With the increasing popularity of smart beta strategies due to the inherent transparency of the process, some investors are concerned that increased infows into the space will lead to a crowding risk and ultimately lower returns.

As a subset of factor investing, smart beta, unlike many traditional investment strategies, is more transparent with regard to the investment process, and this has been attracting investors, especially institutional ones.

The reason, according to Felix Goltz, research director at smart beta index provider Scientific Beta, is that they allow investors to know exactly what return drivers the strategies are trying to capture.

Goltz has examined the thinking behind investors’ concerns. “The downside of this feature [according to them] is what will happen when everyone knows about the factors, such as value, size, momentum, etc., that have been well-documented for a very long time? Would these strategies still work even though everyone knows about the factors?"

However, Goltz notes, Scientific Beta has examined the smart beta indices and found that there is no specific evidence to support the theory that more investors pursuing smart beta strategies lower long-term returns.

Another related theory centres around buying pressure, a trading effect specific to the transparent implementation of smart beta strategies. As factor investing earns premiums by taking exposure to factors, the thinking is that once the investors know about the documented premiums of certain factors, they will crowd into them and again lead to a drop in the post-publication returns.

“For example, using a popular value index to get you exposure to the value premia could be a bad idea," Goltz says, explaining the logic of this theory. "Because in the popular value indices, rebalancing is mechanical and completely transparent. So maybe you will suffer some losses because it is traded along with everyone else in this popular value index."

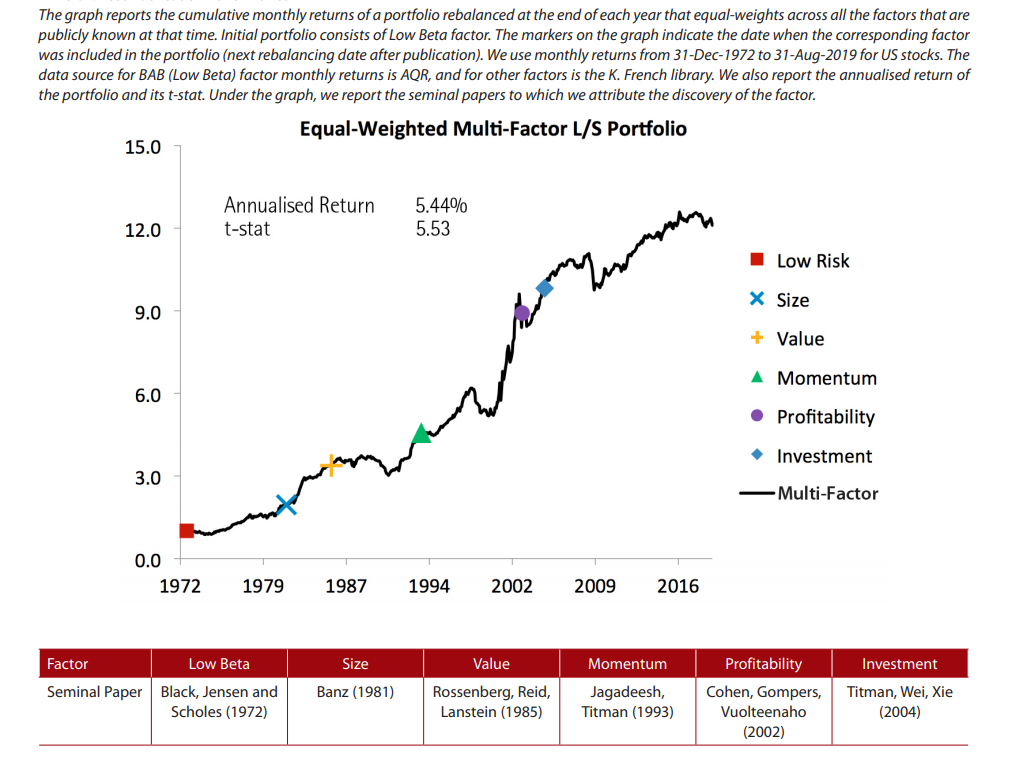

Yet Goltz again maintains that there is no specific data that can verify this index rebalancing effect or post-publication returns. Scientific Beta picked the six most consensus factors, namely risk, size, value, momentum, profitability, and investment, and constructed a multi-factor portfolio.

The portfolio allocated equal weights each year only to factors (long-short portfolios) that had been mentioned in published studies at that time. Examining the post-publication returns, Scientific Beta found that the benefits still existed even when everybody knew about the factors.

Source: Scientific Beta

Thus, the crowding risk theory, Goltz concludes, is not based on data or substantial evidence, and, in fact, it is not beneficial to investors as it argues that there is probably something wrong with too much transparency.

“I would argue it’s the opposite,” he states. “We should have more transparency because if index providers are completely transparent and provide a lot of analytics on how the indices behave, then we would rely less on theories and hypotheses.”