As China rebounds from the coronavirus pandemic and policymakers push ahead with capital market reforms, one thing remains clear: the world’s second largest economy is more determined than ever to make progress in the area of sustainable investment.

In September, President Xi Jinping announced China’s ambitious plan to achieve carbon neutrality by 2060 at the General Debate of the 75th Session of The United Nations General Assembly. A significant part of the effort required to achieve this will be in enforcing rigorous environmental, social, and governance (ESG) standards for China’s corporations, given the rapidly ballooning global demand for sustainable assets. To implement it and achieve a high quality of ESG data disclosure will require joint efforts from corporates, regulators, financial service providers, and all other relevant industry players in both domestic and international markets.

Investment flows tell the story

The momentum behind investor interest in ESG and sustainable assets shows no sign of abating in 2021. The total AUM of ESG-related mutual funds in the domestic Chinese market has reached a record high of US$31.6 billion at the end of 2020. These capital flows signify a heightened awareness among both domestic and international investors that companies should commit themselves to building a sustainable economy, rather than solely focus on their own short-term profits.

Divergence in ESG approaches

The differences between China’s ESG disclosure practices and the ESG frameworks embraced by Europe and North America need to be acknowledged. After all, China has grown exponentially into the world’s second largest economy in the past 40 years. Managing such rapid growth is a delicate balancing act. For that reason, China’s policymakers approach ESG in a way that best suits the country’s unique development trajectory and its social and environmental circumstances. Nevertheless, formulating a standardized approach to sustainability reporting and metrics is a key objective for a number of global policy and standard setters, and one that will be closely followed as Chinese regulators weigh the implementation of ESG disclosure standards.

For example, in terms of ranking ESG factors, the environment has been a clear focus for China’s policymakers – an emphasis that mirrors the government’s determination to improve environmental protections. China’s 40-year economic transformation has not been without environmental impact and the government has placed significant emphasis on developing new environmental protections relative to agriculture, land degradation, and public health. A focus on environmental protection has also been a feature of China’s most recent five-year plan. In the wake of last October’s carbon neutrality commitment, the government has also started to focus on climate change, aligning the environmental agenda more closely with global interests.

On the flipside, international investors often emphasize the importance of strong governance practices within ESG, requiring companies to regularly disclose how potential conflicting interests are handled internally. But despite these differences between the West and China, there is significant convergence in regard to the sustainable development goals (SDG) included in the UN’s 2030 Agenda. These goals include poverty reduction, reducing inequality, and responsible consumption and growth – all initiatives China’s government has vocally supported.

New ESG guidelines

Due in part to the havoc unleashed by the coronavirus in 2020, the mandating of "compulsory" ESG reporting in China has temporarily stalled. Even so, as of September 2020, a pilot scheme is in place in 13 cities and further rollout is anticipated in due course as stability returns.

China is also issuing new policies that aim to further promote the growth of China’s green economy. The central government, regulators, investors – and even local district offices – are all actively involved. Shenzhen’s regulators have passed a law that requires local financial institutions to disclose information related to their environmental impact, effective from March 1 2021. This is the first green finance legislation in China.

Improving disclosure

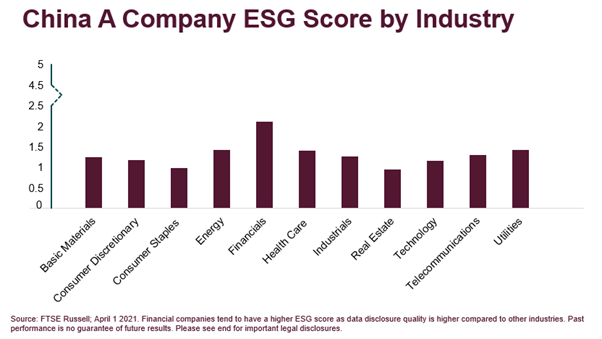

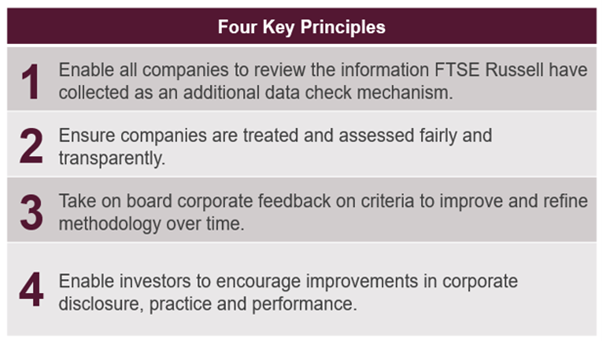

Looking ahead into the next few years, FTSE Russell expects ESG reporting to become more compulsory for an increasing number of Chinese companies – and for the quality of ESG data to improve as well. FTSE Russell has built a robust engagement programme to communicate with corporates and help them better understand their ESG ratings and improve the quality of their disclosures. We welcome corporates to provide feedback and information related to their ESG practices as we continue to work across markets to drive improvements in sustainability standards and disclosures.

China’s impact on ESG standards and on sustainable investment trends is too big to ignore. Driving the adoption of ESG standards globally requires consensus and understanding across global market participants to achieve a more sustainable future. Given the significance of Chinese businesses in the global economy and fight against climate change, an increase in reporting disclosure and reporting standards allied with improved ESG practices stands to benefit a range of global stakeholders.

Ying Bai is ESG lead for Greater China at FTSE Russell.