Risk management and regulatory requirements are the principal reasons why asset owners are implementing sustainability or considering making it part of their investment strategy.

Globally, risk management is the primary consideration, although in the Asia-Pacific region regulation is also highly important for asset owners when implementing or considering sustainable investing, according to a study by FTSE Russell.

The study, conducted in April 2021 and published on October 7, surveyed the opinions of investment professionals at 179 global asset owners, with 40% hailing from North America, 36% from Europe, the Middle East and Africa (EMEA) and 19% from Asia-Pacific. Among respondents from Asia-Pacific, 32% were located in Australia or New Zealand, with the remaining 68% spread across the rest of the region. Pension funds and plan sponsors accounted for 42% of respondents, insurance companies made up 18%, government organizations represented 12%, and endowments and foundations, 10%.

Nearly half, 46%, of the participating asset owners had assets under management (AUM) totalling US$10 billion or more. Those with AUM of between US$1 billion and US$10 billion accounted for 30%, and those with under US$1 billion made up the remaining 24%.

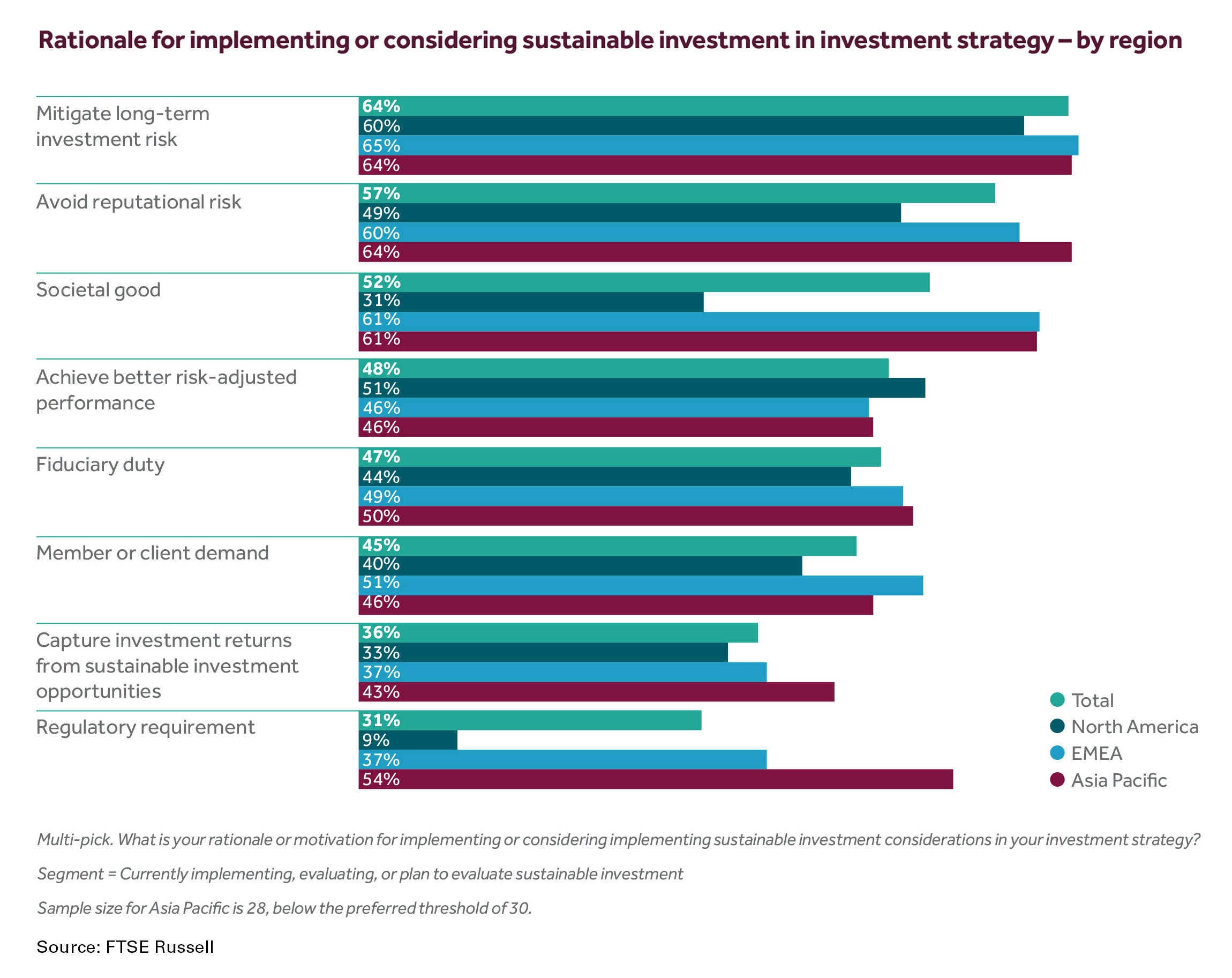

When asked about their reasons for implementing or considering sustainable investing as part of their investment strategy, 54% of Asia-Pacific asset owners cited regulatory requirements, much higher than those from EMEA, 37%, and North America, 9%.

However, in the case of those owners citing long-term investment risks as the main reason for implementing or considering sustainable investing, the regional gaps closed sharply, with about 64% of those in Asia-Pacific doing so, 65% in EMEA and 60% in North America.

In terms of those owners citing reputational risk as their reason, the regional gaps were a bit wider when compared with those citing long-term investment risk, but not as wide those citing regulatory requirements. About 64% of Asia-Pacific asset owners cited reputational risk as did 60% of those from EMEA and 49% from North America.

Achieving better risk-adjusted performance was also a key consideration for adopting sustainable investing, with 46% of Asia-Pacific, 46% of EMEA and 51% of North American asset owners citing this consideration.

Before the Covid-19 pandemic, business leaders and governments around the world had started to address the climate crisis. Despite the possibility that the pandemic would interrupt the momentum of the global climate action campaign, over two-thirds, 67%, of asset owners that took part in the study said that climate/carbon issues were their leading sustainability priority focus areas.

However, a closer look at the regional data indicates differing opinions, with 77% of EMEA and 68% of Asia-Pacific asset owners focusing on climate/carbon issues, while in North America the focus was more on social themes, 62%, followed by governance, 58%, and climate/carbon issues, 56%.

Although 60% of asset owners surveyed said that social themes, including diversity and inclusion, human rights, customer responsibility and social impact, were a sustainability priority focus, 40% of respondents disagreed.

“Our research investigated why this group of asset owners do not consider social themes to be a current priority focus for their institutions,” says Sylvain Chateau, global head of SI product management, LSEG. “Over half (53%) say that they would prioritize social themes if social data were reliable and widely available. As the quality and availability of social data improves, we expect that asset owners will increasingly view social as an area of priority focus.”

“[Overall,] among the key drivers and motivations fuelling sustainable investment are risk management considerations, which the survey shows playing out with varying emphasis in different regions,” Chateau adds. “Although asset owners are moving toward a greater level of adoption, their methods and approaches differ, reflecting their size, investment strategy and geography.”