China’s decarbonization initiatives are expected to create investment opportunities in the commodities sector, both in based metals used for renewable energy development, and in coal and other fossil fuels that will eventually be phased out in the transition to a carbon-neutral economy.

This win-win investment scenario for Chinese commodities in the transition to a carbon-neutral economy was described by Stephen Chang, portfolio manager, Asia, and Carol Liao, China economist, both of PIMCO, in a study published on July 27 2021.

But despite the win-win investment scenario, commodities investors still face the challenging task of identifying specific opportunities as China rebalances its economy, tightens industrial pollution standards, improves energy efficiency and increases renewable energy capacity.

“Demand for certain base metals used in the installation and manufacturing of renewable energy will likely be supported by China’s decarbonization goal,” Chang and Liao say. “Base metals, such as aluminium, widely used in renewable energy installation, electrical power grids, electricity storage and the manufacturing of hybrid and electric vehicles, will be needed in the medium term.”

In the near term, demand for coal, steel and other fossil fuel commodities will create investment opportunities as they continue to be supported by the Chinese government’s development efforts and the accompanying increase in traditional energy consumption. But, in the long term, China’s demand for fossil fuel commodities should diminish as the country switches to clean energy.

“This will be negative for owners of coal and oil assets, with risks relating to the viability of what would typically be considered long-term assets,” Chang and Liao point out. “More broadly, sectors related to renewable power generation and the transmission and distribution of electricity could benefit from government support and the rebalancing of the economy, providing attractive opportunities for investors.”

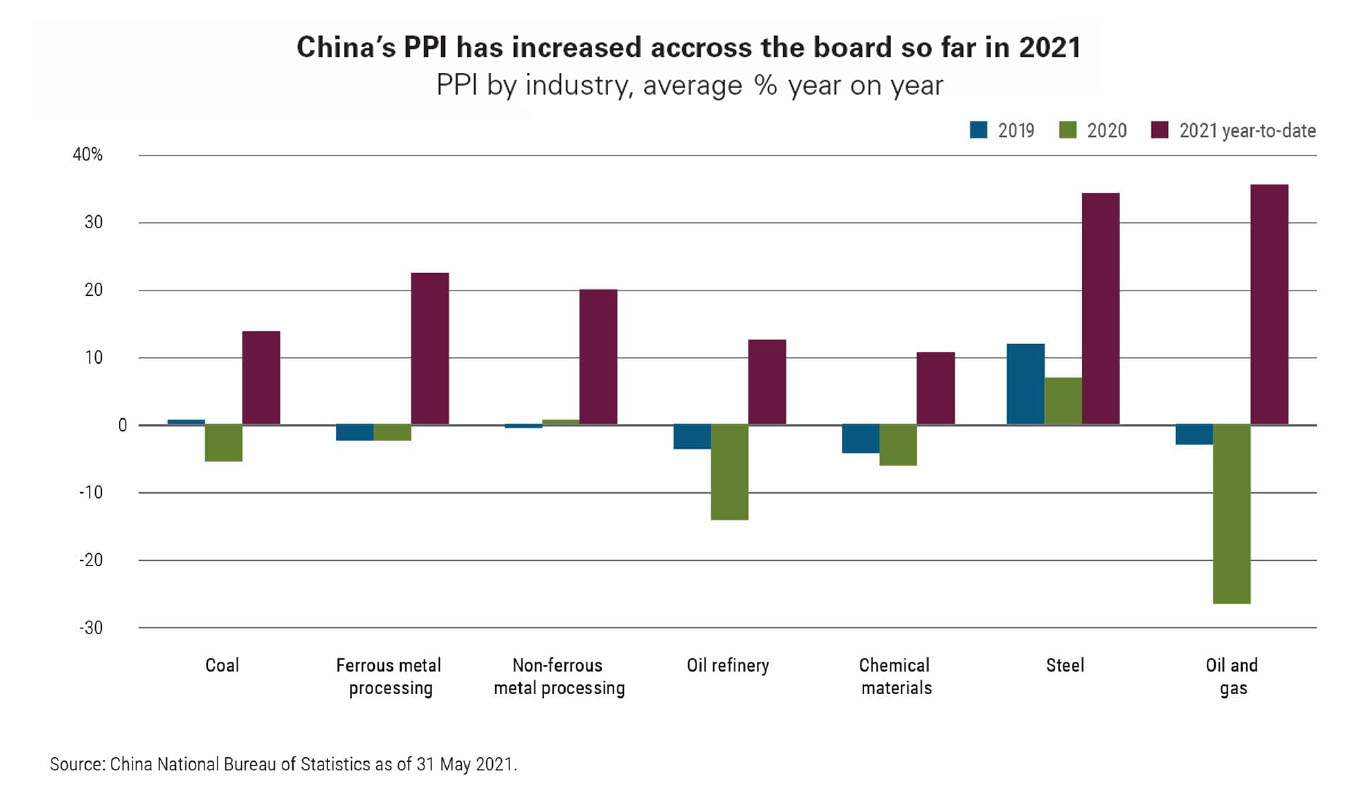

Production controls have exacerbated a supply-demand imbalance aggravated by rebounding demand in developed markets, a delayed recovery in supply in many emerging markets, and logistical bottlenecks (although these pressures will ease by year-end), according to Chang and Liao. As a result, prices of major commodities surged in the first half of 2021, and China’s domestic producer price index (PPI) jumped 9% year-on-year in May.

“While the Chinese government has expressed concern about the commodity price surge, we do not expect any significant tightening of monetary and foreign exchange policies," Chang and Liao note. “Indeed, the government just cut the reserve requirement ratio for banks to avoid over-tightening risks and ensure adequate support for the recovery. And the government has taken measures to reign in speculative commodity trading and fine-tune the pace of carbon-related production curbs on steel, aluminium and coal.”

Although China has established ambitious goals to achieve peak carbon emissions by 2030 and carbon neutrality by 2060, Chang and Liao feel this may be difficult because energy-intensive and highly polluting manufacturing has driven the country’s rapid growth since Beijing joined the World Trade Organization in December 2001. The country, in general, relies heavily on coal, which is more carbon intensive than most of its other energy sources.

China is currently the world’s largest carbon emitter, contributing nearly 30% of the global total in 2019. Although its per capita carbon-dioxide emissions are only half those of the US, China’s intent to double GDP by 2035 and further increase urbanization only add to its emissions reduction challenge. The country will need to aggressively lower its carbon intensity, measured as emissions per unit of GDP, to meet its 2030 peak emissions target.