Singapore’s National Environment Agency (NEA) has launched a S$3 billion (US$2.2 billion) multicurrency medium-term note (MTN) programme and green bond framework. Proceeds from the issuance of notes under the MTN programme will be used to finance sustainable infrastructure development projects, including the Tuas Nexus Integrated Waste Management Facility (IWMF), NEA’s flagship waste management project.

According to NEA, the issuance of green bonds will help develop green finance solutions and markets to support the country’s ambition to become a leading centre for green finance in Asia and around the world.

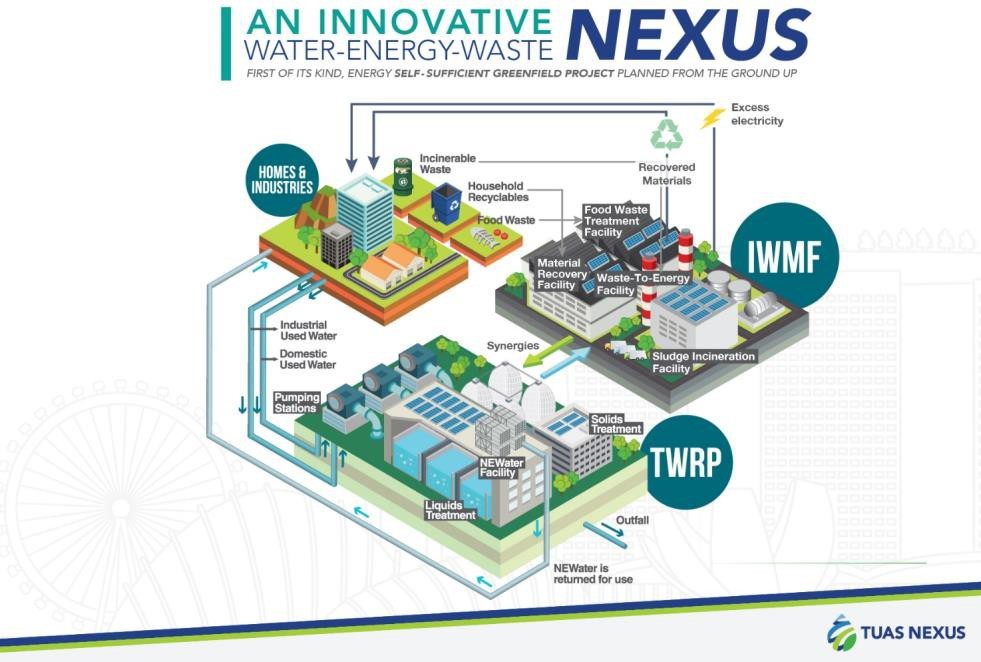

Tuas Nexus IWMF will be the country’s first integrated facility to treat incinerable waste, source-segregated food waste, and dewatered sludge. It will also have the capability to sort household recyclables collected under the national recycling programme. The facility will be co-located with the Public Utility Board’s Tuas Water Reclamation Plant (Tuas WRP) to form Tuas Nexus, Singapore’s first integrated solid waste and used water treatment facility that will meet the country’s long-term solid waste management and used water treatment needs.

Luke Goh, NEA’s chief executive officer, says: “The establishment of NEA’s green bond framework to finance Tuas Nexus IWMF and other environmentally sustainable projects, marks another milestone in our stewardship journey. Tuas Nexus IWMF will be the region’s most advanced, efficient and integrated solid waste treatment facility that treats separate waste streams with greater energy efficiency and reduces Singapore waste resource management’s overall carbon footprint.”

V.E, part of Moody's ESG Solutions, has provided a second-party opinion on NEA’s green bond framework. DBS Bank is the sole arranger for NEA’s MTN programme and green structuring adviser for NEA’s green bond framework.