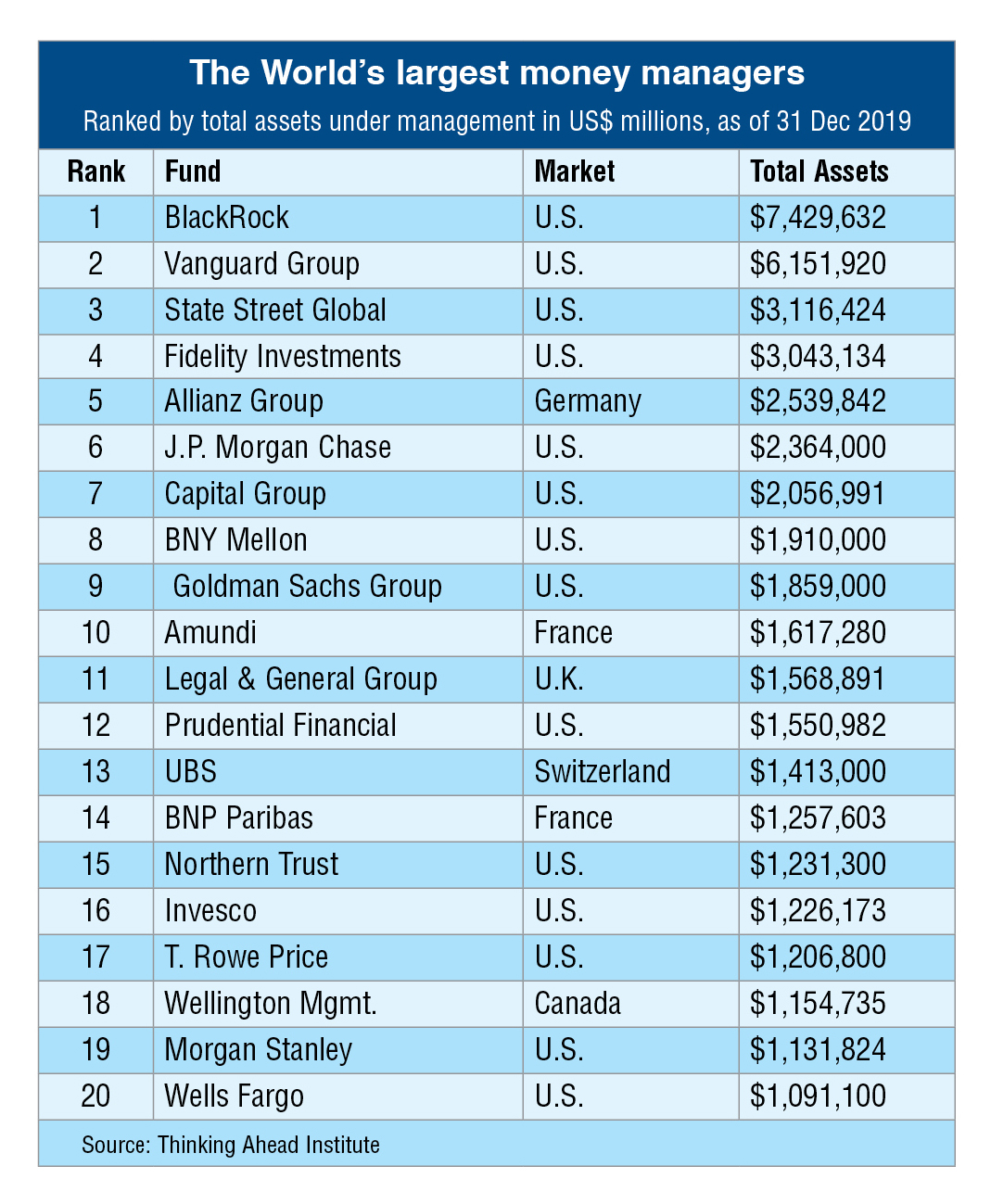

Assets under management (AuM) at the world’s 500 largest asset managers exceeded US$100 trillion for the first time in 2019, according to a new study by Thinking Ahead Institute, a not-for-profit investment research group. Total AuM for the year reached US$104.4 trillion, up 14.8% from US$91.5 trillion in 2018 and an almost three-fold increase from US$35.2 trillion in 2000.

The research, conducted in conjunction with US investment newspaper Pensions & Investments, shows growing concentration among the top 20 managers whose market share increased during the period to 43% of total assets, up from 38% in 2000 and 29% in 1995. It also shows that in the last decade, 232 asset management firms have dropped out of the ranking, pointing to a quickening pace of consolidation in the industry.

