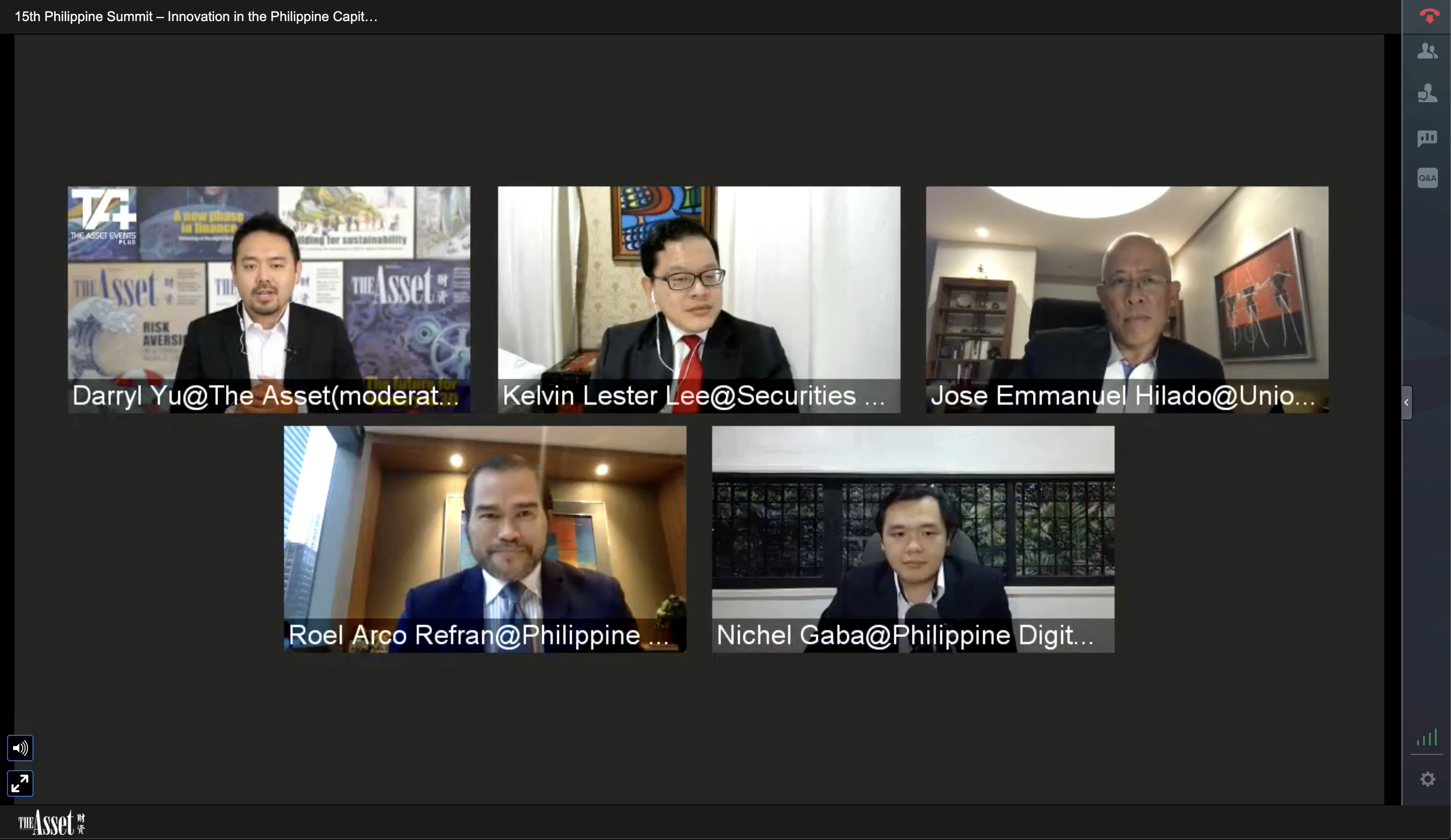

Amid the volatile economic conditions triggered by the Covid-19 pandemic, areas of innovation in regard to access to capital markets have started to take shape in the Philippines. That’s according to speakers at The Asset+ 15th Summit Part 2 webinar discussing transformation in the Philippine capital markets.

