THE Covid-19 pandemic has sent shockwaves throughout the global economy, and many economies have found themselves plunged suddenly into recession. The effects on employment, exports, and consumer spending have been sharp and immediate. Somewhat less clear, however, is how severely the economic shock has affected corporate credit risk, and how much worse it could get.

There are many ways to measure credit risk: agency credit ratings, credit spreads from the bond or CDS markets, fundamental financial ratios. However, here corporate probabilities of default (PDs) are used. As forward-looking (one year ahead), point-in-time measures of credit risk, PDs capture changes in the credit risk of public companies in as close to real time as possible, and are thus an ideal metric for taking the temperature of corporate credit risk.

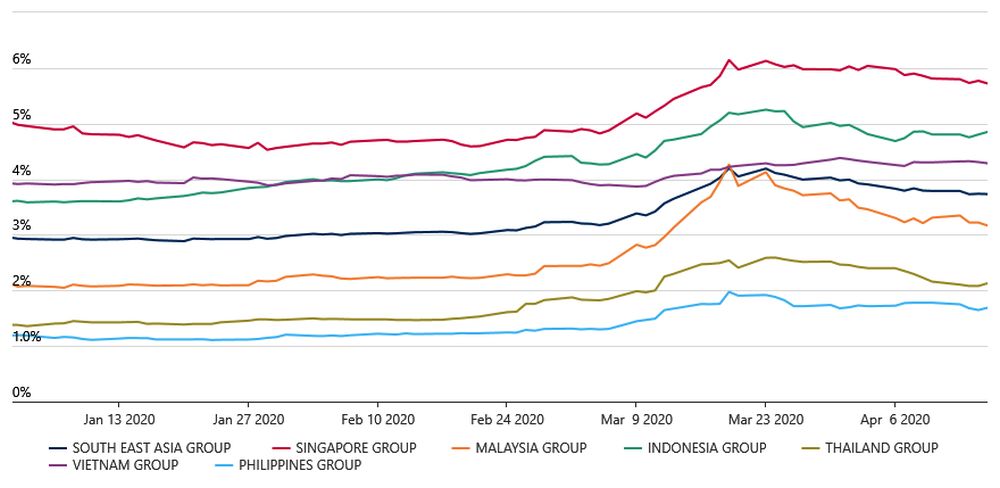

Figure 1: Average corporate default probabilities have moved higher across SE Asia

Figure 1 shows the impact on corporate credit risk for seven economies in Southeast Asia. The graph, covering 2020 so far, shows that average probability of defaults for companies in Southeast Asia have jumped since the Covid-19 outbreak. Each economy had its own story at the start of 2020, with different starting average PDs, but across the region the pandemic shock has caused credit risk to surge. In many cases – such as in Malaysia, Thailand, and the Philippines – the average country-level corporate PDs have doubled since January. In other cases, such as Singapore, the average PD started at an already elevated level, and has increased by about 20% since the start of the year.

As central banks and governments have flooded markets with stimulus and liquidity, average corporate PDs in Southeast Asia have come off their March peaks. However, they remain significantly elevated. Investors remain concerned that the full impact of the pandemic on credit risk is yet to be realized. So far, there has not been a surge in corporate defaults, or the default of a large, economically important firm. But as the economic damage begins to be revealed in corporate earnings, and companies grapple to sustain their businesses not knowing how long the economic slump will last, there remains a material risk.

In such an uncertain environment, considering the potential effect of different economic scenarios becomes critical. The forward-looking corporate default probabilities can be conditioned not just on firm-specific information, but also on projections of macroeconomic factors like GDP, exports, consumer spending, the unemployment rate, etc. The projected effect on average corporate PDs under a severely adverse economic scenario is shown in Figure 2. The average projected corporate PDs are based on the Moody’s Analytics S4 economic scenario, which is the most severe projected alternative scenario (but also the least likely to occur).

Figure 2: Projected average corporate PDs under a severely adverse economic scenario

.jpg)

Under the assumptions of the severe downturn scenario, average PD measures for the companies in all of these economies in Southeast Asia would surpass the highs reached during the global financial crisis (GFC). The average corporate PD for Singapore, for example, reaches almost 12% in the severe scenario. It reached 9% during the GFC. The projections also show that peaks in average credit risk for companies in Southeast Asia would not occur until Q3 or Q4 of this year.

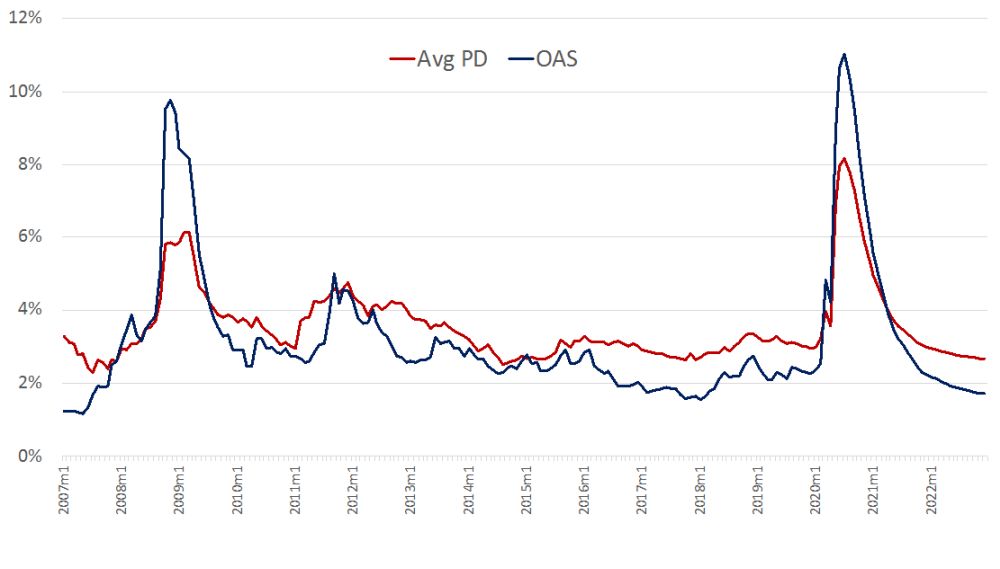

Figure 3 shows the potential impact that a sharp rise in the average corporate PD for the Southeast Asia region would have on the pricing of credit risk. The figure plots the average corporate PD against the Option-Adjusted Spread (OAS) for the BofA-Merrill Lynch Asia Emerging Markets Corporate Plus Index back to 2007, as well as projections through 2022 for both series under the severely adverse economic scenario. It must be emphasized that these are not the expected outcomes at this time, but are in the range of possibility should the public health crisis endure long enough to inflict deeper and more protracted economic damage.

Figure 3: Projected average SE Asia corporate PDs and credit spreads under a severely adverse economic scenario

Covid-19 will continue to pose economic challenges for economies in Southeast Asia for the foreseeable future and, as a consequence, its effect on corporate credit risk may linger on well into 2021 and beyond. So far, the economic shock has not caused a financial shock that would cause corporate PDs to jump to the levels seen during the GFC. Central banks and governments have provided unprecedented stimulus to try to ensure that that does not happen.

However, as the duration of the public health crisis is still uncertain, the depth and duration of the economic downturn is also uncertain. As the simulations showed, default risk could, under a very severe economic scenario, surpass the average PDs seen just over a decade ago, and as a result drive up credit spreads. The likelihood of such a scenario is still far from certain, however, the temperature of the credit risk climate can change rapidly.

David Hamilton is managing director of credit risk analytics, Asia-Pacific at Moody’s Analytics.