The biggest Asia-Pacific deal for the third quarter of 2020 took place in Hong Kong, helping it to navigate a slight 4% decline in commercial property activity year-on-year to US$2.6 billion while the Asia Pacific market slid again during the quarter.

A mainland Chinese insurance investor acquired a partial interest in a pair of office towers, in a forward sale priced at US$1.5 billion. Still, for the first nine months of 2020, Hong Kong office activity is down 67% compared with the same period in 2019 and transactions of retail and hotel properties fell at a similar rate, according to the latest Asia Pacific Capital Trends report from Real Capital Analytics.

Benjamin Chow, RCA’s senior analyst for Asia-Pacific, comments: “With commercial pricing having fallen by almost 20% since the peak in early 2019, investors have been gradually returning to the market. Even without the office megadeal, there has been a modest uptick in deal activity compared with the first half of this year, aided by the return of mainland Chinese investors. This has coincided with a slowdown in the pace of price decline in the third quarter.”

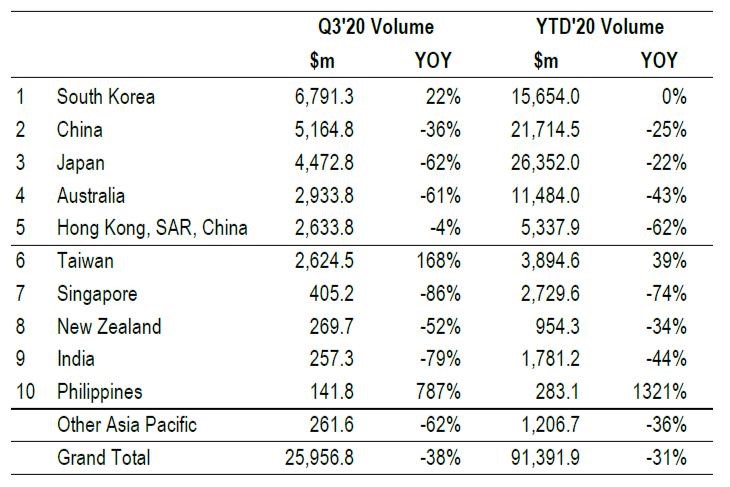

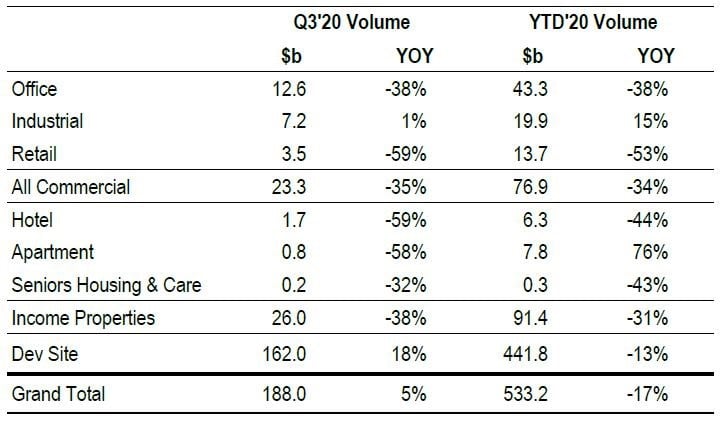

Hong Kong’s performance echoed the overall trend in the region. Sales of commercial property in Asia-Pacific fell by 38% in the third quarter of the year as the global health crisis put a dampener on cross-border dealmaking. Sales across the major income-producing property types dropped to US$26.0 billion, down from US$33.0 billion in the second quarter of 2020 and US$42.2 billion a year ago. Industrial sector activity matched the levels of a year ago but all other key property types declined, with hotel and retail sales showing the sharpest drop.

Transactions involving individual properties increased from the previous quarter to total US$23.0 billion, boosted by a smattering of high-value deals. Portfolio sales, by contrast, fell to levels last seen during the global financial crisis. So far this year, deal volume of this type is down 48% from a year ago.

Sales of development sites, which principally take place in China, grew from a year earlier. Deal volume reached US$162.0 billion, an 18% year-over-year increase.

Says David Green-Morgan, RCA’s managing director for Asia-Pacific: “The global pandemic continues to hamper dealmaking for a swathe of cross-border investors, and the clouded economic outlook in many markets still presents uncertainty that puts many investors on hold. Domestic players seem to hold the advantage at the moment, and the major markets with robust domestic investor bases – such as South Korea, Japan and China – are holding up better in the current environment.”

Most active markets in Asia-Pacific

Source: Real Capital Analytics

The Covid-19 pandemic has accelerated the rift in sectoral trends, with the industrial sector playing out as the most positive market. For the first three quarters of 2020, sales of warehouses and tech-focused assets totalled US$19.9 billion, up 15% from a year ago. Interest has been weighted to logistics properties and data centers.

Offices remain the largest component of the Asia-Pacific commercial real estate market (excluding land sales), and though investment fell by 38% in the third quarter, interest is still being seen for prime offices in some markets.

Trading of retail and hotel properties suffered the sharpest drop in the last quarter. While there are hopeful signals for the hotel industry, such as the easing of some major travel routes, positives for the retail sector are hard to find. For the year so far, trading of retail properties totalled US$13.7 billion, down 53% year-over-year.

Acquisitions by property type

Source: Real Capital Analytics