Transformation, indeed, is needed during the pandemic where traditional business models are being tested. It is something that Edwin R. Bautista, president and CEO at Union Bank of the Philippines (Unionbank), touched on during his opening address at the virtual event, when he explained to viewers around the region what he learnt from his own digital transformation journey, particularly on ensuring that an open culture mindset is needed to enact technological change.

Edwin Bautista, president and CEO of Union Bank of the Philippines giving his digital banker of the year viewpoint

“I think what people miss, which I believe is the secret sauce, is cultural transformation, because the technology itself can be bought but if the organization does not transform itself to be able to harness this technology towards customer satisfaction or customer experience then nothing is going to happen,” explains Bautista at the virtual event.

Over the past year there have been developments, both in the equity capital markets and debt capital markets, to change the culture of participation in the Philippine capital markets, aiming to pivot away from a traditional process that has seen investors lining up outside banks and brokerage offices to take part in capital market transactions.

In debt capital markets, for instance, the emergence of Bonds.PH, a blockchain-based platform developed by the Philippine Digital Asset Exchange (PDAX) and Unionbank this summer, has made it possible for the first time for retail investors to invest into a Republic of the Philippines retail bond via their mobile devices for as low as 5,000 pesos (US$100).

“Bonds.PH was a product of necessity but at the same time it’s also just a starting point for other innovations in the capital markets space,” says Nichel Gaba, CEO at the PDAX. “A lot of the technology that was applied in Bonds.PH and the technology applied in many financial services these days were technologies that were available more than a decade ago. It’s just difficult to implement a market-wide solution disrupting existing processes. Capital markets rely on stability and normalcy.”

The next step now is whether interested parties in the platform can be adopted by corporate issuers and investors going forward. “Investing in bonds within the Philippines has been inefficient for some time, and there are a lot of pain points. We wanted to come up with a platform that would make investing very efficient from the moment that you sell and distribute to the trading side, all the way to the backend, including the use of blockchain technology,” comments Jose Emmanuel “Toto” Hilado, CFO and treasurer at UnionBank, on the bank’s initiatives.

Exciting developments have also been happening in the equity capital markets side, particularly when it comes to IPO subscriptions. In November 2019, the Philippine Stock Exchange (PSE) launched the PSE Easy mobile application to make it easier for local small investors to purchase shares through a mobile app.

“Six IPOs ago, we didn’t have PSE Easy, what that meant for the investors before is that they had to go through the process of lining up during lunch breaks. This posed problems as the offer period is only around five business days,” recalls Roel Acro Refran, chief operating officer at the Philippine Stock Exchange. “We are making PSE Easy more user-friendly, the second-generation version of this platform will connect now to payment solutions, we want this to be seamless so that you don’t need to leave your home to subscribe to an IPO. We are looking at this at a longer-term approach for the rest of the public offering, not only just the 10% allocated for the local small investors.”

With several encouraging achievements in access to the capital markets, financial regulators are taking an open-minded yet cautious approach to such initiatives, placing importance on investor education.

“Regulators have the very difficult task of fighting fires before they are lit and regulating fintechs can be hard. When we approach fintechs and these digital solutions, we need to approach it very carefully,” highlights Kelvin Lester Lee, commissioner at the Philippines Securities and Exchange Commission. “We always need to keep in mind the delicate balance of innovation and possible risks to the financial industry which are uncertain at this point, examining areas such as financial stability, integrity of the market and risk to the investing public.”

While new channels in terms of capital market access are a step in the right direction, another important move going forward would be to get more investor participation into the local capital markets with an aim to reach meaningful long-term investment goals. That is one target the country’s central bank is aiming to do, recently launching the digital PERA (personal equity and retirement account) to get more Filipinos to plan and save for the future.

For more information on this year's virtual 15th Philippine Summit please go here.