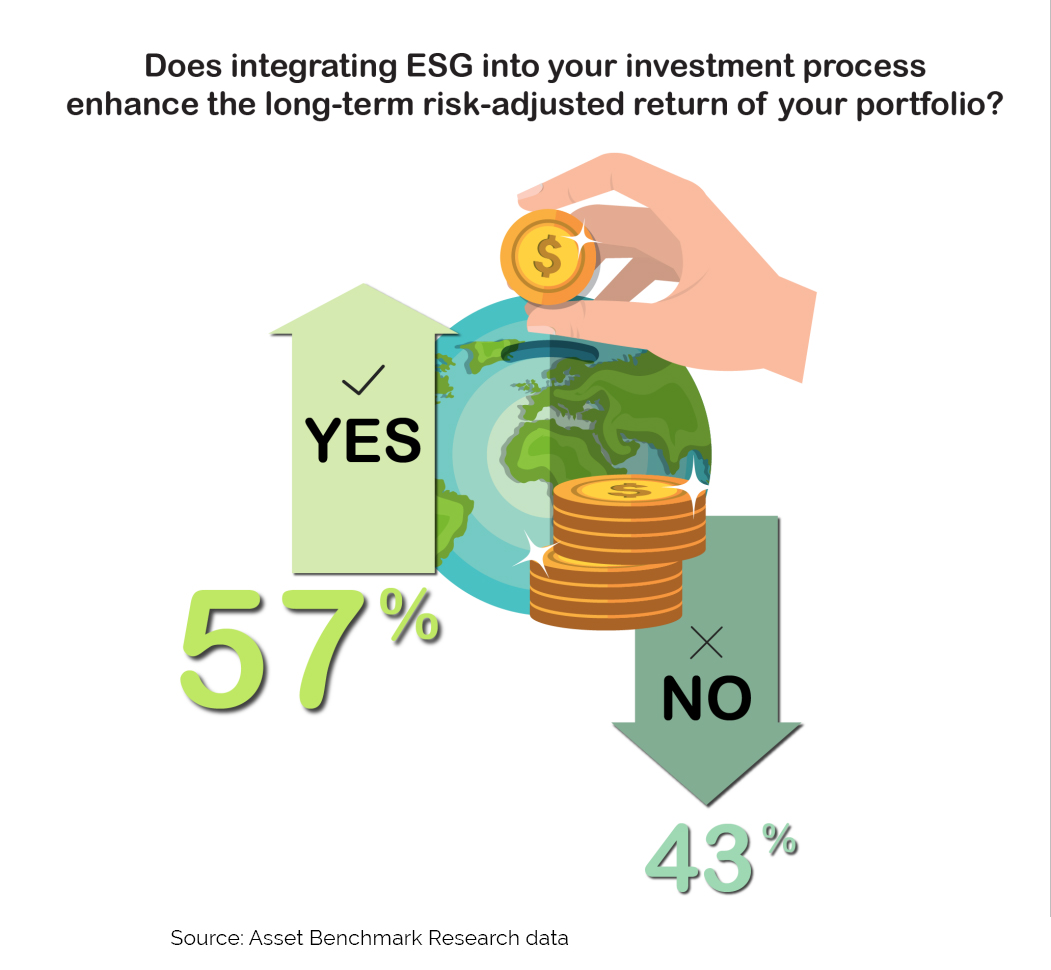

According to data from Asset Benchmark Research, the majority (57%) of Asia-based fixed-income investors believe that integrating ESG into the investment process enhances the long-term risk-adjusted returns of their portfolios.

Yet, the question still remains for companies – is there any financial benefit in issuing a sustainability bond?

The answer, at least for the time being, is a slight yes. Several bond bookrunners have shared that there has been some advantage when it comes to executing G3 bond deals, particularly by expanding their current investor base to ESG-focused investors, who typically wouldn’t invest in standard bonds. Due to a wider set of investors participating in a given sustainability bond, the orderbook for these bonds tends to be oversubscribed because of the scarcity of such issuances in the market.

Other bookrunners have shared that due to chunky orders from investors, they have experienced less pricing sensitivity at the final pricing stage of the bond, resulting in around 10-15bp reduction in borrowing costs for the issuer. Dubbed by some banks as a “greenium” or the extra spread that investors would be willing to pay for sustainability bonds, it is something that companies active in the bond market need to consider for their fund-raising strategies. Finally, bankers that have worked on sustainability bonds have also seen spreads tightening during the secondary trading of the bond.

This same issuer advantage is yet to be determined in local currency bonds, whether it be in Thailand or the Philippines, signifying that the awareness and appetite for ESG-focused fixed-income assets is yet to be realized on the local investor stage.

High-yield issuers

In Asia, the adoption of sustainable financing has grown by leaps and bounds over the past several years, with the issuer base expanding from financial institutions like banks to more recently high-yield issuers such as Chinese property companies. In January 2021 alone, the likes of Yuzhou Group, Zhenro Properties and Modern Land have all tapped the market with green bond issuances.

While hurdles remain for the sustainable bond industry, it is growing increasingly clear that both issuers and investors stand to gain from developing such a market going forward. Already there have been several efforts to address some issues such as ESG standards, to help guide future green bond issuers. The International Capital Market Association (ICMA), through its green bond and social bond principles, has provided a useful guide for the ESG financing ecosystem. Just recently the ICMA provided guidance to issuers looking to explore transition financing as a way to pivot towards sustainability.

Governments themselves have also sought ways to encourage sustainable bond development, either by issuing the bond themselves, as was the case for Hong Kong recently, or by providing grant schemes to offset the cost of third-party opinions on sustainable bonds. Places like Singapore and Hong Kong have established green bond grants over the past two years. More recently, the Securities Commission of Malaysia announced plans to expand its green SRI sukuk grant scheme to support the development of both Islamic and conventional green bonds in the country.

Going into 2021, the sustainable bond market looks bright with a growing acceptance of the asset class by investors and issuers looking for financial incentives. French-based bank Crédit Agricole CIB predicts that the sustainable bond market will increase volumes by 55% from 2020.

S&P Global Ratings forecasts that global issuance in sustainable debt will surpass US$700 billion in 2021 from US$500 billion in 2020. As issuers look to ensure liquidity in the post-Covid world, embracing sustainability through fundraising may not be such a daunting task after all.