Investors in environmental, social and governance (ESG) compliant assets should expect risks involving extreme volatility, expensive valuations, and sudden changes in policies or regulations that can impact the short- to medium-term performance of sustainability funds.

This warning was issued by Martin Bloemen and Craig Cameron, lead portfolio manager and portfolio manager, respectively, for the Templeton Global Climate Change Fund, a US$1 billion strategy that invests in a balanced and diversified portfolio of sustainable assets launched in 1991.

Even before the pandemic, the record-breaking volume of violent storms, floods, droughts, forest fires and melting sea ice, has resulted in considerable uncertainties impacting climate change and renewable energy investing.

“I’m going to stand with the position that it may be very volatile going forward as we see in areas like the renewables (renewable energy). But the underlying theme towards this area of climate change is really that it is a long-term proposition. For investors to be part of this and make money they have to be ready to invest in a sector where the risks are clearly highlighted in the volatility in some of these sectors like the renewables. We are really in that space, that we are diversifying our size position as well,” says Bloemen.

In addition to market volatility, another risk facing investors is finding ESG-compliant companies with valuations that are cheap enough to be of value to the portfolio. In particular, equity securities of companies which seek opportunities presented by climate change and resource depletion have historically been subject to significant price movements that may occur suddenly due to market or company-specific factors.

As a result, the performance of such ESG-focused portfolios can fluctuate significantly over relatively short time periods. Foreign currency, derivatives instrument, and emerging market risks may also be significant.

Another risk for ESG investors is that sustainability-focused companies may be subject to changes in government policy arising from political developments in specific markets.

“Policy reversal is really the big risk. In the US, just before the Biden administration took over, you saw wind deals being held up waiting for him to come into power because there was a feeling that the Trump administration wouldn’t support renewable energy deals. That quickly changed and I think you’re going to see better opportunities for companies to build out renewable energy in the US as a result. But that could change again,” says Cameron, who is also head of renewable energy research at Franklin Templeton.

“What happened in Texas recently with the cold weather, you see a bill being put forth by the Republican Congress to effectively penalize renewable energy companies because they had shortage of power,” he says. “And that is not based on facts or science but based on a political perspective. And that can certainly happen in other parts of the world. Even in mainland China you’re seeing talk of some local or regional governments being less supportive of efforts to decarbonize. And there are just transition concerns around that. Is it right to reduce the economic growth in some of the world so that the more advanced parts of the world can have lower GHG (greenhouse gases) and limit global warming?”

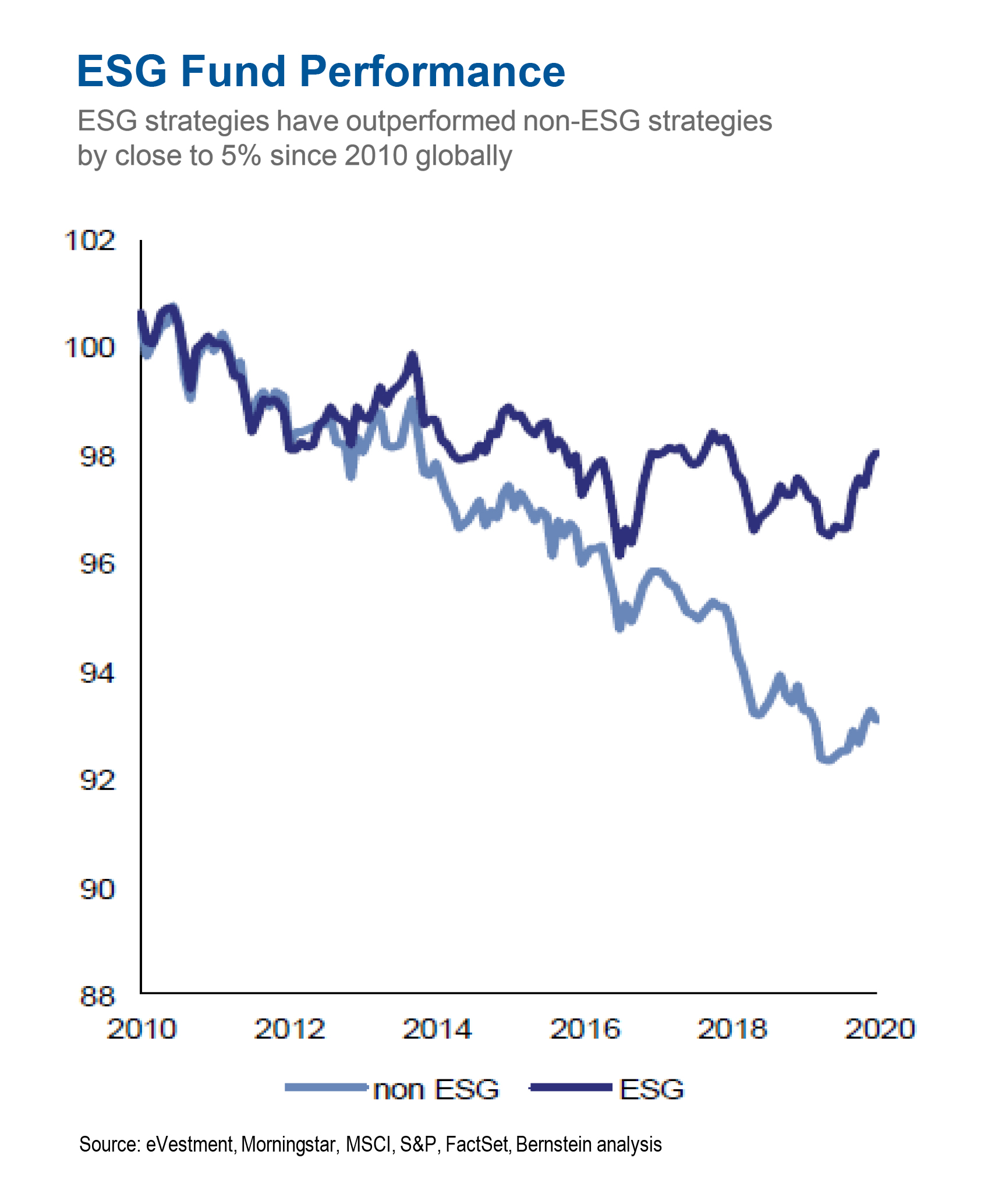

In 2020, ESG strategies have continued to outperform non-ESG strategies by close to 5% globally, a trend that has been sustained since 2010. Strong growth in sustainable investments has also continued from 2016 to 2020 with a 447% growth to US$50.8 billion in Asia, 179% growth to US$1,360.3 billion in Europe, and 193% growth to US$235.7 billion in North America.

This growth in sustainable assets has continued despite little progress in reducing GHG emissions in line with the Paris Agreement.

“I just can’t get over how we haven’t been able to get very far even on a global basis, even on signing issues, because GHG levels have remained steady or even going higher than they were five years ago. You’re going to have market sell-offs, these things are not immune to them. But the renewable energy theme continues and that is where you may have protection going forward because investors realize that this theme is not going away,” Bloemen says.