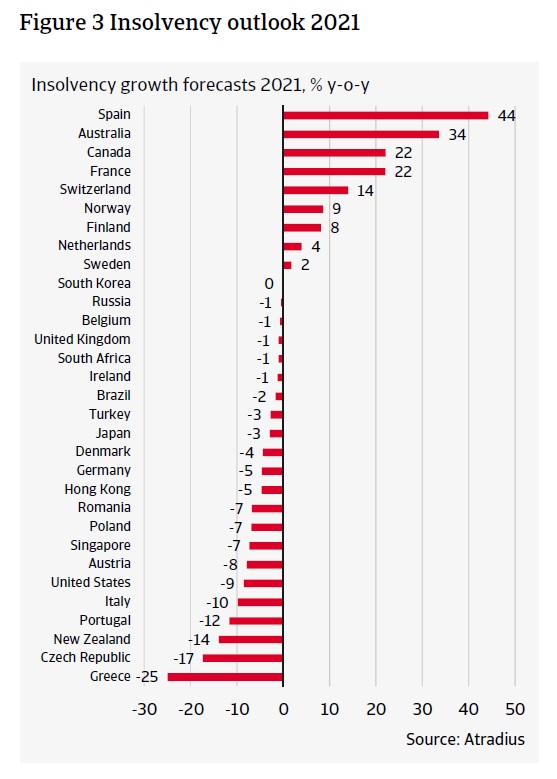

THE result of lockdowns, social distancing and negative consumer sentiment is playing out in the global economic arena as a number of major economies recorded double-digit drops in their quarterly GDP numbers. From South Korea to the United Kingdom, insolvencies are on the rise and are expected to globally increase by 26% in 2020. That’s according to data compiled by trade credit insurer Atradius which cites markets such as Hong Kong, Turkey and the United States as areas where insolvencies will be particularly high this year.

Fellow trade credit insurer Coface also predicts tough times ahead for companies, recently stating that corporate insolvencies were set to increase by one third worldwide between now and 2021 compared to 2019.

Predicted to be one of the few economies to grow in 2020, China is expected to see increased delayed payments in 2020. Already Chinese companies were experiencing a deterioration in payments before the pandemic. Around 37% of companies surveyed by Coface stated that they were experiencing payment delays longer than 120 days in 2019 compared to 31% recorded in 2018.

"The pandemic has put downward pressure on Asia's export-driven economies as global supply chains come under pressure and demand wanes. However, as one of the first regions to reopen, Asia is well-positioned to benefit from the rebound in economic activity, which will lead to falling rates of insolvency in 2021,” says Bart Poublon, head of risk at Atradius APAC.

In addition to being one of the first regions to feel the wrath of Covid-19, Asia has also seen several countries rally together to craft stimulus packages to curb insolvency growth. Japan, for instance, in May approved a US$1.1 trillion stimulus package or around 21.1% share of the country’s GDP. Around the same time, Mainland China confirmed a 4-trillion-yuan (US$559 billion) stimulus package to support factories and merchants in the country.

While much is needed in the short-term, these packages will evidently lead to higher debt burdens in years to come. According to Moody’s Investor Service (Moody’s) this is something emerging markets will need to keep an eye on with policy effectiveness being key.

“We expect government debt in the EM19 to rise by almost 10 percentage points of GDP on average by the end of 2021 from 2019 levels, driven primarily by wider primary deficits, although some are also likely to see higher interest payments contributing to higher debt,” explains Christian Fang, assistant vice president and analyst at Moody’s.

The recent emergence of Covid-19 second and third waves in several markets will push the effectiveness of government economic policies to the test, with the prospect of recovery remaining uncertain for the time being. “We caution that the level of insolvency risk will still remain more elevated than before the coronavirus crisis as a result of only minor economic recovery in 2021,” highlights an Atradius whitepaper.