As Chinese investors become more sophisticated, exchange-traded funds (ETFs) are gaining more popularity in the country. And with the China ETF market size hitting a ten-year high, ETF providers are keen to know more about the investment habits of local investors.

Despite last year’s market volatility, investor interest in ETFs appears to have increased. According to the annual ETF Investor Survey issued by Brown Brothers Harriman (BBH) recently, 72% of global ETF investors plan to increase their ETF allocations in the next 12 months, which translates into a 3% increase from the previous survey.

Against this backdrop, Chinese investors are showing a growing interest in ETF products. According to the survey, 76% of the respondents expect to increase the use of ETFs, up from last year’s 72%, with continuing focus on historical performance, trading volume and spreads when choosing ETF products.

According to the latest data from the Shenzhen Stock Exchange, there are 366 ETFs listed in China, with combined assets under management (AUM) of 1.1 trillion yuan (US$168 billion), a ten-year high.

Product-wise, Chinese investors favour active ETFs, with 71% planning to increase their exposure in the upcoming 12 months, according to the survey.

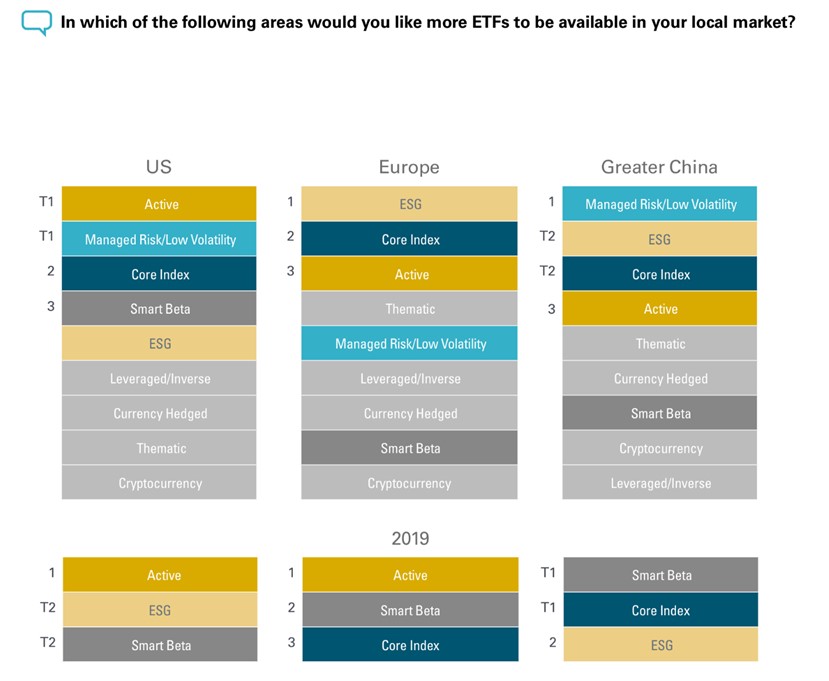

Another interesting finding from the survey is the growing interest in cryptocurrency ETFs. This is not restricted to the Chinese market, but more of a global trend. In the United States, Europe and Greater China, respondents ranked this product as one of the top three ETF strategies they want to see more of in 2020.

Source: 2020 Global ETF Investors Survey by BBH

This is significant compared to last year’s survey results, in which cryptocurrency was ranked among the least interesting ones.

Another type of product favoured by Chinese investors is thematic ETF. The survey finds that 84% of Chinese investors are considering increasing their exposure to these products. Among the most popular themes are internet and technology, robotics and artificial intelligence, environment and sustainability, healthcare, digital assets, autonomous driving, and electric vehicles.

Source: 2020 Global ETF Investors Survey by BBH

Going forward, Chinese investors are expected to increase their allocation to equities, and ETF will be one of the efficient tools, according to Chinese fund managers. The tech sector is deemed a key driver for Chinese economy in the long run. Therefore, the current correction in Chinese equities, particularly in the tech sector, can be an opportunity for ETF investors.