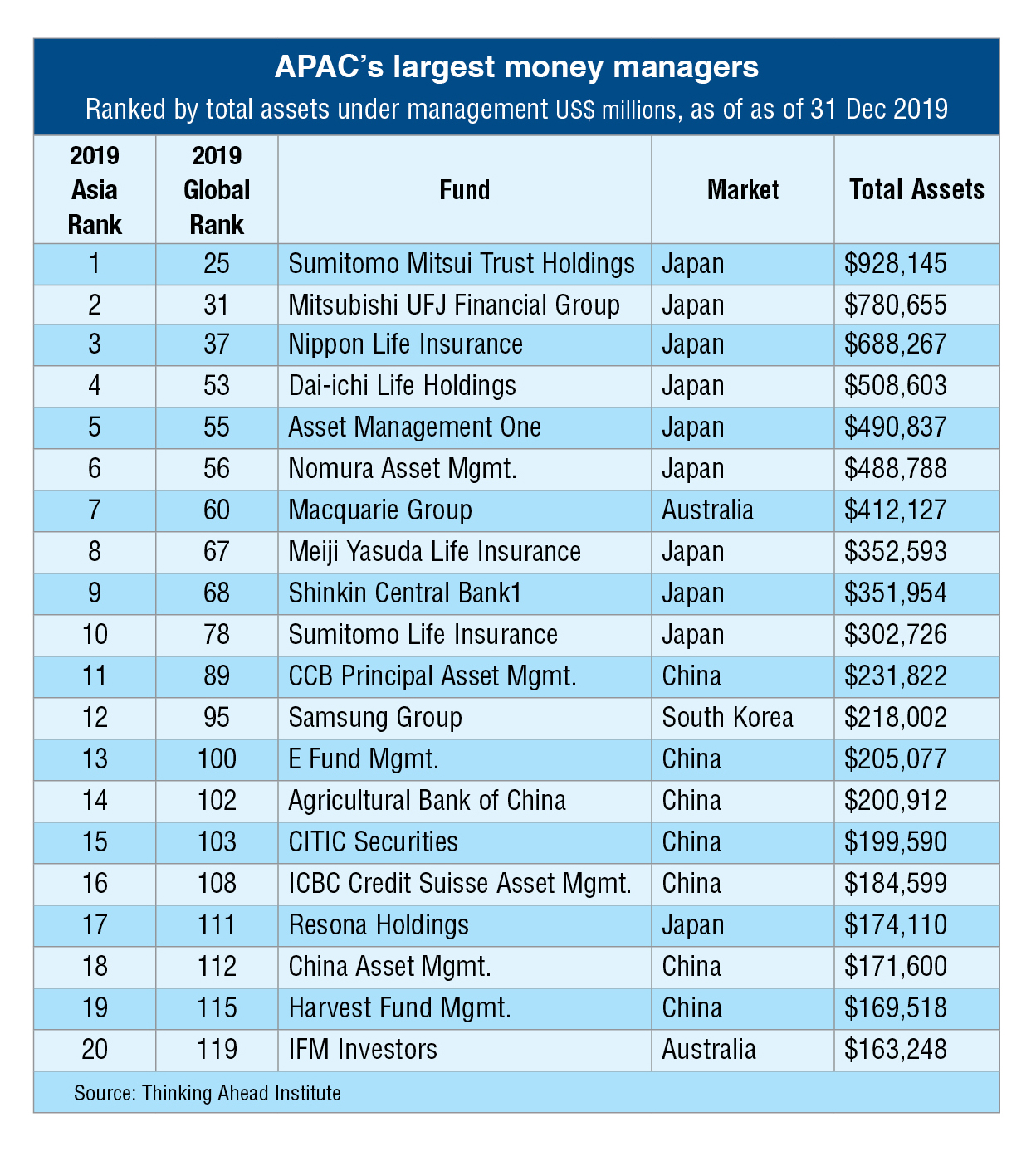

Reflecting the global position, the top 20 asset managers in Asia saw a 57% increase in total AuM in 2019. The region’s continued importance to global asset management growth is underlined by the fact that Japan, at 24.9%, registered a larger increase in AuM than anywhere else in the world. This continues a longstanding trend in regional growth. Over the last five years, China experienced the biggest rise in AuM at 22.5%, closely followed by India at 11.9%, South Korea at 9.3%, Australia at 8.5% and Hong Kong at 9%.

Roger Urwin, co-founder of the Thinking Ahead Institute, comments: “The investment industry has always been dynamic, but the pace of change is speeding up, manifested notably through consolidation. In addition, rapidly advancing technology is changing the shape of mandates and producing products that require less governance and are more streamlined. This has led to the growth of passive and index tracking, factor-based strategies and solutions. Private markets have also continued a significant growth trend in the last decade, during which investors have sought higher returns involving higher risk.”

According to the research, passively managed assets in the survey grew to US$7.9 trillion in 2019, up from US$4.9 trillion in 2015.

Urwin adds: “Most asset management processes, including investment, operating and decision-making, are also having to evolve. This is being driven by, in particular, asset owners seeking the benefits of outsourcing; the increased use of the Total Portfolio Approach, especially when targeting absolute return; and the use of index tracking in ETFs, where there is an active choice of the index.”

Notes Jayne Bok, head of investments for Asia at Willis Towers Watson: “Asia’s asset managers continue to experience rapid growth compared to their peers in other markets across the globe, with Japan and China leading the charge. However, there are choppy waters ahead with markets increasingly volatile due to Covid-19, ongoing geopolitical tensions and the intensification of the climate emergency. There will be greater demand for Chinese equities and bonds in global portfolios.

“But as asset managers in Asia continue their meteoric rise, they will need to create greater diversity and resilience in their business models as well as within their portfolios. The Asian asset managers who succeed at making the transition to regional or even global players, will be those who can tap global demand for Asian assets, invest in ongoing innovation and technology, and adapt to changing client expectations around ESG, societal impact, purpose, diversity and inclusion.”

Other findings:

- About 50% of managers increased the number of ethnic minorities and women at high positions.

- Client interest in sustainable investing, including voting, increased across 88% of managers.

- Some 84% of managers increased resources deployed to technology and big data and 76% increased resources deployed to cyber security.

- The number of product offerings during the year increased across 65% of surveyed firms.

- Aggregate investment management fee levels decreased for 34% of managers and increased for 7% of the managers.

- About 51% of managers reported an increase in the level of regulatory oversight.