The Covid-19 pandemic is accelerating the adoption of technology as work-from-home becomes the new normal. In the first six months of 2020, the pandemic has changed plenty. What it has not disrupted as much is the normal operations of securities markets across the globe, reinforcing the value of a robust financial infrastructure and its connectivity, which underpin the world’s investment management industry.

Indeed, even before the pandemic and its resulting health emergency, the adoption of technology and digitalization was underway due to a need for asset managers and service providers to differentiate and become more competitive. Equally important was the increasing use of new technology, including artificial intelligence, robotics, and other automated processing software, to manage regulatory, operational and investment risks. Technology is also now prevalent in reimagining engagement and enhancing client experience.

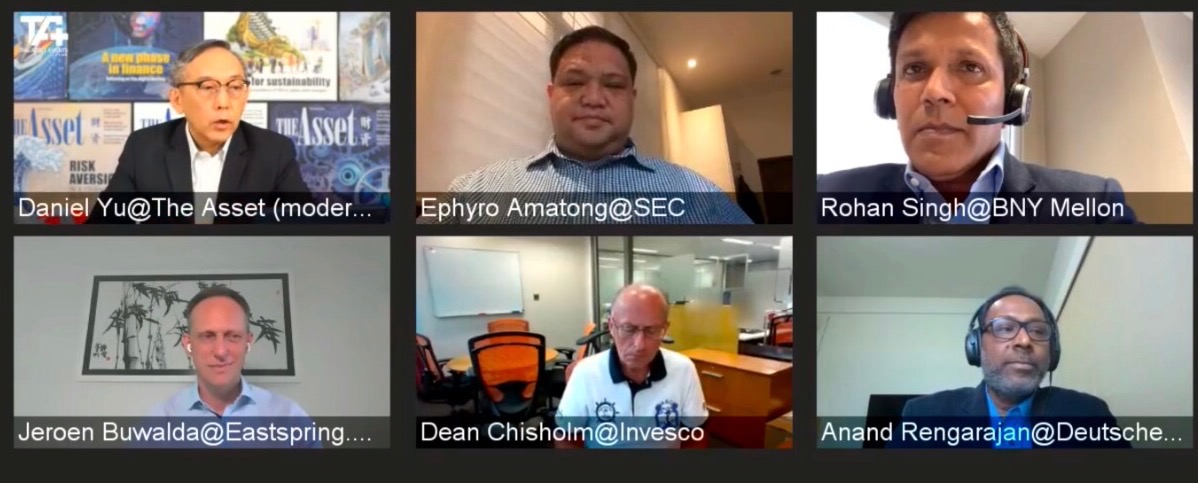

In an in-depth webinar on June 24 hosted by The Asset Events+, in association with Deutsche Bank, on the topic of “Accelerating Technology-Led Transformation”, speakers, including a regulator, asset managers, and asset servicing providers, shared their experiences of dealing with the pandemic and their insights on technology-led initiatives underway or being planned in the coming years. The webinar was attended by participants from 25 countries in Asia, North America, Europe and the Middle East.

Among the webinar's speakers sharing their views was Ephyro Amatong, commissioner, Securities and Exchange Commission Philippines. “You have these high-level goals of reaching more people efficiently through mobile apps, and then you realize that your rules are based around paper,” Amatong notes. “Those are some of the challenges that we are trying to deal with. How do you go beyond the paper mechanisms that we are so familiar with and have taken for granted?”

Another speaker, Anand Rengarajan, managing director, head of securities services, Asia-Pacific, Deutsche Bank, says: “We try to find solutions that are easy to deploy across all client types from large to small asset managers. From a regulatory standpoint, the one good thing that has happened from a post-Covid-19 perspective is that everybody has become much more open towards technology.”

Jeroen Buwalda, chief operating officer, Eastspring Investments, the Asian asset management business of Prudential, adds during the debate: “You’d be surprised how many institutions have not adopted digital solutions that have been available for a long period of time already. We have to use the situation right now to avoid procrastination and push for efficient digital solutions.”

Dean Chisholm, regional head of operations, Asia-Pacific, Invesco, observes: “We are talking to service providers about how working and collaboration tools help us manage queries and make sure the right people are included in a specific conversation.”

Another speaker, Rohan Singh, managing director, head of asset servicing, Asia-Pacific, BNY Mellon, says: “Now one of the things we will see after Covid-19 is the questioning of resilience, with clients now asking how reliable are my service providers. We need to automate on a much vaster scale and at a much faster pace than what we were doing before.”

While adoption of technology is likely to be the norm, accelerating the technology-led transformation looks more like an evolution rather than a revolution for most large firms. But it is a race against time to remain relevant, especially as investing goes digital, new opportunities emerge, and financial infrastructures adopt leading-edge automation to improve market latency.

For more insights and information on The Asset Events+ webinars, please click here.

For more information about the virtual event hosted by The Asset Events+ please go here.