Additional winds of change are picking up for traditional banks, at least that’s according to a research note by Moody’s Investor Service that highlights the disruption facing banks due to the development of central bank digital currencies (CBDCs).

With the Covid-19 pandemic speeding up digital payment usage across the globe, there are growing questions about the role of physical cash in today’s financial environment. Coupled with the emergence and development of digital currencies or stable coins, such as Bitcoin and Libra, some central banks are exploring the role of defending public money with the possible launch of their own respective CBDCs.

There are three methods, according to Moody’s, by which a country’s central bank can approach launching a CBDC. Firstly, a central bank can adopt the direct method whereby individuals or companies can have a direct electronic claim to the central bank rather than to an individual bank. The second method takes an indirect approach similar to what we have now, where the central bank grants an intermediary role to banks and payment providers to process CBDCs. The third model uses a hybrid approach incorporating elements of the direct and indirect models where the CBDC holder has a direct claim on the central bank, but the know-your-customer and payment processing would be conducted by a commercial intermediary.

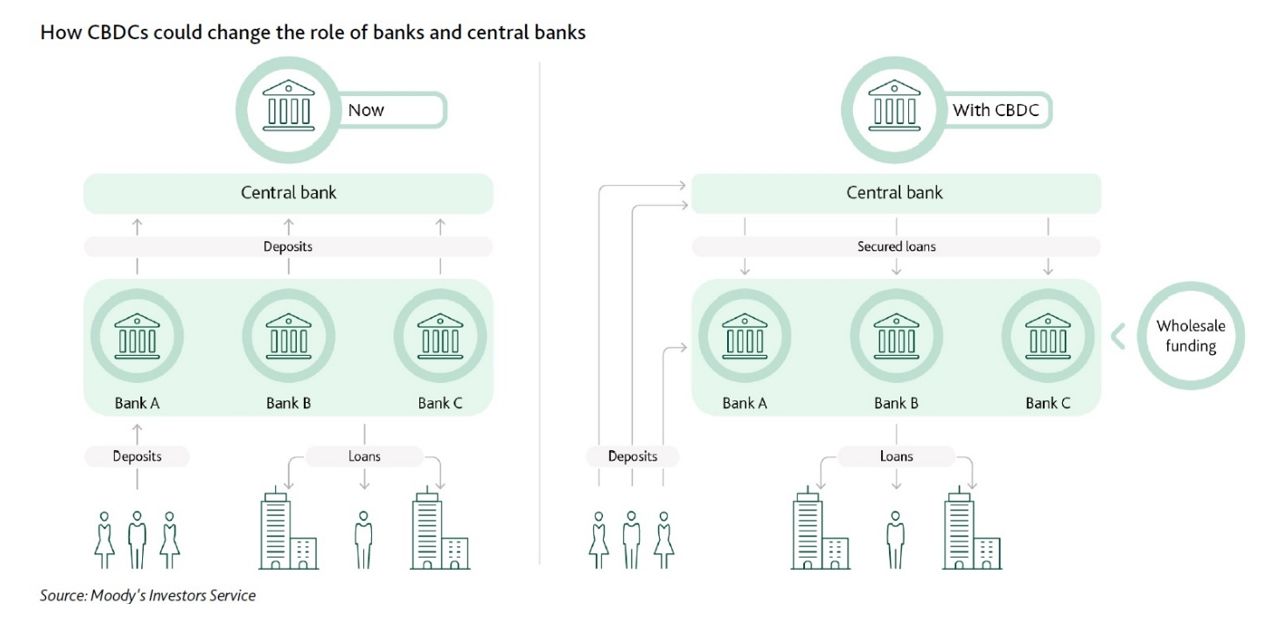

For commercial banks, the approach each jurisdiction takes will have a major impact on the way they run their operations, particularly with the direct model, which in theory could displace them from everyday financial transactions. In any case, whichever path a central bank takes, the CBDC development will drastically reshape the way commercial banks process transactions in the future.

“A central bank digital currency would have a critical advantage relative to digital ‘stable coins’ in that they can provide a direct claim to the central bank, allowing a quick and convenient form of payment relatively free of credit risk,” says Nick Hill, managing director of banking at Moody’s. “CBDCs would bring downsides, however, as some forms of digital currency would disrupt commercial banks’ business models. The role of these banks in the payments system would be displaced, and there would be disruption to their funding models too.”

Already several countries have started to envision their own CBDC, with mainland China being one of the leading jurisdictions blazing the trail. Already in 2020, the country has piloted its e-RMB platform in a number of chosen cities, most recently in Shenzhen where 10 million yuan worth of digital currency was given to 50,000 randomly selected inhabitants of the city.

And early this year, in Europe, Sweden and the United Kingdom did research and conducted studies on what a digital currency would mean for their respective markets, but realistic development and pilot programmes for a CBDC there appears to be nonexistent for the time being.